Ah, the world of digital currencies-a realm where innovation dances with absurdity, and finance flirts with folly. How delightful!

It seems that stablecoins, those charming chameleons of the crypto jungle, are outpacing their lumbering cousins, Central Bank Digital Currencies (CBDCs). While CBDCs sit around like forgotten debutantes at a ball, stablecoins are busy stealing the spotlight. Governments? Oh, they’ve noticed. And they’re rather smitten.

But let us delve deeper into this theatrical shift, shall we? 👀

CBDCs: A Tragic Tale of Irrelevance 🎭

At the WebX conference in Tokyo-a city known for its embrace of all things futuristic-Binance’s very own Changpeng Zhao delivered a monologue worthy of Shakespeare himself. “Central Bank Digital Currencies,” he declared, “are already outdated.” Outdated, you say? Why, it’s as if someone handed them a rotary phone while everyone else was FaceTiming on an iPhone 15.

He pointed to Hong Kong’s Stablecoin Ordinance and the U.S. GENIUS Act as examples of progress. Meanwhile, CBDCs languish like last season’s fashion trends. Indeed, efforts to launch CBDCs began back in 2013-2014, but alas, most projects wilted faster than a bouquet left in the sun. Only a handful saw the light of adoption, and even then, it was more flicker than flame.

Stablecoins: The Belle of the Ball 💃✨

Why do stablecoins captivate so? Perhaps it is because they are backed by tangible assets, or perhaps it is simply their ability to facilitate transactions without the melodrama of central banks. Either way, nations are beginning to take note-and act accordingly.

In January 2025, President Donald Trump signed an executive order banning U.S. institutions from dabbling in CBDCs. One might call it the final nail in the coffin for America’s digital dollar dreams. Meanwhile, the Bank of Korea has suspended its CBDC project, joining the likes of Japan, Denmark, Finland, and Singapore in quietly retreating from the stage. The European Central Bank, however, remains undeterred, planning to unveil the digital Euro this October. Bravo, Europe! Or should we say, *meh*?

Global Adoption: A Race Worth Watching 🏁🌍

The passage of the GENIUS Act has sparked a global frenzy over stablecoins. China, ever the pragmatist, is contemplating allowing yuan-backed stablecoins-a move as surprising as finding wit in a politician. Hong Kong, too, is crafting its own stablecoin ecosystem, while Japan prepares to debut its first yen-backed stablecoin this fall. Truly, the East is rising, and the West may soon find itself playing catch-up.

Stablecoins: The $2 Trillion Dream 💰📈

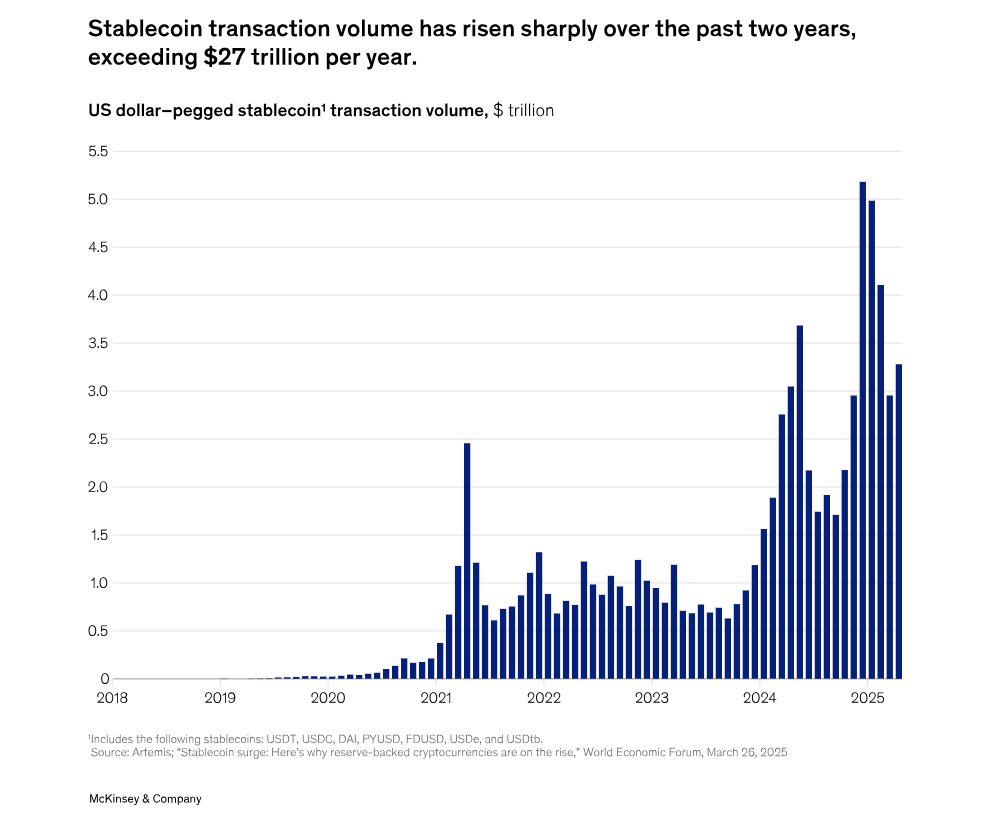

According to McKinsey, the total value of issued stablecoins has doubled in just 18 months to $250 billion. By 2028, they predict this figure will swell to a staggering $2 trillion. While stablecoins currently account for less than 1% of global money transfers, their growth trajectory suggests they may soon overshadow traditional payment methods. Instant settlement, lower risks, and global accessibility? It’s enough to make one wonder why anyone would choose anything else.

And so, dear reader, as CBDCs fade into obscurity and stablecoins rise like phoenixes from the ashes, one thing is clear: the future belongs to those who adapt-or at least pretend to. 😉

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-08-25 14:24