Shocking Truth: 98% of Gold Investors Are Just Playing with Paper! Here’s Why That’s a Disaster

So, there’s a total buying frenzy in the gold market, sending prices soaring by over 80% in just a year. Who knew shiny rocks could be so popular?

So, there’s a total buying frenzy in the gold market, sending prices soaring by over 80% in just a year. Who knew shiny rocks could be so popular?

Ah, the theater of the crypto markets! A little-known Solana memecoin, as insignificant as a flea on the back of a drunken bureaucrat, has shocked traders with a rally sharper than a barber’s razor. All because of a single post from the White House, a place where penguins and presidents apparently walk hand in wing. What a spectacle, dear reader, what a farce!

Technically speaking, XRP is still stuck in a downward trend so deep it could make a cave feel self-conscious. The price keeps getting rejected below the 200-day mark like a toddler at a tea party, and the $1.90-$2.00 range is acting like a bouncer who’s seen it all. This region, once a beacon of hope, has become a decision range-where decisions are made to do nothing, really.

In the grand theatre of finance, the Central Bank of Brazil has enacted IN 701/2026, a set of rules so elegant that even a banker’s daughter might applaud them. Banks and brokers now must audition a reputable, independent body to confirm they will keep customers’ assets separate from their own purse‑strings and prove their coffers are less susceptible to a “crypto scandal.”

Behold, the mighty Bitcoin has fallen, not with a bang, but with a whimper-1.33% since yesterday, and a staggering 7.1% over the week. A tragedy, you say? Nay, it is but a farce, played out on the grand stage of human folly.

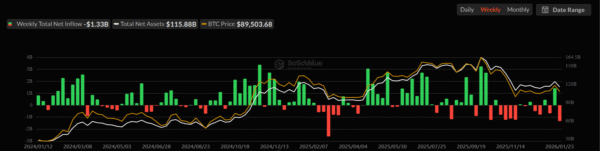

U.S.-listed crypto exchange-traded funds (ETFs) faced a sudden pullback last week as investors cut exposure with the enthusiasm of a failed dating app swiping left in December. Bitcoin and Ethereum funds, meanwhile, bled money like a wine merchant’s wallet at a discount store. Onchain data now whispers of a mood shift after the sector’s earlier “I’ve got Wings & Things” inflows in January.

The stakes are simple: When true quantum computers finally stop being European camping laptops and become the sort of devices that can crack your wallet’s digital smudge‑brace signature, every block‑chain can dissolve into a cold, untrustworthy mess. Ethereum’s crew, armed with a coat of quantum‑resistant armor, decided that acting now is just common sense-unless you’re a wizard who prefers to wait until the world dissolves.

Just last week, our beleaguered hero plunged from a rakish $96,000 to the sullen depths beneath $88,000-its most abject performance since the Great Meme Crash of ’25 (or was it ’23? History blinks). Yet, in the catacombs beneath the chart, where data squirms like blind fish, whispers stir. The bears, those grizzled pessimists in trench coats and frowns, appear spent-exhausted by their own success. Could it be? Are they developing existential fatigue from all that growling?

Yes, you read that right. Over 5,700 Bitcoin enthusiasts (or, as I like to call them, “HODLers with hope”) admitted that their crypto wallets are about as useful as a screen door on a submarine when it comes to real-world transactions. And why? Well, it’s not like they’re short on excuses.

At the helm of this quixotic endeavor stands the redoubtable Thomas Coratger, a cryptographic engineer of no mean repute, ably seconded by Emile, whose contributions to the leanVM project have earned him a place in the pantheon of the mildly celebrated. Together, they lead a charge not of mere academic navel-gazing, but of practical, if somewhat frantic, execution. Live testnets, developer séances, and tooling so scalable it might as well be a mirage-such are the weapons in their arsenal against the quantum menace.