Pi Network’s Secret Weapon: DeFi Miracle or Fancy App?

Behold, an X user, that paragon of wisdom, has bestowed upon the project a scroll of decrees. Let us heed their words, for they are as profound as a tavern conversation in a provincial town.

Behold, an X user, that paragon of wisdom, has bestowed upon the project a scroll of decrees. Let us heed their words, for they are as profound as a tavern conversation in a provincial town.

But one must ponder, dear reader, amidst all this flurry of activity-has it truly stirred the stagnant waters for the native token, TRX? Or is it merely a delightful spectacle, akin to a peacock displaying its feathers, while remaining firmly rooted in one spot?

The filing, dated Jan. 21, is as charming as a well-timed quip. If approved, it would grant BlackRock’s iShare Bitcoin Trust ETF (IBIT) and its Ethereum cousin (ETHA) the freedom to dance without the 25,000-position leash. A bold move, indeed, though one wonders if the SEC’s patience is as robust as its regulatory framework.

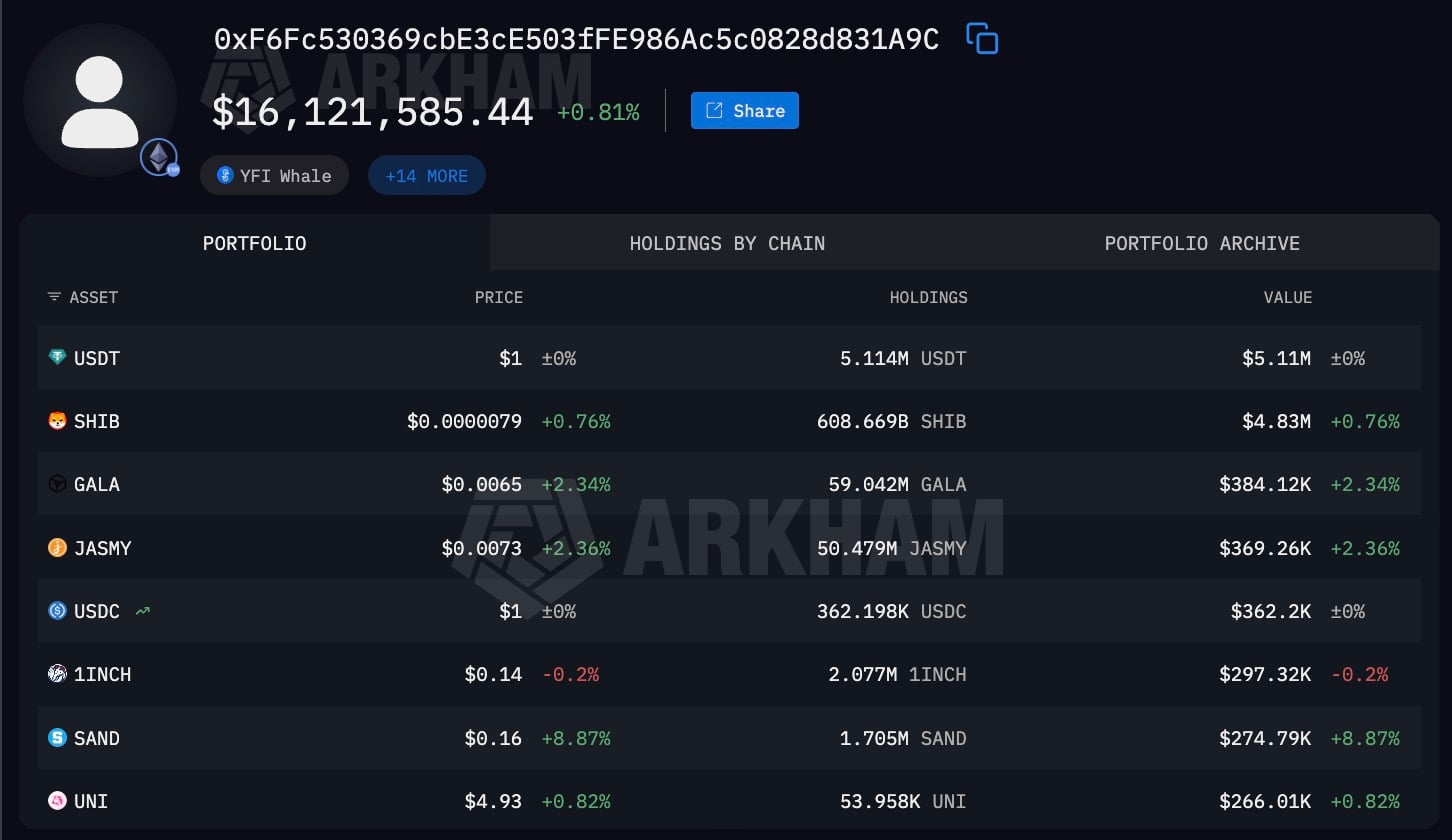

Indeed, the addresses 0xA9d, 0xe9E, and 0x875, linked to this WazirX operation, whisper secrets of an Indian origin so loud one might think they’re shouting. Over the past day, 158 billion SHIB slithered into the address “0xA78B…b40,” a digital den of vice that has siphoned $170,000 in Ethereum assets this week alone. An hour later, a paltry 1.53 million SHIB returned, like a timid soul reconsidering its sins.

This wave of panic (or “adult supervision,” depending on your portfolio size) briefly sent Bitcoin tumbling back to the $85k-$90k zone. But here’s the kicker: the sell-off fizzled out like a toddler’s temper tantrum. No one actually lost faith; they just took a coffee break while macro forces hogged the spotlight.

Indeed, Morgan’s words echo the sentiments of a fellow advocate, @589CTO, whose meticulous documentation of Ripple’s regulatory compliance is as thorough as it is enlightening.

Behold, over 2.35 million transactions in a single day! The XRP Ledger, that tireless scribe, records each with the precision of a man counting his last kopecks. Payment counts? They soar like a goose fleeing the winter, while payment volumes spike with the unpredictability of a Gogol character’s monologue. And yet, the number of payments between accounts lingers at the upper echelons of its annual range, as if attending a never-ending ball where no one dares to leave.

With a wave of his hand, Zhao suggested that this clever trick could unlock trillions-yes, trillions-with the kind of ease one might expect from a magician pulling rabbits from hats. Why, even before cryptocurrencies grow up and figure out what they want to be when they become adults, the tokenized asset market is projected to balloon to a staggering 16 trillion dollars by the year 2030. That’s right, folks, while we’re busy arguing over whether pineapple belongs on pizza, the financial world is gearing up for a transformation that’ll make the Gold Rush look like a yard sale.

Google’s Gemini AI, that paragon of logical brilliance, predicts XRP’s ascent with the certainty of a man who’s never lost a bet. One might ask: How does it know? Does it commune with the spirits of Wall Street? Or does it simply echo the delusions of its makers, who, like all humans, crave a narrative where chaos makes sense?

The man who once counted rubles in a Soviet breadline now commands a digital empire, Galaxy Digital, where he tells Anthony Scaramucci, “Tariffs and wars? Just noise. Crypto’s dancing to a different beat.”