Ripple’s RLUSD Celebrates 1st Birthday with 5 Epic Wins!

According to McDonald, RLUSD, which launched on Dec. 17, 2024, is ending 2025 among the top five USD stablecoins in record time. 🧠💸

According to McDonald, RLUSD, which launched on Dec. 17, 2024, is ending 2025 among the top five USD stablecoins in record time. 🧠💸

Now, you might hear folks describe trading platforms as “transitioning” from contracts-for-difference to crypto-sounds fancy, right? But let’s not kid ourselves. In reality, CFDs and spot crypto trading are like those quirky roommates who can’t quite share the same couch but somehow make it work in the living room of financial freedom. It’s less about one replacing the other and more about brokers saying, “Hey, we’ve got options!” Traders then pick their tools like kids in a candy store, matching them to their own tastes and risk appetites. 🍭

CertiK Alert, in a jolly tweet on X, revealed that a cool 1,337.1 ETH (roughly $3.9 million, give or take a penny) has been spirited away into Tornado Cash. The scallywags behind this caper used the wallet address 0xc946981F5dFBFA10cf858B95d51Fc06DCD15BfE3. Blighter! 😠

By Tuesday, the metal had recovered. Spot silver rebounded 3.1% to $74.49 after reaching a record high of $83.62, with year-to-date gains remaining near 158%. 📈✨

On trading platforms, Bitcoin lounges next to growth stocks and commodities like they’re old friends. Price feeds share real estate with live cricket betting odds, because why not? In this chaotic carnival, Bitcoin’s “digital gold” persona crumbles like a stale biscuit. It’s less “ancient relic” and more “glamorous, high-stakes dartboard.”

The big reveal exposes their ninja-like Bitcoin boots, catapulting them to “the world’s largest publicly admitted Bitcoin collectors” category. Yes, the accolade of showing off like this is probably on their to-do list!

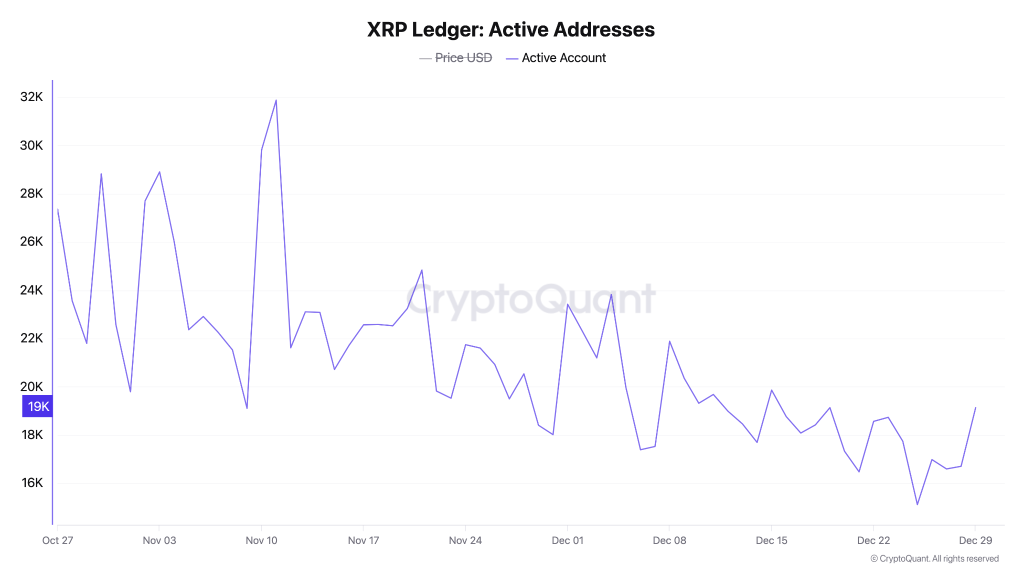

Cooling network activity, sell pressure rising like a poorly timed balloon animal, and derivatives positioning weaker than a jellyfish’s handshake all scream: “Prepare for a trip to the $1 express!” 🚂

Their shares are now performing better than Bitcoin itself – which is rather like discovering your butler makes better martinis than you do. Shocking, but terribly convenient. 🍸 Today’s NAV per share sits at $170, proving that sometimes corporate stubbornness does pay off – who knew? 🤷♂️

While the naysayers are busy declaring Bitcoin’s demise (again), Waterman is waving historical charts around like a magician with too many scarves up his sleeve. Turns out, pullbacks like this are as predictable as a British summer-unpleasant, but hardly unexpected. And here’s the kicker: gold and silver, those shiny relics of financial anxiety, have already hit new highs. Historically, Bitcoin follows suit like an excitable puppy chasing after them. So, if you’re thinking of ditching crypto for gold bars, Waterman suggests you might want to rethink that life choice.

О, the enigmatic Cardano! Since the December 25 low, it has ascended by a mere 13%, yet now it teeters on the edge of a breakout, ensnared within a falling wedge. A mere 10% decline this month-how quaint! But this week, dear reader, is no mere flicker of hope, but a tempest of possibilities. 🌪️