As the great game of geopolitics unfolded, a most…unsettling event occurred. Israel’s attack on Iran’s nuclear sites sent shockwaves throughout the land, causing the usually stalwart crypto investors to quake in their boots. 😱

The price of Bitcoin, that most mercurial of assets, plummeted below $105,000, while the market capitalization of all cryptocurrencies tracked by CoinMarketCap fell to a mere $3.26 trillion. The 24-hour liquidations, a grim reminder of the market’s unforgiving nature, jumped by 252% to over $1.15 billion, leaving 247,950 traders to ponder the transience of their fortunes. 💸

The altcoins, those plucky also-rans, fared even worse. SPX6900 (SPX) token plunged by 20%, while Fartcoin (FARTCOIN), Celestia (TIA), and Bonk (BONK) fell by over 15%, their valuations dwindling like the ebbing tide. 🌟

The stock market, that venerable institution, also declined, with futures tied to the Dow Jones, S&P 500, and Nasdaq 100 falling by over 1%, a somber reminder that even the most seemingly solid foundations can be shaken. 📉

And yet, dear reader, we must ask ourselves: is the crypto bull run still possible? Can Bitcoin, that most resilient of assets, survive the slings and arrows of outrageous fortune? 🤔

A look at past “black swan” events, those unpredictable and unforeseen occurrences that send markets into a tailspin, suggests that Bitcoin and other altcoins tend to recover after the initial knee-jerk reaction. 📊

Consider, if you will, the example of Bitcoin’s plunge to a multi-month low of $74,488 in April after Donald Trump delivered his “Liberation Day” speech, only to surge to a record high of $111,928 two months later. 🚀

Or, if you prefer, the example of Bitcoin’s drop from $10,480 to $3,948 in March 2020 after the COVID-19 pandemic began, only to surge a few months later and peak at $68,897 in November 2021. 📈

And, of course, who could forget Bitcoin’s fall to $34,000 when Russia invaded Ukraine in 2022, only to bounce back to nearly $48,000 a month later? 🤯

Thus, we see that Bitcoin, that most mercurial of assets, has a tendency to bounce back from adversity, like a phoenix rising from the ashes. 🔥

But, dear reader, the main reason why the crypto bull run may continue is that Bitcoin, which influences the industry, has strong fundamentals and technicals. 📊

Fundamentally, demand is rising as ETF inflows grow, with BlackRock’s IBIT now holding over $72 billion in assets. Companies like Trump Media, GameStop, Strategy, and MetaPlanet are accumulating the coin, their confidence in its value a testament to its enduring appeal. 💰

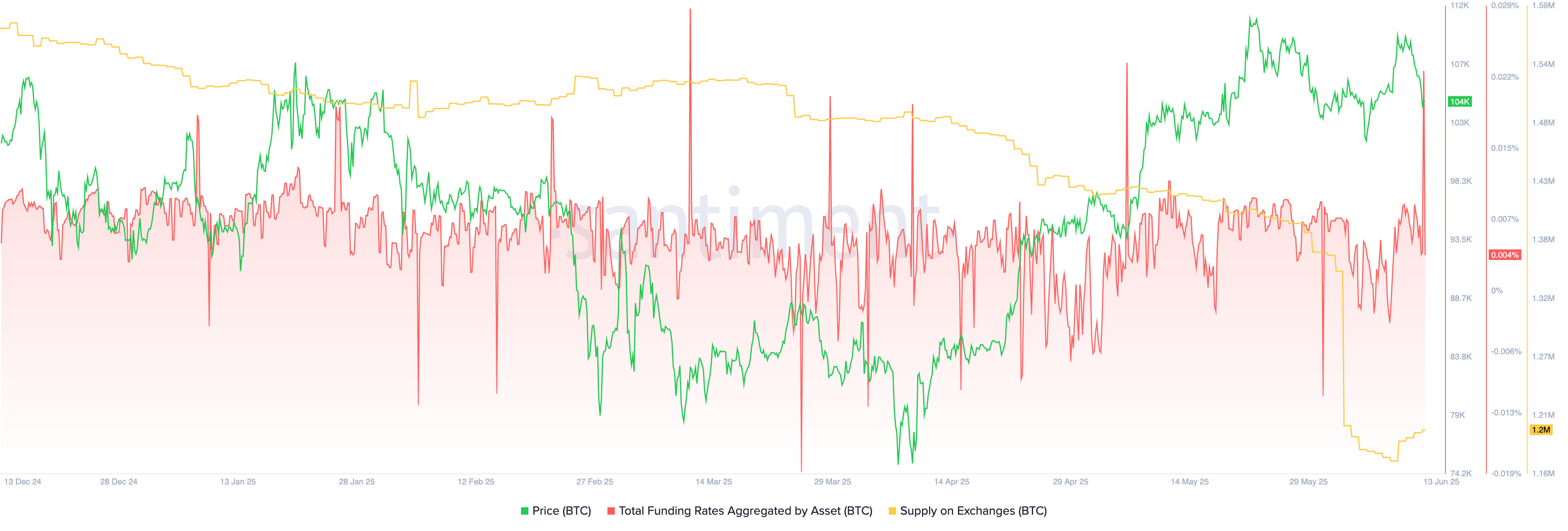

This demand is soaring as supply on exchanges and over-the-counter venues has plunged. Santiment data shows that supply on centralized exchanges has dropped to 1.2 million, down from 1.5 million in January, a clear indication that investors are holding onto their Bitcoin for dear life. 📉

As the chart above shows, Bitcoin’s funding rate has also surged — a sign that market participants expect it to bounce back, like a coiled spring waiting to unleash its pent-up energy. 🚀

Further, as crypto.news wrote, this pullback is part of Bitcoin’s handle in the cup-and-handle pattern, a pattern that often results in a strong bullish breakout, with Bitcoin’s target projected above $140,000. 📈

Read More

2025-06-13 15:57