Oh, the sweet, sweet irony! The Federal Reserve, that ever-dramatic hero of high finance, injected $29.4 billion into the system-its largest single-day swoop since the dot-com era’s tragic romance. Meanwhile, China’s central bank, ever the overzealous stage manager, flooded its markets with record cash. A Shakespearean tragedy? A comedy of errors? Only time will tell. 🎭

These liquidity love letters from central banks signal what traders call a “turning point” for risk assets. Bitcoin, that mercurial diva of the crypto world, watches with bated breath. Will it be the star of the 2026 show or merely a footnote in the annals of financial theater? 🎭💸

Fed’s Liquidity Move: A Desperate Love Letter to the Markets

The Fed’s overnight repo operation-a term that sounds suspiciously like a sci-fi villain’s weapon-followed a tempestuous Treasury sell-off. The stress? As palpable as a Victorian maiden’s anxiety at her first ball. 🤯

BREAKING 🚨U.S. Banks

Fed Reserve just pumped $29.4 Billion into the U.S. Banking System through overnight repos 🤯 This amount far surpasses even the peak of the Dot Com Bubble 👀 Probably Fine, carry on

– Barchart (@Barchart) November 1, 2025

Overnight repos, those arcane financial taffy pulls, let banks trade securities for cash. The October 31 injection? A record so bold it makes the dot-com bubble look like a timid garden party. 🌪️

Analysts, ever the armchair philosophers, claim this is the Fed’s way of whispering, “Fear not!” to Treasury markets. When bond yields rise like a phoenix from ashes, the Fed arrives like a tragic hero attempting to outrun their fate. 🦋

And Bitcoin? It thrives on such chaos, a glittering opportunist in the chaos of monetary policy. The money supply swells, and risk assets rally-like moths to a flame, or perhaps vampires to a masquerade ball. 🧛

Enter Christopher Waller, Fed Governor and would-be poet of rate cuts, advocating for December’s “relief.” Contrast this with Jerome Powell’s recent hawkishness, a performance so confusing it’s left markets clutching their pearls. 🎭

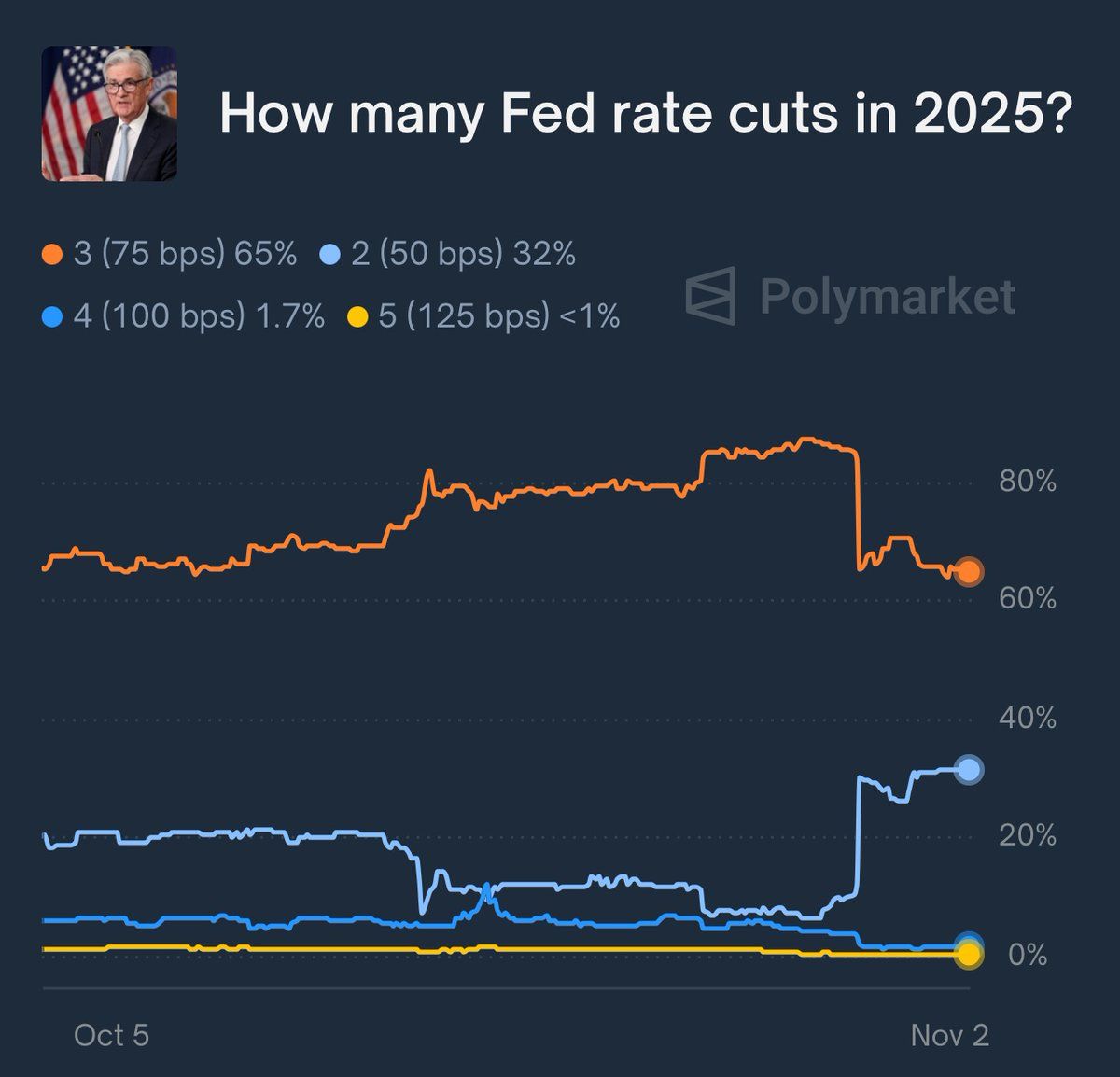

Polymarket’s odds for a 2025 rate cut? Slipping like a buttered eel-from 90% to 65%. Investors, ever fickle, now play a game of “hot potato” with their expectations. 🐍

If the Fed disappoints, markets might throw a tantrum worse than a toddler denied dessert. Risk assets could flee faster than a cat from a bathtub. 🚿

The Fed’s balancing act? A tightrope walk between inflation and stability, performed with the grace of a drunk acrobat. 🤹

China’s Cash Infusion: A Dragon’s Generosity or a Trojan Horse?

Meanwhile, China’s central bank, ever the enigmatic puppeteer, injected a record cash sum to prop up its economy. A bid to combat deflation? Or a masterstroke in the global liquidity chess game? 🐉

🏦 China’s M2 Just Surpassed the U.S. by Over $25 Trillion

For the first time in modern history, China’s M2 Money Supply is now over twice the size of the United States.

🇨🇳 China M2: ≈ $47.1 trillion

🇺🇸 U.S. M2: ≈ $22.2 trillionThat’s a $25 trillion gap – a difference that…

– Alphractal (@Alphractal) November 1, 2025

The PBOC’s move? A carbon copy of its crisis-era playbook. Supply funds, lower borrowing costs, and pray the property sector doesn’t collapse like a poorly baked soufflé. 🏗️

Global liquidity swells, and asset inflation tickles stocks and cryptos alike. History whispers: the 2020-2021 Bitcoin bull run coincided with pandemic-era money printing. Déjà vu, anyone? 🌊

China’s liquidity has shown a stronger correlation with Bitcoin’s price than that of the U.S.

Many analysts still focus exclusively on U.S. macroeconomic data – and of course, America’s influence is undeniable.

But for almost two decades, other global powers have been gaining…– Joao Wedson (@joao_wedson) November 1, 2025

Analysts call it a “liquidity tug-of-war” between Washington and Beijing. The Fed tiptoes on inflation tightropes; the PBOC juggles growth and debt like a circus performer. The winner? Determines whether Bitcoin becomes a ballerina or a wallflower. 🎭

Bitcoin: The Belle of the Liquidity Ball or a Cinderella Story?

Bitcoin, that nervous debutante, hovers in a narrow range. Traders weigh central bank antics like a chef measuring salt-too little, and the dish flops; too much, and it’s inedible. 🧂

Open interest drops like a hot potato, signaling derivatives traders are as cautious as a cat on a tightrope. 🐱

Yet, if liquidity flows like champagne at a Gatsby party, Bitcoin may yet shine. Lower U.S. inflation and expanding money supply? A match made in Wall Street heaven. 🍾

But beware: If the Fed scales back repo operations, Bitcoin’s rally might vanish faster than a magician’s rabbit. 🎩🐇

China’s stimulus, too, is a double-edged sword. Fail to revive the economy, and risk sentiment crumbles like a stale cookie. 🍪

As the curtain rises on 2026, the world watches. Will central banks keep the liquidity love alive, or will inflation slay the bull run? Only the most cynical-or optimistic-pundits dare predict. 🎭

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Mewgenics Tink Guide (All Upgrades and Rewards)

2025-11-03 00:15