Cardano Treasury Throws Down the ADA 🤑: Will This Save the Blockchain or Just Confuse Everyone?

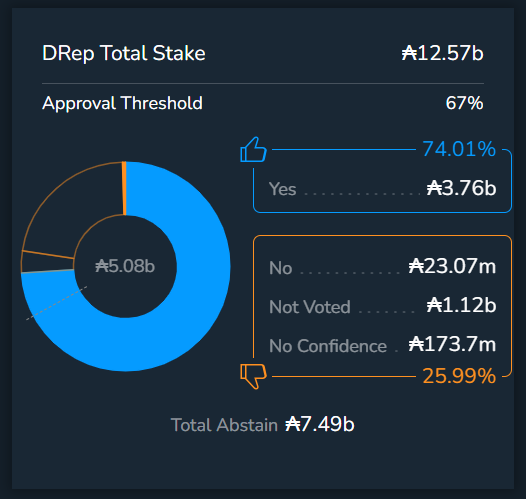

This decision came after an August 2 vote where nearly 74% of voters said, “Sure, why not?” Which begs the question: did they even read the fine print? Or was it one of those “agree to terms and conditions” moments?