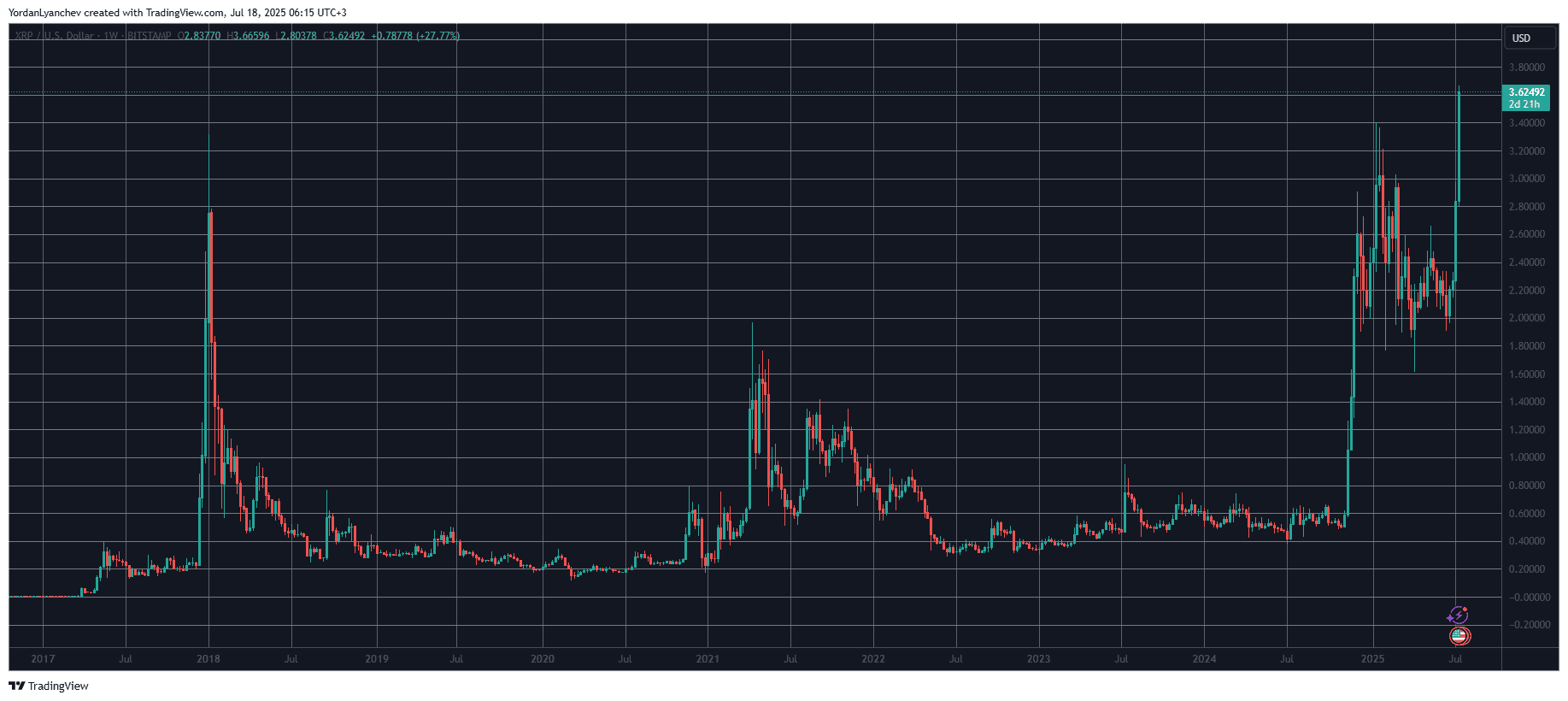

XRP’s $3.65 Glory Overshadowed by These 3 Altcoins!

And guess what? XRP isn’t even the top performer this week. Shocker, right? Another top 3 coin has stolen the spotlight, outperforming XRP’s performance. I know, it’s like finding out your favorite sitcom got canceled because it wasn’t as popular as that new reality show about people eating bugs.