XRP’s Exchange Balances Soar: Sell-Off Alert!

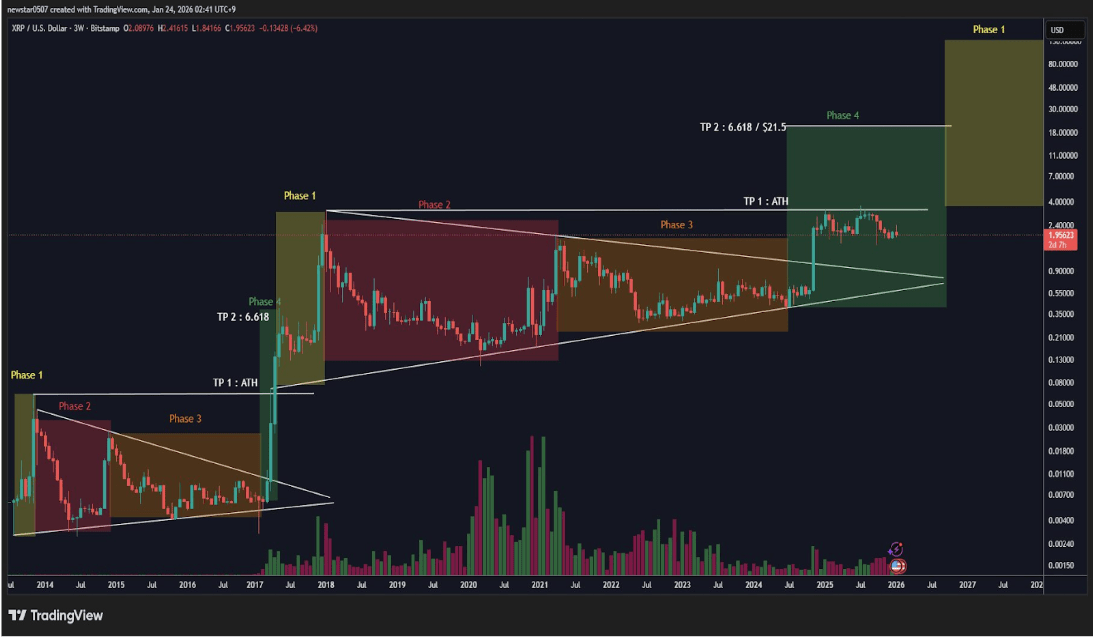

The pullback coincides with global tensions, sending investors scrambling to the safety of risk-off positions. But don’t worry, analysts are still optimistic about XRP in 2026-because who needs a crystal ball when you have a spreadsheet?