Bitcoin 2026: Mega-Boom or Mega-Bust? 🤯💰

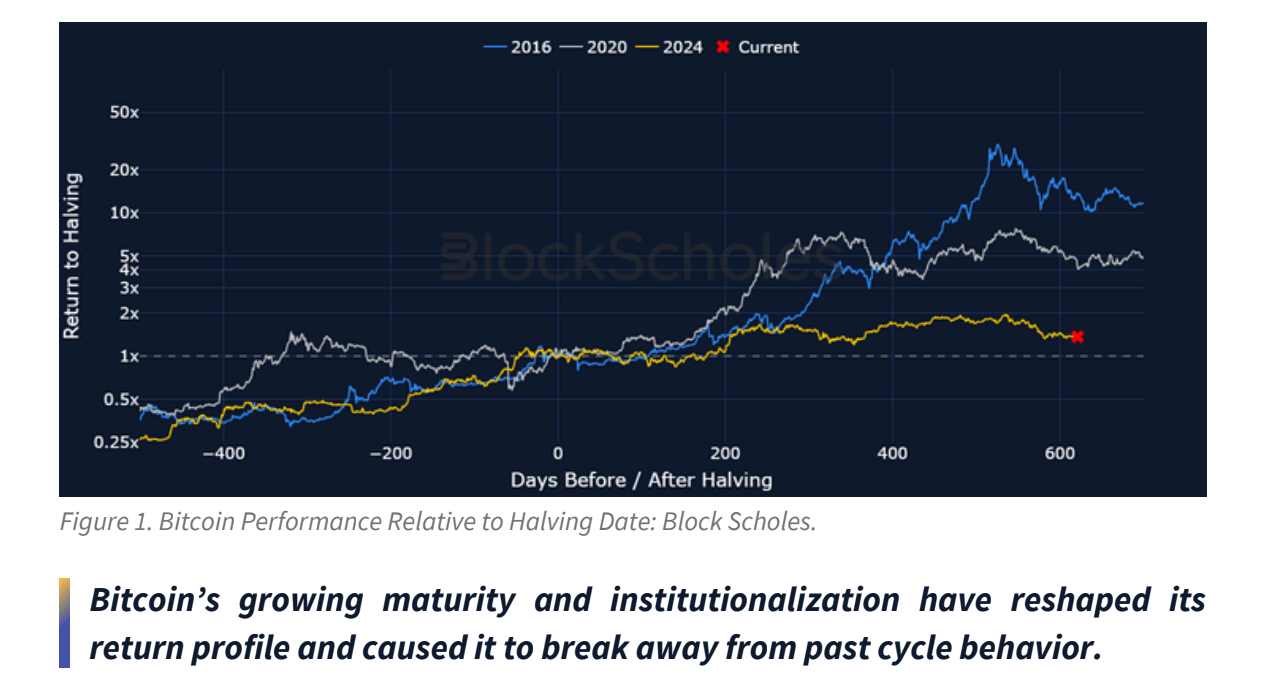

Enter Raoul Pal, the macro guru with a theory that’s basically, “Chill, the bull market’s just fashionably late.” 🕶️ According to Nathan Sloan’s breakdown, Pal’s like, “Crypto’s 4-year cycle? More like 5-year cycle now. Peak’s in 2026, folks. Spoiler alert: No crypto winter, just a delayed mega-boom.” 🚀✨