WhiteFiber’s IPO: Bit Digital’s AI Arm Goes Public? 🚀

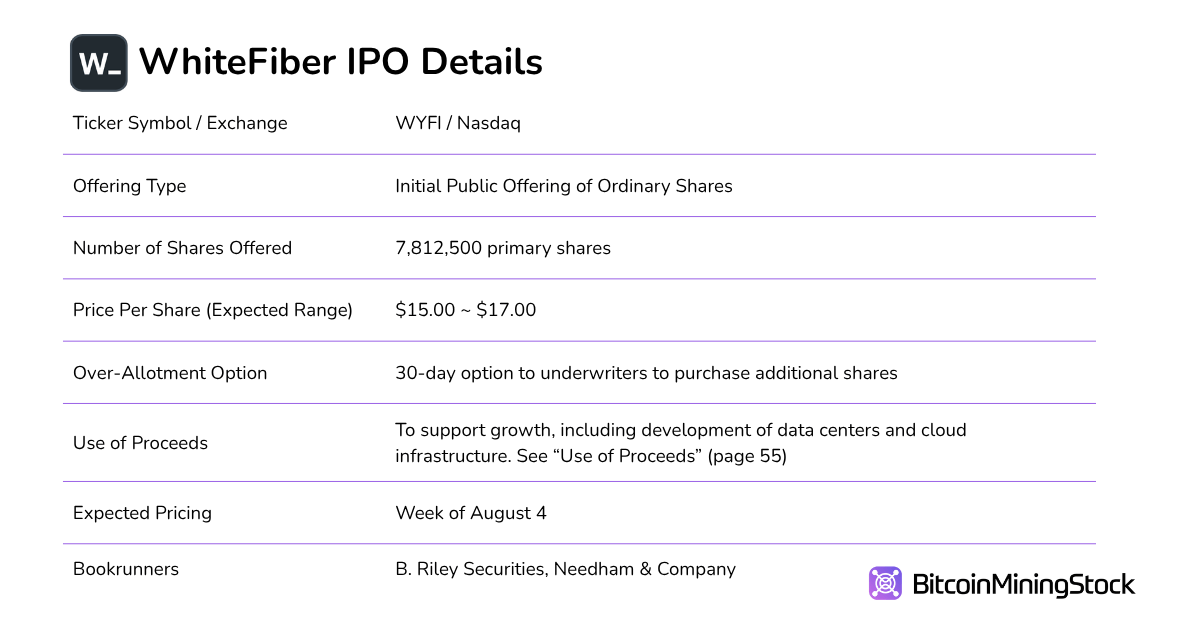

WhiteFiber Inc., the high-performance computing (HPC) and AI infrastructure subsidiary of Bit Digital (NASDAQ: BTBT), has launched its initial public offering. The company is offering 7,812,500 ordinary shares at a proposed price range of $15.00 to $17.00 per share, with underwriters granted a 30-day option to purchase an additional 1,171,875 shares. Upon listing under the ticker WYFI on the Nasdaq Capital Market, WhiteFiber will become a publicly traded provider of AI-focused cloud and data center services. 🚀💸