Bitcoin’s Mid-Cycle Shuffle: A Comedy of Errors or the Next Big Thing? 🤷♂️💰

A structural shift is unfolding in Bitcoin’s [BTC] supply dynamics, and it’s about as predictable as a cat in a room full of yarn. 🐱

A structural shift is unfolding in Bitcoin’s [BTC] supply dynamics, and it’s about as predictable as a cat in a room full of yarn. 🐱

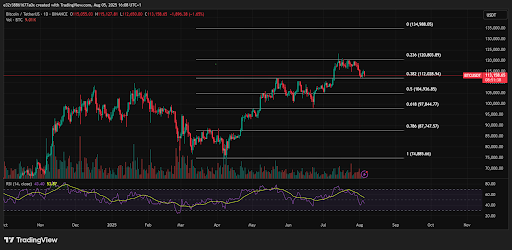

Bitcoin’s price action is sizzling like a hot potato right now as it sets its sights on $116,000. After bouncing back from the weekend’s price lows, the world’s largest cryptocurrency is flexing its muscles like a bodybuilder at a beach party. 🏋️♂️

Amidst this fervor, Anatoly Yakovenko, the architect of Solana’s dreams, sat with Kevin Follonier on the When Shift Happens podcast. 🗣️🎙️ With a voice steeped in conviction, he declared, “Mobile was my baby,” tracing his lineage back to Qualcomm, where the seeds of this endeavor were sown. “The chips,” he mused, “already whisper secrets of security, waiting to be harnessed for the crypto age.” 🤖🔐

But lo and behold, the tides are turning! Recent spectacles show XLM bouncing back with the grace of a diva re-entering the stage, fueled by the rush of eager investors throwing more coin at the good ship Stellar. It’s attempting to flip the script-perhaps even write a new, more glamorous chapter in its glamorous ledger.

Picture August 5th: Sui (SUI), ever the adventurous sort, tumbled 4.71%, rolling gleefully from $3.61 to a less glamorous $3.39. Compare that to the broader crypto market’s dainty 1.57% slip, or Ethereum and Solana’s almost-graceful little trip-ups under 3%. It’s as if Sui was determined to win the Misfortune Olympics, clutching the gold medal for “Biggest Splash.”

But guess what? On Friday, the USD finally decided to take a breather after some pretty disappointing US data. The pair ended up settling at around 1.1550, still holding onto some serious weekly losses. 🤦♂️

traders are now poised to enjoy the sweet taste of approximately 4.5% yield from Franklin Templeton’s fund. Plus, they can indulge in the additional exchange-based yield opportunities, because who doesn’t want a little bonus on top?

Now, the technicals are lookin’ as bullish as a hound dog smellin’ bacon. It’s respectin’ the 0.236 Fibonacci retracement around $0.83, which is fancy talk for support-like a sturdy porch before the big storm. Targets at $8.74, $12.09, and a jaw-dropping $29.85 are alignin’ across the board, lookin’ like the right way to go as the wave of fortune crashes ashore.

Numbered and silent, their 521,939 tokens glisten like frost-covered apples abandoned in the snowfields of Moscow. Cold, resolute, but oh! so very valuable.

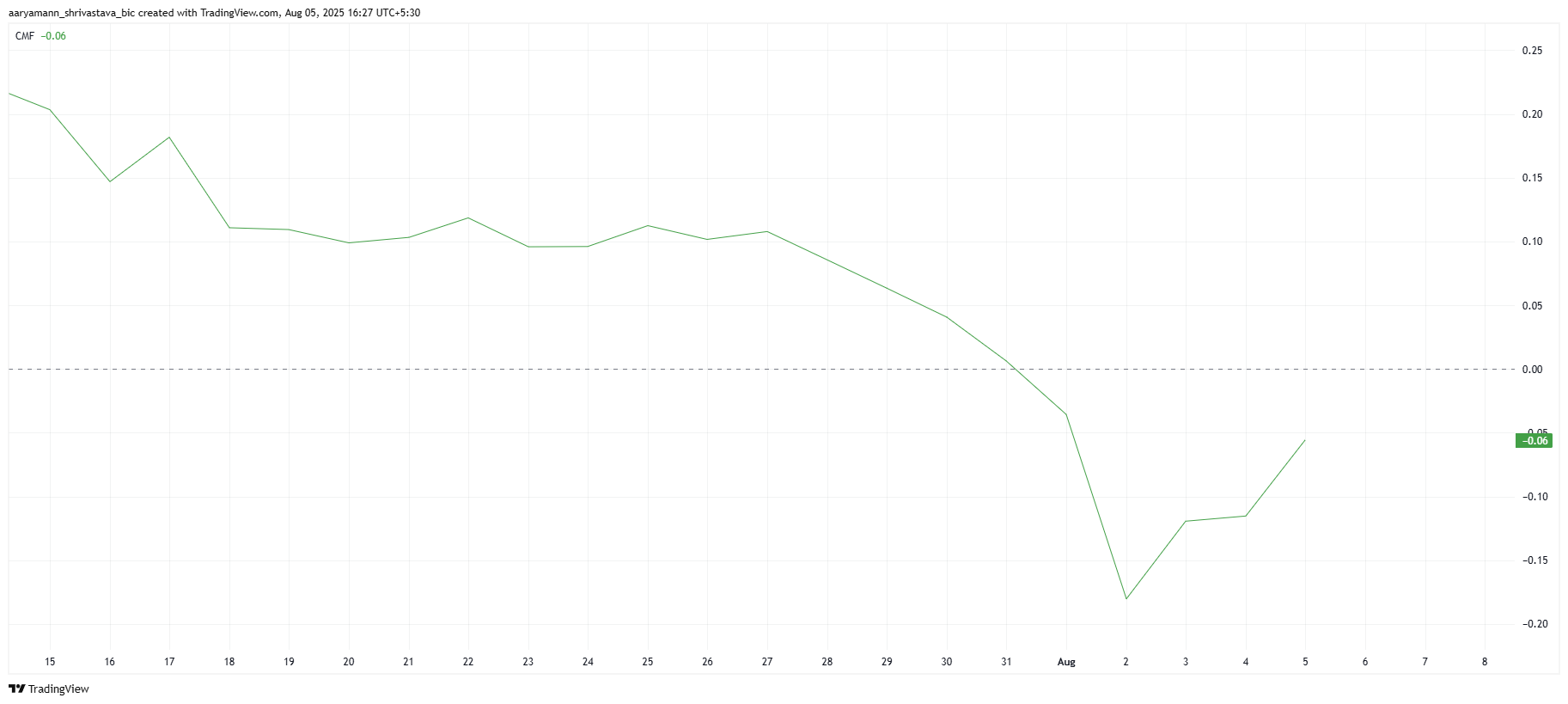

But as the broader market waltzes through its usual chaos, traders are left pondering whether SHIB’s momentum will endure through August or if it is merely running out of puff. One must examine where the funds are flowing and whether the critical support level-so recently tested-can withstand the pressure. Shall we proceed with this investigation? Of course, we shall!