In the US, a recent court ruling brings ambiguous results regarding cryptocurrency regulations, affecting platforms like Coinbase and investors across the country.

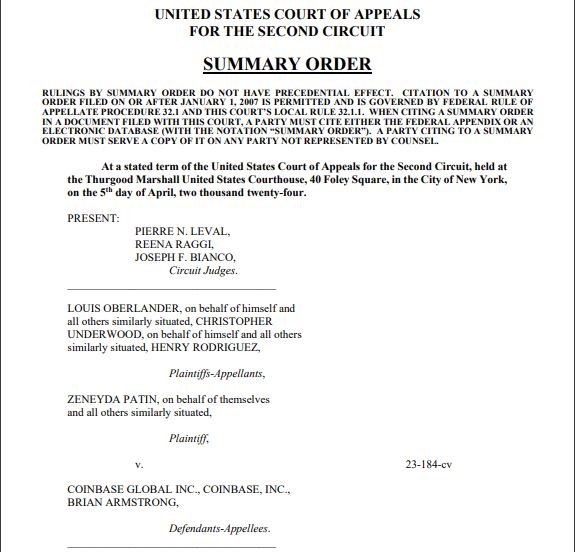

In simpler terms, the Second Circuit Court of Appeals in the United States decided that transactions involving the sale of cryptocurrencies as a secondary market on Coinbase are not subject to the regulations set by the Securities Exchange Act of 1934.

The win for the crypto exchange eases some concerns for the crypto industry, yet leaves lingering legal doubts about cryptocurrencies uneresolved.

Coinbase Wins Appeal On Secondary Sales

The legal dispute hinged on whether the cryptocurrencies transacted through the exchange fell under the category of securities. If identified as securities, they would become subject to more stringent SEC oversight.

Plaintiffs from across the country accused Coinbase of enabling the sale and distribution of unregistered securities on its platform, contradicting the Securities Act of 1933 and Securities Exchange Act regulations.

COINBASE WINS AGAINST THE SEC $COIN

A notable crypto exchange, Coinbase, secured a significant win in an ongoing court case. In a recent decision by the U.S. Court of Appeals for the Second Circuit, it was determined that Coinbase is not responsible for transactions involving the secondary sale of cryptocurrencies on its platform.

— amit (@amitisinvesting) April 6, 2024

Instead of this: “Coinbase argued that cryptocurrency transactions conducted as secondary sales on their platform didn’t fit the regulatory description of securities deals.”

The Court of Appeals’ ruling brought relief to Coinbase as it determined that transactions involving secondary sales on their platform did not fall under the definition of securities in the Securities Exchange Act.

For Coinbase and its crypto-enthusiast users involved in secondary market transactions from October 2019 to March 2022, this is a substantial victory.

Unresolved Issues Cloud The Verdict

Although the court’s verdict wasn’t a total win for Coinbase, it did partially uphold an earlier ruling. This means that Coinbase might still face liability under Section 12(a)(1) of the Securities Act for selling unregistered securities.

The user agreements at issue with Coinbase are a source of dispute. The court recognized that these agreements can change frequently, making it challenging to understand their precise legal meaning. This lack of clarity leaves investors and the exchange in doubt.

Lingering Debate And Need For Clarity

The decision made by the Court of Appeals brings attention to the persistent dispute over cryptocurrency regulation in the United States. While Coinbase views this ruling as validating that transactions involving the sale of cryptocurrencies as secondary markets do not classify as securities, those who filed the lawsuit interpret it as a crucial step towards implementing securities regulations on crypto exchange platforms.

The varied viewpoints highlight the importance of having detailed and all-encompassing laws to manage the cryptocurrency industry.

Industry experts and Coinbase concur that unclear regulations negatively impact innovation and expansion in the cryptocurrency sector. Paul Grewal, Coinbase’s Chief Legal Officer, recently highlighted the importance of having clear-cut regulations in a blog post.

I. He hoped that the court’s ruling would open up productive conversations with regulators, leading to the creation of a supportive environment for innovative and responsible practices in the cryptocurrency sector.

The ruling from the court provides some much-needed guidance regarding the categorization of secondary crypto transactions on Coinbase. However, it does not resolve the larger question of cryptocurrency regulations as a whole.

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- LIT PREDICTION. LIT cryptocurrency

- BCH PREDICTION. BCH cryptocurrency

- USD CNY PREDICTION

- USD MYR PREDICTION

- CITY PREDICTION. CITY cryptocurrency

- ORAI PREDICTION. ORAI cryptocurrency

2024-04-08 23:11