In a move that could be described as either genius or a desperate grab for relevance, Coinbase has swooped in to acquire Vector, a Solana-based social and on-chain trading platform. No one saw it coming! Well, actually, some did, but the excitement is palpable. Coinbase has decided that Vector’s underlying tech will be folded into its consumer trading stack, possibly in a bid to open up those oh-so-velvety high-velocity on-chain markets that everyone’s talking about. The question is, does anyone care?

The acquisition is part of Coinbase’s grand plan for 2025 – expanding services like a well-meaning but slightly misguided personal trainer trying to get you to do more push-ups when you can barely handle one. The company believes that the booming Solana DEX market, with volumes surpassing $1 trillion this year, is worth investing in. And yes, it is a booming market, but let’s not pretend like the public’s interest in Solana is undying, shall we?

According to Coinbase’s blog (as if there’s anyone left who reads blogs), Vector’s Solana-native engineering team will join the ranks of Coinbase, adding their highly specialized knowledge to improve the speed, liquidity, and general ‘shiny new toys’ of Coinbase’s DEX trading interface. The ‘get it done’ attitude is commendable, even if it’s not enough to distract from the fact that this acquisition also means the slow demise of Vector’s mobile and desktop apps. RIP, Vector, it was fun while it lasted.

In a move that’s somehow predictable but still awkward, Coinbase made sure to emphasize that the Tensor Foundation – known for the Tensor NFT marketplace and its token – will remain completely independent from Coinbase. Because when you’re already juggling a billion-dollar acquisition, you might as well throw a little independent charity project into the mix. Nice touch.

Solana Falls Victim to End-of-Week Market Liquidations

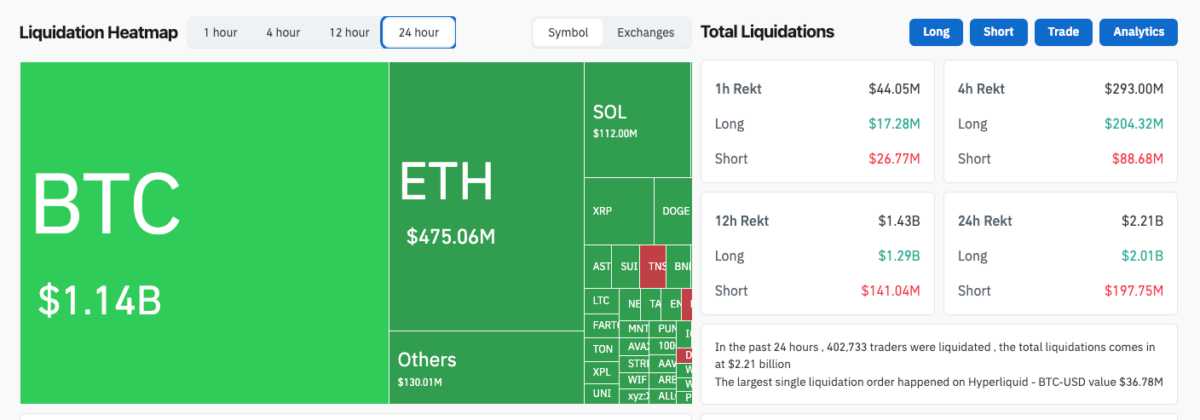

Of course, none of this really matters when Solana’s market is having a meltdown. No matter how much Coinbase buys up or integrates, Solana was already in the midst of another Friday freakout. SOL saw a drop of a lovely 9%, joining the ranks of Ethereum and XRP, which were also hemorrhaging value like a reality star on a bad press tour. Volatility isn’t just a number here; it’s the number.

The stress in the Solana derivatives market was visible. Coinglass data shows that SOL trading volume jumped by 46% – like everyone was trying to exit the burning building at once. Meanwhile, open interest fell 9% to $6.75 billion, signaling that traders were far from confident. The long-to-short ratio slid to 0.91 – for those keeping track, that means more people are betting that Solana will continue to crash into the weekend. It’s a tough crowd in crypto.

Solana derivatives market analysis | Source: Coinglass

Solana Price Forecast: Falling Wedge Signals 29% Relief Potential if Bulls Hold $124 Support

And now, the moment you’ve all been waiting for: the thrilling price forecast of Solana, coming to you live from the bottom of the falling wedge. With Solana struggling at $124.51, the crypto community is holding its collective breath. It’s like watching a slow-motion car crash, but with a little more hope and a lot more spreadsheets.

Solana (SOL) Technical Price Analysis | Nov. 21, 2025

At present, Solana is tangled in a two-month falling wedge – a technical setup that’s been trailing the price down since October. Despite the gloom, there’s a sliver of hope. The key moving averages are all hanging above Solana’s current price, like stars in the sky that seem unreachable yet somehow offer the promise of a better tomorrow. In short, a recovery would need a miracle or at least a $160 breakout to convince anyone that the bear market is over.

But the MACD line remains firmly planted in the negative territory at -14.53, confirming that bearish momentum is still the boss around here. A full resolution of the wedge could see Solana price climb to a dreamy $220, but that’s a big if. For now, the only thing that’s certain is the 29.12% upside projection, provided the bulls can hold that $124 support level. And if not? Well, say hello to $110. That’s going to be fun.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-11-22 01:25