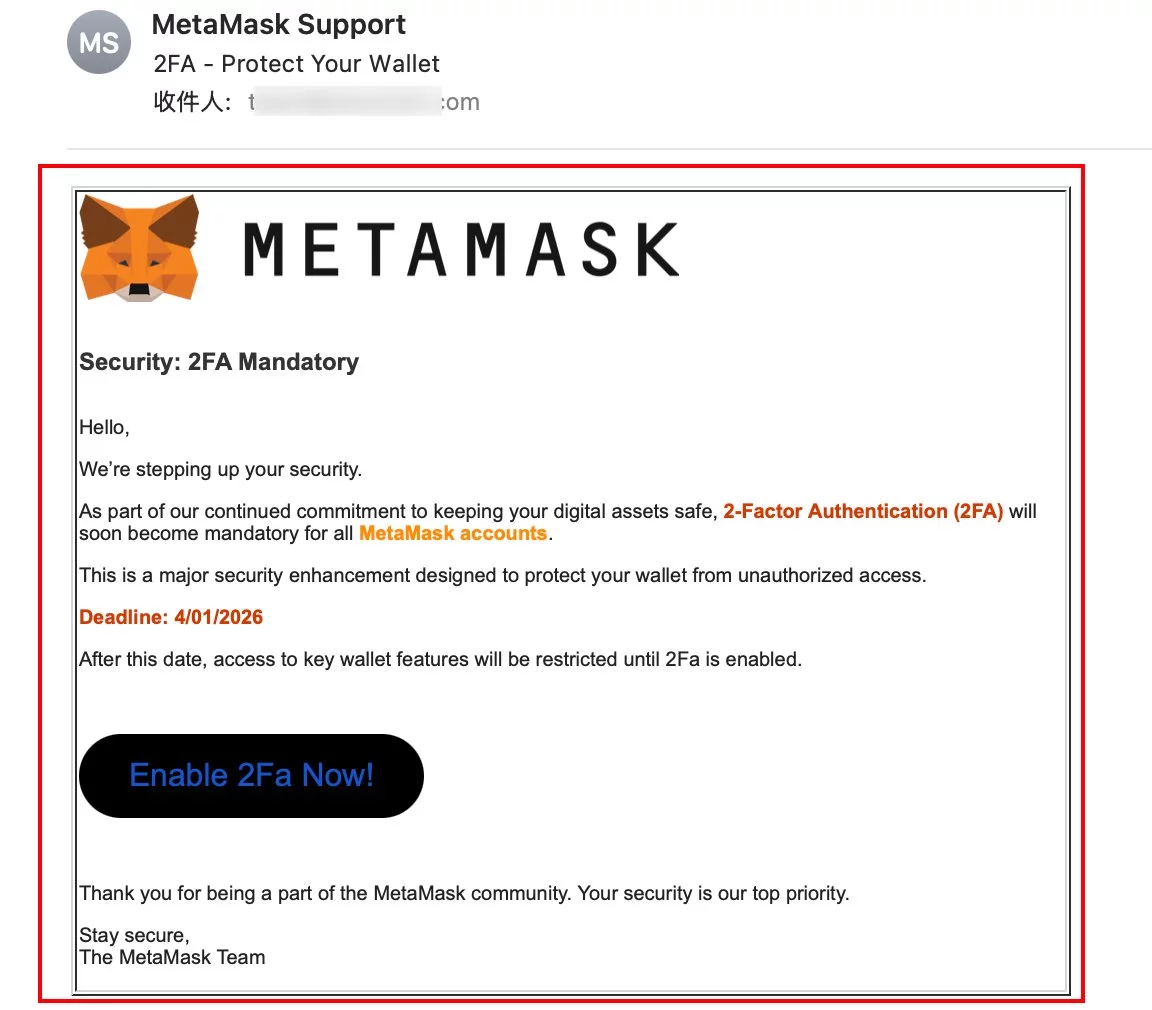

Beware of the 2FA Phishing Scam: Your MetaMask Could Be Next! 😱

According to the folks at SlowMist-who apparently have nothing better to do than keep an eye on these scams-MetaMask users have been receiving emails that scream urgency. The kind of urgency that makes you feel like you’re late for a date with your bank account. The emails are decked out in MetaMask branding, so they look almost convincing at first glance. (See below for some real artistry.)