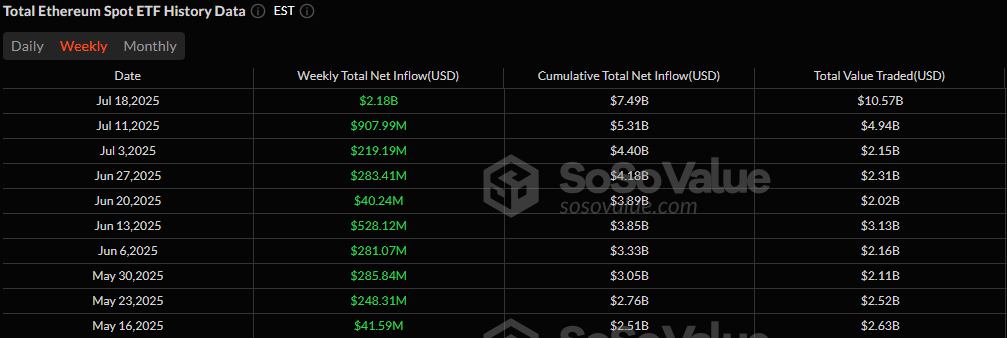

Shocking Crypto Surge: Ether ETFs Strike Gold with $2.18 Billion Inflow!

As the annals of history bore witness, the ether ETF surged forth, unfurling the banners of victory with a staggering $2.18 billion in net inflows—a feat unmatched in the grand saga of ether. Such a performance not only boasts a ten-week triumphant streak but also underscores the burgeoning and perhaps intoxicating thirst of institutions for ETH exposure. Oh, the irony of wealth and wisdom, tangled yet sublime!