As a seasoned crypto investor with a knack for deciphering market trends and patterns, I find myself intrigued by the latest developments surrounding Chainlink (LINK). The consistently negative exchange netflows over the past month as reported by IntoTheBlock could potentially be a bullish sign for LINK’s value. This trend often suggests accumulation, which, if true, would reduce immediate sell pressure and might lead to an upward price movement.

According to blockchain information, there’s been an ongoing trend of decreased outgoing transactions for Chainlink (LINK), which might be a positive indicator for the token’s worth.

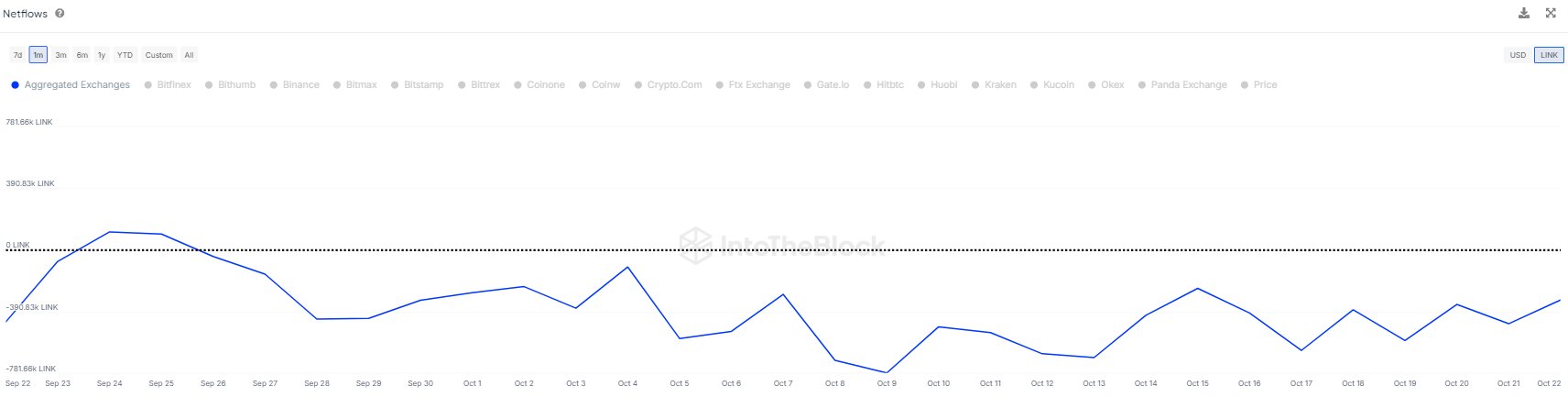

Chainlink Exchange Netflows Have Been Negative For Almost A Month

On their recent update on platform X, IntoTheBlock has delved into the current flow pattern of Chainlink’s exchange transactions, a metric they call “exchange netflow”. This term specifically signifies the net quantity of LINK tokens flowing in or out of wallets linked to centralized exchanges.

When the value of this measure is more than zero, it indicates that these platforms are gaining a total amount of tokens. Since many investors transfer their coins to trading platforms primarily for selling, such a pattern might suggest negative or downward price trends for the asset.

Conversely, a negative indicator implies that holders are withdrawing more cryptocurrency than they’re depositing from exchanges. Typically, holders remove their coins for safekeeping when they plan to hold onto them long-term, making this type of trend potentially bullish for LINK.

Now, here is a chart that shows the trend in the Chainlink exchange netflow over the past month:

From the graph you see, Chainlink exchange netflow has remained at zero for several weeks now. This suggests that investors have consistently withdrawn their funds from these platforms over this period.

According to IntoTheBlock, this pattern frequently indicates that owners are stockpiling assets by transferring them to offline or personal wallets, which lessens immediate selling pressure. The question now is whether these outflows will ultimately prove advantageous for LINK.

Another positive indicator suggesting a potential upward trend in cryptocurrencies, aside from the negative exchange netflow, is highlighted by the on-chain analytics firm Santiment in their recent blog post.

The referred signal pertains to the Weighted Sentiment analysis, providing insights into the current public opinion or sentiment towards a specific asset across prominent social media sites.

This tool employs a machine-learning algorithm from the analytics company to distinguish between positive and negative social media posts, determine their combined impact, and label it as the ‘net sentiment’. It then measures this sentiment value relative to the total number of posts on social media that day, which we refer to as ‘Daily Social Activity’.

The following table demonstrates how this specific indicator fluctuated across various time intervals for diverse digital currencies within the crypto market.

As a researcher studying market trends, I’ve noticed an intriguing shift in Chainlink’s Weighted Sentiment. Over the past day, there’s been a significant -372% reversal, suggesting that investors are experiencing a wave of fear, uncertainty, and doubt (FUD) following the recent bearish price movements.

Historically, cryptocurrencies often go against the general public’s predictions. When traders grow excessively pessimistic (bearish), there’s a good chance of a bullish turnaround. Given the current strong negative sentiment, it might contribute to an increase in the value of LINK.

LINK Price

At the time of writing, Chainlink is floating around $11.4, up 4% over the past week.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Luma Island: All Mountain Offering Crystal Locations

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- 13 EA Games Are Confirmed to Be Shutting Down in 2025 So Far

- Space Marine 2 Teases 2025 Plans

2024-10-25 10:12