As a researcher with experience in cryptocurrency markets, I find the recent price action of Bitcoin intriguing, to say the least. The intense bearish pressure over the past few days has driven the premier cryptocurrency below key support levels, with prices falling as low as $57,000 on Thursday and dipping further below $54,000 on Friday.

In recent times, the cryptocurrency market has shown some intriguing developments. Specifically, Bitcoin, the leading digital currency, has faced significant downward pressure, causing its price to dip below the $60,000 threshold on July 4, reaching a low of around $57,000.

BTC experienced a decline in price on Friday, dipping below $54,000 at certain points. This downturn in value can be attributed to several factors, such as government sell-offs and possible profit-taking following the announcement of the Mt. Gox payout.

Government Bitcoin Selling Is Overestimated: CryptoQuant CEO

In his latest update on the X platform, CryptoQuant CEO Ki Young Ju shares his insights on rumors of governments around the world selling confiscated Bitcoins. Notably, Germany’s government has been active in conducting several substantial Bitcoin transactions lately.

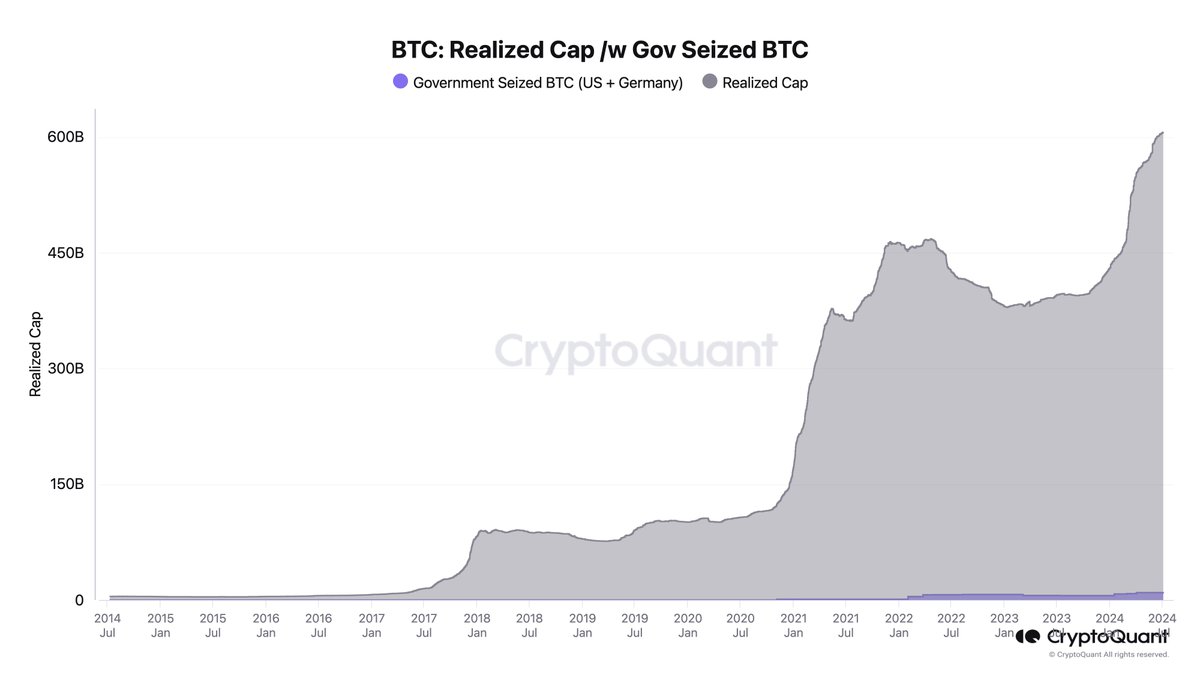

As an analyst, I’ve noticed that the FUD (fear, uncertainty, and doubt) surrounding recent selloffs has significantly contributed to the current bearish trend in Bitcoin’s price. However, it’s important to note that the influence of governments selling seized Bitcoins on this downward pressure might be overestimated. According to the CEO of CryptoQuant, these sales could be having a smaller impact than what is being perceived in the market.

The assessment takes into account the total value of Bitcoin realized over the past year, with approximately $9 billion (or under 5%) being derived from Bitcoin confiscated by US and German authorities between 2023. It’s important to mention that this data only reflects Bitcoin seized by these two governments.

In his recent write-up, Young Ju explained that the “realized cap” refers to the overall capital investment in the market since 2023. This concept differs from the commonly used “market cap” as it takes into account the price at which each coin was last transacted.

The CEO of a blockchain company expressed optimism about Bitcoin’s future potential in a separate post on X, asserting that the current bull market isn’t coming to an end just yet. Based on their belief, the bullish trend is predicted to persist well into the early part of next year.

Additionally, Young Ju identified the possible peak of the Bitcoin market cycle through the realized cap metric. According to the CryptoQuant CEO, Bitcoin is predicted to hit its maximum price in this cycle at approximately $112,000.

BTC Price At A Glance

Bitcoin’s price bounced back above $56,000 during late hours on July 5. Currently, it is being traded at around $56,400. However, it’s important to note that despite this recovery, Bitcoin has experienced a decline of almost 6% over the past week.

Read More

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- TOWER PREDICTION. TOWER cryptocurrency

- AST PREDICTION. AST cryptocurrency

- FET PREDICTION. FET cryptocurrency

2024-07-06 19:41