HYPE Whales Splash Cash: Is the Tide Turning or Just Another Fishy Tale?

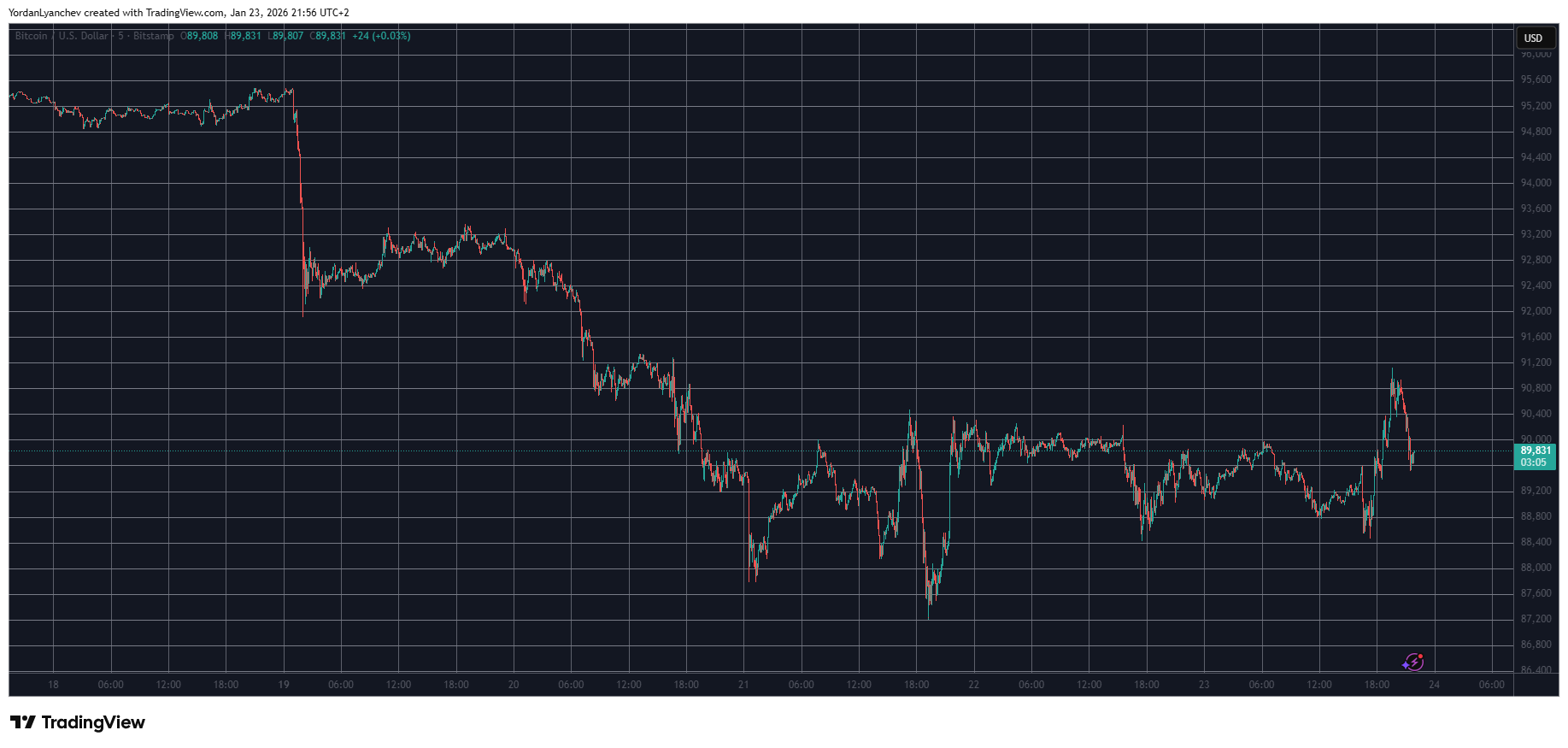

The broader trend, of course, is still as corrective as a nanny with a ruler, but this little rebound has everyone squinting at their crystal balls. Traders, those eternal optimists, are now wondering if the downside cycle is as tired as a troll after a night of bridge-guarding. With momentum puffing its chest and liquidity flowing like a river of gold, the market is watching with the intensity of a cat eyeing a particularly suspicious fish.