In the grand theater of finance, where every dollar is a character and every trade a plot twist, the US spot ETF inflows, which had been the unsung heroes of Bitcoin and Ethereum’s Q2 rally, have decided to take an early curtain call.

On a Monday that felt more like a Monday in a Russian novel, US Bitcoin and Ethereum ETFs experienced a record outflow of $333 million and $465 million, respectively. 📉💰

The Largest Outflow Ever from Ethereum ETF: A Tragedy in Three Acts

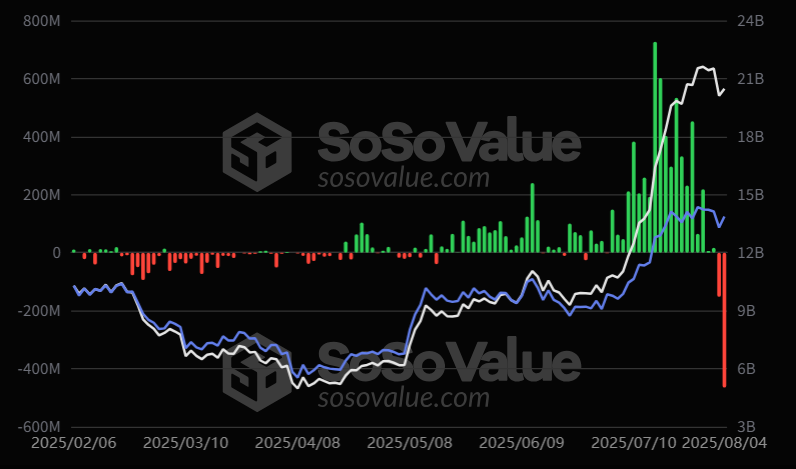

According to the ever-reliable crypto data platform SoSoValue, US spot Bitcoin ETFs saw a net outflow of $333.19 million. Most notably, BlackRock’s IBIT, the largest Bitcoin-holding spot ETF, recorded a net outflow of $292.21 million-the largest since May 30. IBIT, the knight in shining armor, had been the staunchest defender of Bitcoin prices during the market’s darkest hours over the past two months.

The drama only thickened for US spot Ethereum ETFs. Total net outflows reached $465.1 million-the largest since these products launched in July 2024. Once again, BlackRock’s ETHA played the lead role, with $375 million leaving the fund in a single day. This abrupt exit ended its 21-day inflow streak and shaved off 3% of its ETH stash. 🌪️🔥

Despite the record-breaking outflows, both Bitcoin and Ethereum managed a small victory, rising around 1% and 5%, respectively, buoyed by a rebound in the three major US stock indexes that day. It’s as if the market was saying, “After all, what are a few million dollars among friends?” 🤷♂️😂

ETF demand, along with institutional buying, had been the lifeblood of the Q2 crypto rally. The question now looms like a dark cloud over the financial landscape: Will this outflow trend continue into the next day or the week? If ETF inflows continue to slow, the top two largest cryptocurrencies might find themselves under increasing pressure in the coming weeks. 🌧️🌪️

The investors, always the most dramatic characters in this play, are confused. Just when it seemed the markets were stabilizing after the shock of last week’s US employment data, a new act began. 🎭🤔

According to FedWatch, a rate prediction tool by the CME Group, the probability of a Fed rate cut in September has surged to 95%. Goldman Sachs, ever the optimist, expects the Federal Reserve to cut rates three times in a row starting in September. 🎉💸

And in a plot twist that could only come from a master storyteller, Trump is expected to announce a new Federal Reserve Board member and the next head of the Bureau of Labor Statistics (BLS) later this week. One can only imagine the conversations at the water cooler. 🗣️🚰

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

2025-08-05 12:32