As a seasoned analyst with over two decades of experience in traditional financial markets and a keen interest in the crypto space, I must say that the current state of the market is reminiscent of a rollercoaster ride – exhilarating at times, nerve-wracking at others. The Coinbase report underscores the increasing interdependence of the crypto market on broader economic events, a reality that has become more apparent since institutional investors started pouring in.

As an analyst, I’m sharing insights from a recent Coinbase Research report indicating that the crypto market is under significant pressure due to broader economic factors. The uncertainty persists because there seems to be a lack of substantial triggers pushing prices upward in the near future. This situation has left many investors on edge, given the shifting global conditions.

Coinbase: Macro Factors At Play

Coinbase’s findings emphasize how the cryptocurrency market is increasingly influenced by larger economic occurrences. For instance, the Bank of Japan’s recent decision to raise interest rates might have triggered a cascade effect in the forex market, as it led to the unwinding of yen carry trades and created disturbances worldwide.

Additionally, the escalating geopolitical conflicts in the Middle East seem to stir worries about oil availability, making the situation even more complex. These aren’t just hypothetical economic forces; they significantly influence investor attitudes and market equilibrium.

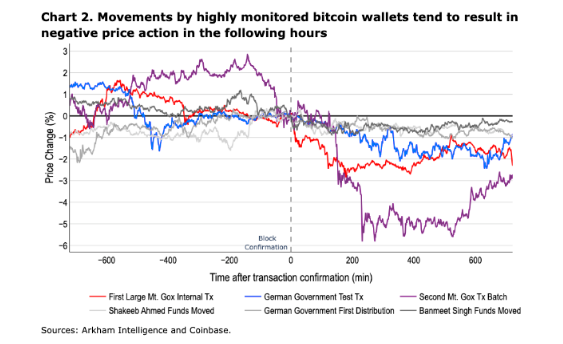

Based on Coinbase analysts’ assessment, the use of leverage in on-chain spot markets has significantly decreased, potentially indicating that investors have become more cautious following the recent substantial price drops.

It’s thought that, because there aren’t any immediate triggers, the short-term fluctuations in cryptocurrency will primarily be influenced by broader economic conditions.

Q3 Strategies

As a forward-thinking crypto investor, I find myself approaching Q3 2024 with a measured stance, guided by Coinbase’s strategic decisions. Their outlook is heavily influenced by the upcoming data releases concerning US inflation. These figures could significantly impact market sentiment and, consequently, our investment climate.

When the cryptocurrency’s performance becomes visible, it might either boost investor confidence or further disappoint them. Without any encouraging updates or advancements in the crypto world, it could be challenging to sustain a favorable trend in prices.

While some analysts may express caution, they also suggest that there could be an uptick in token values if there’s a recovery in the U.S. economy, as they have pointed out.

Some experts predict that Bitcoin‘s record high might be surpassed again this year, given favorable macroeconomic circumstances. The varying opinions within the cryptocurrency industry underscore the present unpredictability of its market trends.

The Road Ahead For Investors

To navigate successfully within the current cryptocurrency environment, it’s crucial to pay close attention to how macroeconomic trends and market movements interact.

It’s quite apparent that there’s an interaction between cryptocurrencies and conventional financial markets, a connection that has become more noticeable ever since institutional investors started entering the market.

In a developing marketplace, it’s crucial for investors to keep in mind that cryptocurrencies aren’t standalone investments anymore; instead, they are influenced by broader economic movements and global trends.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

- USD COP PREDICTION

2024-08-11 19:11