In the grand theater of financial markets, where bulls and bears engage in their eternal dance, one act has captured the attention of many: the Chainlink (LINK) performance. Satoshi Flipper, a seasoned critic of this digital spectacle, has pointed to the tightening structure on the 8-hour chart, hinting at a potential breakout above the $24 resistance zone. It’s as if the market is holding its breath, awaiting the final note of the overture.

Meanwhile, the ever-optimistic Crypto Candy has emphasized the lower-timeframe setup, forecasting a 20% to 30% upside if the asset can muster the courage to clear key barriers near $25.29 and $27.91. Both analysts, like wise soothsayers, see the current consolidation as a mere prelude to a grander movement, aligning with the broader market’s bullish sentiment. After all, why settle for a waltz when a tango looms on the horizon?

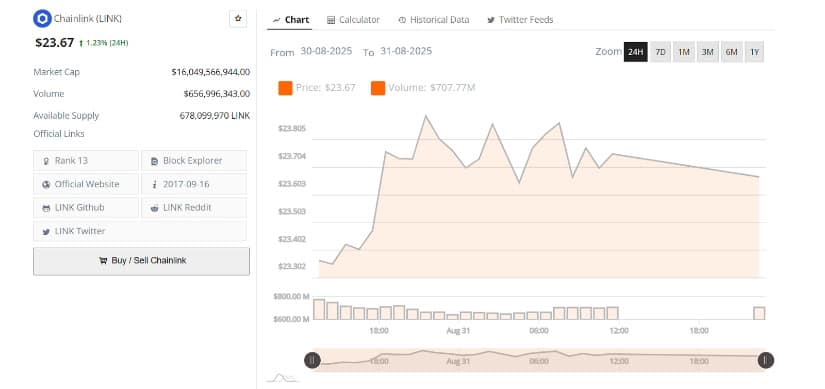

Currently, LINK trades around $23.67, with a market cap of $16.04 billion and a daily volume of $656.9 million. The technical strength above $23.30 support underscores a persistent demand, much like a stubborn melody refusing to fade, while the narrowing price action signals pressure building for a decisive breakout. The market, it seems, is on the edge of its seat, eager for the next move.

Technical Setup Points to Breakout

Analyst Satoshi Flipper noted that Chainlink is forming a symmetrical triangle on the 8-hour chart. The pattern, a classic in the repertoire of technical analysis, shows price compression between converging support and resistance levels. Such formations are often considered early signs of a breakout once momentum strengthens. It’s as if the market is tightening the strings of a violin, preparing for a crescendo.

According to the chart, the asset has been consolidating following recent volatility, much like a dancer pausing to catch their breath before the final leap. Hence, market momentum remains aligned with the prevailing trend, which leans bullish. The structure indicates that traders may be anticipating a strong move if it holds above the current range, a move that could turn the current act into a grand finale.

Analyst Projections and Resistance Levels

Analyst Crypto Candy observed a similar triangle formation on the lower-timeframe charts. With the token trading near $23.75, the analyst suggested the token may attempt another push higher. The forecast points toward a potential rally of 20% to 30% if buyers manage to clear immediate resistance. It’s as if the market is setting the stage for a dramatic reveal, with key price levels identified at $25.29 and $27.91, both considered important markers for continuation.

A move above these levels could open the way toward $30, extending its short-term bullish trajectory. Analysts also emphasized the relevance of the $23.70 support, which remains a critical zone to defend for the upward scenario. It’s a delicate balance, much like a tightrope walker’s act, where a single misstep could change the entire performance.

Market Performance and Liquidity

On the 24-hour chart, Chainlink showed modest upward momentum, rising 1% to $23.67. The token briefly tested $23.80 before retracing to the $23.60 level, reflecting active trading and intraday profit-taking. This performance indicates that analysts are cautious at short-term resistance zones, much like a conductor carefully guiding the orchestra through a challenging passage.

Trading volume reached $656.9 million, maintaining steady liquidity through the period. The early push above $23.80 was followed by retracements, showing hesitation among buyers to extend beyond the near-term ceiling. However, the coin has held above $23.30, which signals ongoing defense of support levels. It’s a game of patience, where the market waits for the right moment to strike.

Broader Market Context

With a market capitalization of $16.04 billion, Chainlink remains one of the top assets in the cryptocurrency sector. The consolidation phase around $23.60-$23.70 suggests that traders are waiting for a decisive break. Analysts believe a move above $24 would provide the confirmation needed for stronger bullish continuation. The narrowing range of the current structure indicates growing pressure. If buying volume increases at the breakout point, the price may attempt to retest the $24 resistance before advancing further. Conversely, if momentum weakens, it could revisit the $23.30-$23.40 support range, extending consolidation in the near term. In the end, the market’s performance will be judged not just by its highs, but by its ability to sustain the rhythm of its dance. 🕺🎶

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-09-01 20:48