Ah, the sweet scent of financial chaos. It seems that in this whirlwind of instability, Bitcoin has taken the spotlight as the latest “must-have” for businesses. According to the ever-astute Bitcoin investment firm, River, companies are gobbling up Bitcoin like it’s the latest fashion trend—surging by a jaw-dropping 154% in just a year! Now, let us dive into this fascinating rise and explore why everyone from finance moguls to your local T-shirt printer is jumping on the crypto bandwagon.

In this thrilling tale, we shall unravel the mystery behind the meteoric rise in Bitcoin accumulation, the forces driving this trend, and the insights from the so-called “experts” (who may or may not be as wise as they sound).

The Great Bitcoin Business Bonanza

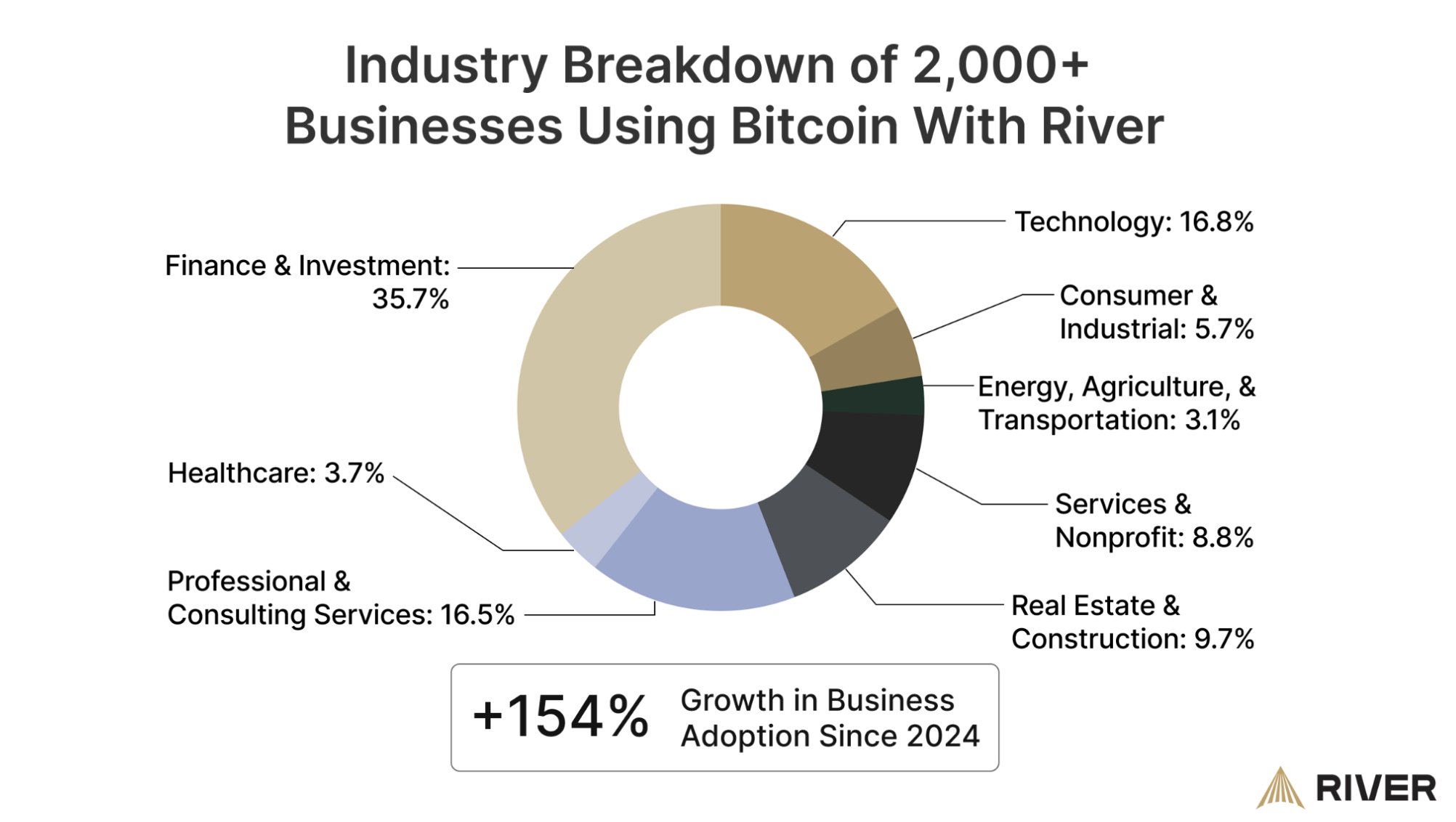

Let’s get this straight: Over 2,000 companies are now proudly hoarding Bitcoin. This is a 154% increase from last year! Can you believe it? And what sectors are leading the charge? Well, finance and investment are hogging a hefty 35.7%, followed by technology at 16.8%, and professional consulting services at 16.5%. Other sectors are joining the fun too, with real estate (9.7%), healthcare (3.7%), and even energy and agriculture (3.1%) getting in on the act.

It’s clear now: Bitcoin isn’t just a toy for the tech nerds anymore. It’s spreading its wings and becoming the darling of industries near and far. Who would’ve thought that a humble T-shirt printing company, BlueCotton, would be embracing Bitcoin? Or that fast food giant Steak ‘n Shake would allow customers to pay for greasy fries with this digital gold? Amazing times we live in.

Even more intriguing—businesses are now the leading Bitcoin buyers, surpassing governments and ETFs! Ah, the power of the people, eh?

Why Are Businesses Suddenly Obsessed with Bitcoin?

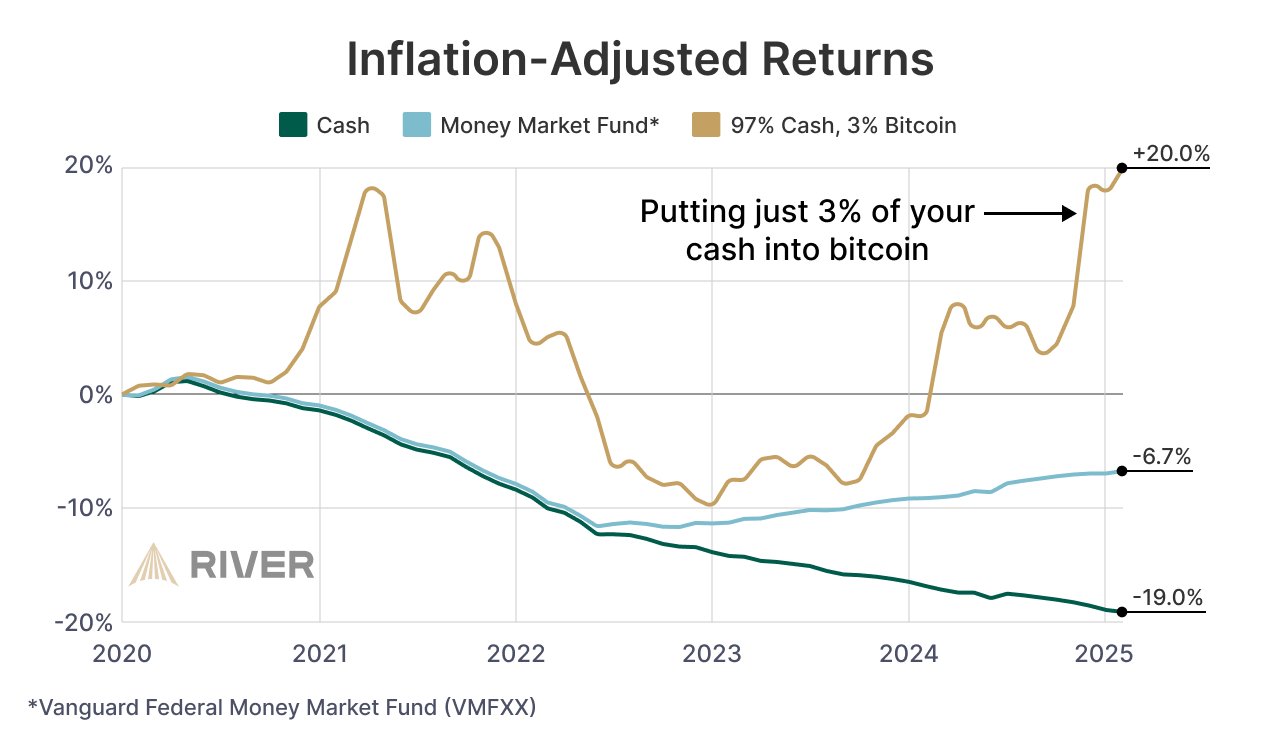

So, why this Bitcoin frenzy, you ask? Well, it’s simple: Inflation is eating cash alive. River’s calculations reveal that a company putting just 3% of its assets into Bitcoin earned a 20% return after adjusting for inflation between 2021 and 2025. Meanwhile, poor ol’ cash holdings lost 19%, and even money market funds couldn’t escape with a measly 6.7% loss. Ouch!

“Bitcoin is like a rare unicorn, a liquid, scarce asset with a fixed supply of 21 million coins. Historically, this scarcity has allowed it to shine brighter than inflation, making it an ideal store of value for the long haul,” the fine folks at River declare.

Take Belo, for example—a company from Argentina that saw its currency inflating by 211% (yes, 211%—not a typo). They decided to stash 30% of their treasury in Bitcoin, because, well, who wouldn’t want to dodge a hyperinflating peso?

Bitcoin’s liquidity is another selling point. It’s available around the clock—no bank hours to worry about here! Just ask the poor souls who couldn’t access their cash during the disastrous collapse of Silicon Valley Bank in 2023. Bitcoin was there, ready and waiting to save the day.

And then, there’s the charm of reducing third-party risks. With Bitcoin, businesses can control their own assets, and avoid those pesky middlemen who tend to complicate things. Genius, right?

All told, private and public companies have now accumulated over 1 million BTC by 2025. Hold on to your hats, folks—Standard Chartered forecasts Bitcoin could skyrocket to $120,000 by Q2 2025 thanks to this avalanche of corporate accumulation.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-05-14 18:08