Why Your Crypto Launch is a Flop: Hilarious Truths Only the Bold Will Admit!

They have a go-to-market delusion. 🤦♂️

They have a go-to-market delusion. 🤦♂️

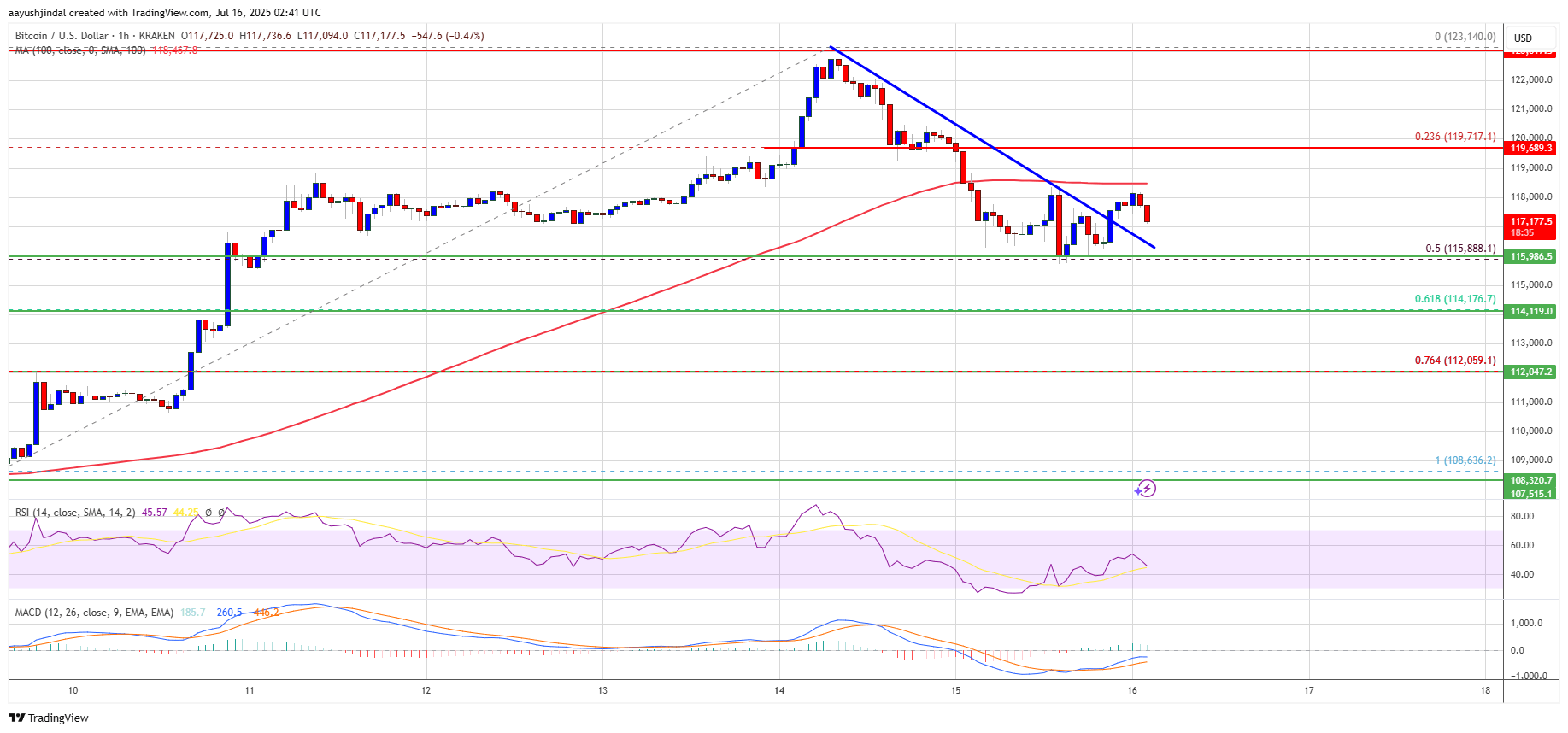

Bitcoin price started a fresh increase after it cleared the $118,500 resistance zone, like a teenager finally outgrowing their awkward phase. BTC gained pace, moving above the $120,000 and $122,000 resistance levels, and the bulls even managed to pump the pair above the $123,000 zone. A new all-time high was formed at $123,140, and now, like a roller coaster, the price is correcting gains. It’s like Bitcoin is saying, “I’m just taking a breather, folks, no need to panic.”

Alas, for the average mortal, the prospect of acquiring even a single Bitcoin seems a distant dream, a luxury reserved for the rarefied realm of high-net-worth individuals. And yet, it is precisely these millionaires who are being urged to act with all due haste, lest they miss their chance to join the exclusive club of Bitcoin owners.

Standard Chartered has announced it will enable institutional clients to directly trade bitcoin ( BTC) and ether ( ETH) through its United Kingdom (U.K.) branch, marking it as the first so-called global systemically important bank (G-SIB) to offer such direct cryptocurrency services.

Now, what exactly does this scorecard do, you ask? Well, it serves up a succulent feast of information, slicing and dicing each state’s performance in a marvelous six-course meal that includes: fabulous government-led blockchain lifts, merry bands of pro-crypto task forces, and of course, a sprinkle of congressional love for blockchain. 🥳 Don’t forget the secret sauce of workforce talent and a dash of bitcoin reserves—all neatly wrapped up in a classy North American Blockchain Association bow!

According to the illustrious The Hill, the noble quest to commence debates on the fiscal 2026 Pentagon funding bill—coincidentally paired with a trio of crypto monstrosities—collapsed faster than a cheap stage prop at a poorly produced play, resulting in a not-so-epic 196-223 defeat. Among the unfortunate casualties of this legislative drama were the GENIUS Act—it was supposed to define the parameters of the elusive stablecoin, the Digital Asset Market Clarity Act (because who wouldn’t want a bit more clarity in their life?), and the Anti-CBDC Surveillance State Act which would prevent the Federal Reserve from fabricating its own digital ghost currency. Spectacular, isn’t it? 🎭

On July 15, Emurgo, the co-founding entity of the Cardano blockchain, announced the launch of the Cardano Card, a multi-functional payment and financial tool aimed at turning ADA into a spendable, yield-generating asset.

An analyst named LSplayQ – sounds like a character from a ’70s spy film, doesn’t it? – has declared on X (because why not?) that Ethereum completed a rounded bottom formation on the daily chart. That’s not just a shape; it’s a whole trend reversal party! 👏 The market’s mood has gone from “We’re doomed!” to “Oh boy, let’s go shopping!”

BTC’s takin’ a wee breather, but I reckon those buyin’ spirits might hold steady ’round $113,000.