Oh, the deviousness of the market! Analysts, with their magnifying glasses and spreadsheets, have noted early signs of accumulation-though one might call it a “modest gathering of pigeons”-weakening momentum (a polite term for “falling like a lead balloon”), and a key trendline resistance that’s more stubborn than a butler refusing to serve tea. The short-term direction hinges on holding $12 and reclaiming $12.50, which could open a push toward the $15-$17 range. A grand adventure, if you ask me, though I suspect the market is less interested in grandeur and more in chaos.

The Altcoin’s Return to the Weekly Demand Zone

Chainlink, that intrepid little rogue, has returned to its weekly demand zone after a steady decline from the $22-$26 band. According to CryptoPulse, this level has served as a base for previous recoveries, much like a well-tailored waistcoat in a gentleman’s wardrobe. The chart shows the coin tapping the green accumulation block once again, with initial signs of support forming on the latest weekly candles. Earlier cycles, one suspects, were merely the market’s way of saying, “Let’s pretend we’re not panicking.”

CryptoPulse, ever the optimist, notes that a bounce from this region could position it for a move toward the $15-$17 range. This potential path aligns with areas where price formed recent breakdown structures-a most dramatic alignment, akin to a Shakespearean tragedy where the hero (or heroine) is felled by their own hubris. Near-term resistance? Oh, it’s there, lurking like a tax audit at a garden party.

The analyst, with a twinkle in their eye, states that the weekly close remains crucial, as it determines whether buyer strength is building or weakening. A firm hold above the zone may support early accumulation, while repeated rejections may indicate hesitation among market participants. One imagines traders pacing their studies, muttering, “Will it hold? Will it hold?” like a Victorian man awaiting the post.

Market Structure and Daily Price Pressure

On the daily timeframe, Chainlink continues to trade under pressure, hovering below the $12.50 level. CRYPTOWZRD reports that the latest daily candle closed with indecision, reflecting ongoing uncertainty in momentum. A most vexing state of affairs, akin to trying to catch a fly with a teacup.

The chart displays a descending trendline that has acted as dynamic resistance since early October, with each rebound capped at lower highs. This pattern suggests the broader trend remains under strain, much like a man in a too-tight cravat. The analyst explains that its next directional move may depend on Bitcoin’s performance and shifts in market dominance. If Bitcoin strengthens, it could attempt to break above the descending trendline, creating room for a move toward the $16 resistance area. A bold gambit, though I’d wager the market will respond with a yawn and a sip of sherry.

This level aligns with prior consolidation phases. However, persistent trading below $12.50 maintains bearish pressure, and lower timeframes are becoming more important for detecting early reversals. One suspects the market is playing a game of hide-and-seek with its participants, and no one has found it yet.

Analysts Track Breakout Triggers

CRYPTOWZRD adds that the altcoin may require time to form a structured recovery, as the broader daily environment remains uneven. The asset is positioned near a zone where sudden short-term volatility is possible if broader market strength appears. A most thrilling prospect, though I’d recommend wearing seatbelts (or perhaps a life jacket).

The chart scenario shows that reclaiming the descending trendline may allow LINK to approach the $15-$17 corridor, previously marked by active trading volumes. Until then, the analyst continues monitoring intraday setups for early shifts in price behavior. A failure to maintain support within the weekly demand zone may shift attention to lower liquidity pockets. CryptoPulse notes that a weekly close beneath this zone would suggest weakening demand. For now, LINK remains at a level where price reactions are historically strong, creating careful monitoring among traders awaiting confirmation of direction. A most delicate dance, like balancing a teacup on a tightrope.

Intraday Volatility and Short-Term Trading Levels

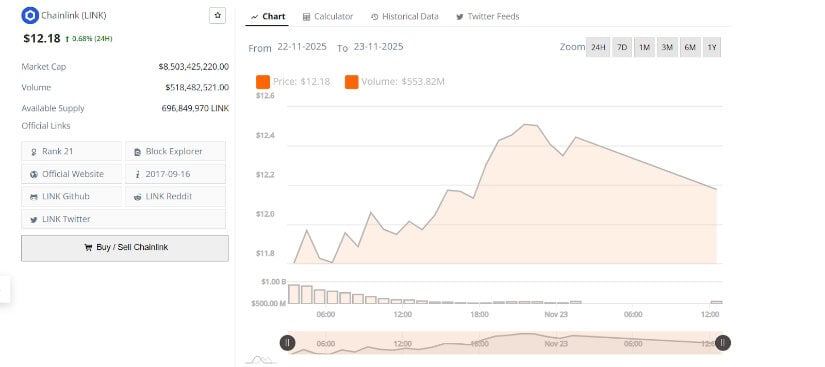

Over the past 24 hours, Chainlink traded at around $12.18, following a choppy session marked by varied momentum. The chart shows an early move toward $11.80, followed by a rebound above $12.40 before encountering resistance. Trading volume decreased during the upswing, signaling that buyers lacked conviction. As the session progressed, LINK pulled back into the mid-$12 range as sellers defended the upper boundary. A most dramatic tug-of-war, though the rope seems to be made of spaghetti.

The broader intraday range shows the altcoin struggling to remain above $12.50, where repeated rejections have formed a short-term ceiling. Despite this, the price continues to hold above $12, indicating steady interest at lower levels. Volume trends appear reduced throughout the session, suggesting cautious participation among traders. Should the asset remain above $12, another test of the $12.40-$12.50 band is possible. A move below $12 may allow the price to revisit the $11.90 level. A most precarious situation, akin to walking a tightrope in a hurricane-though at least the hurricane has a sense of humor.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Mewgenics Tink Guide (All Upgrades and Rewards)

2025-11-24 02:16