IRGC’s Billion-Dollar Crypto Conundrum Awaits in the UK! 🚀💥

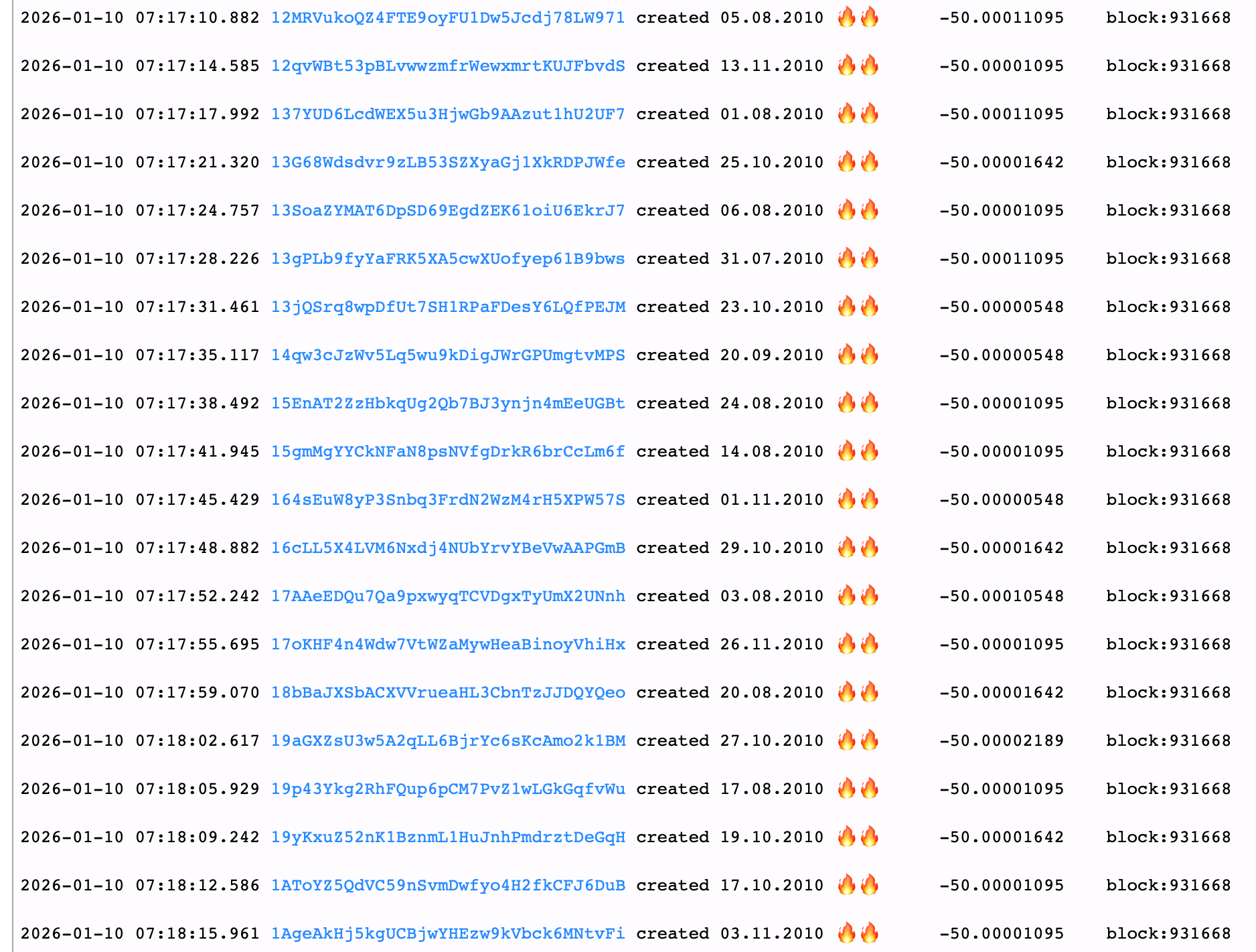

These exchanges flit about, entangling sanctioned IRGC wallets with offshore intermediaries and a few local crypto wizards in Iran, much to the chagrin of those monitoring such playful intrigue!