In a turn of events that could only be described as spectacularly unfortunate, the cryptocurrency derivatives sector has experienced a mass liquidation event that would make even the most stoic of investors weep into their digital wallets. Yes, dear reader, Bitcoin and its merry band of assets have taken a nosedive that would make a skydiver envious.

Crypto Market Has Seen A Long Squeeze In The Last 24 Hours

According to the ever-reliable data from CoinGlass (which sounds suspiciously like a futuristic glass that tells you your financial doom), a staggering number of contracts have been liquidated in the past day. A position is deemed “liquidated” when the platform, in a fit of digital rage, decides to shut it down, usually after the holder has amassed losses that would make a black hole look like a savings account.

Now, there are two delightful factors that can increase the chances of liquidation. The first is volatility, which is like a rollercoaster ride designed by a mad scientist. A highly volatile asset can swing back and forth so dramatically that it’s hard to tell whether you’re betting on a bull or a particularly angry chicken.

Volatility is out of the user’s control, but the second factor, leverage, is like that friend who convinces you to take a shot of tequila before a big presentation. “Leverage” refers to the amount of money an investor can borrow against their initial collateral. It can multiply profits faster than you can say “I should have stayed in bed,” but alas, it also multiplies losses, leading to a delightful risk of liquidation.

In the cryptocurrency market, both of these factors are as common as bad puns at a comedy club, with coins often displaying wild swings in short windows and a plethora of speculators ready to bet their life savings on the next big thing.

The result? Mass liquidation events, affectionately known as squeezes, happen with the regularity of a British train being late. One such event has occurred in the last 24 hours, as the table below dramatically illustrates.

As you can see, cryptocurrency-related liquidations have totaled a jaw-dropping $904 million in the past day. Out of this, a staggering $811 million—almost 90%—involved long contract holders, who are now likely questioning their life choices.

The reason for this overwhelming liquidation of traders betting on a bullish outcome is as clear as a foggy day in London: Bitcoin and its friends have crashed spectacularly during this time.

Here’s a heatmap that shows how the liquidations have looked when divided by symbol, because who doesn’t love a good color-coded disaster?

As displayed above, Bitcoin has contributed the largest share of the liquidations at $261 million. Ethereum (ETH) has come in second at $113 million, and Solana (SOL) has managed to snag third place with a mere $39 million. XRP (XRP), despite being larger in market cap than SOL, has performed worse, possibly because it’s been on a rollercoaster of its own.

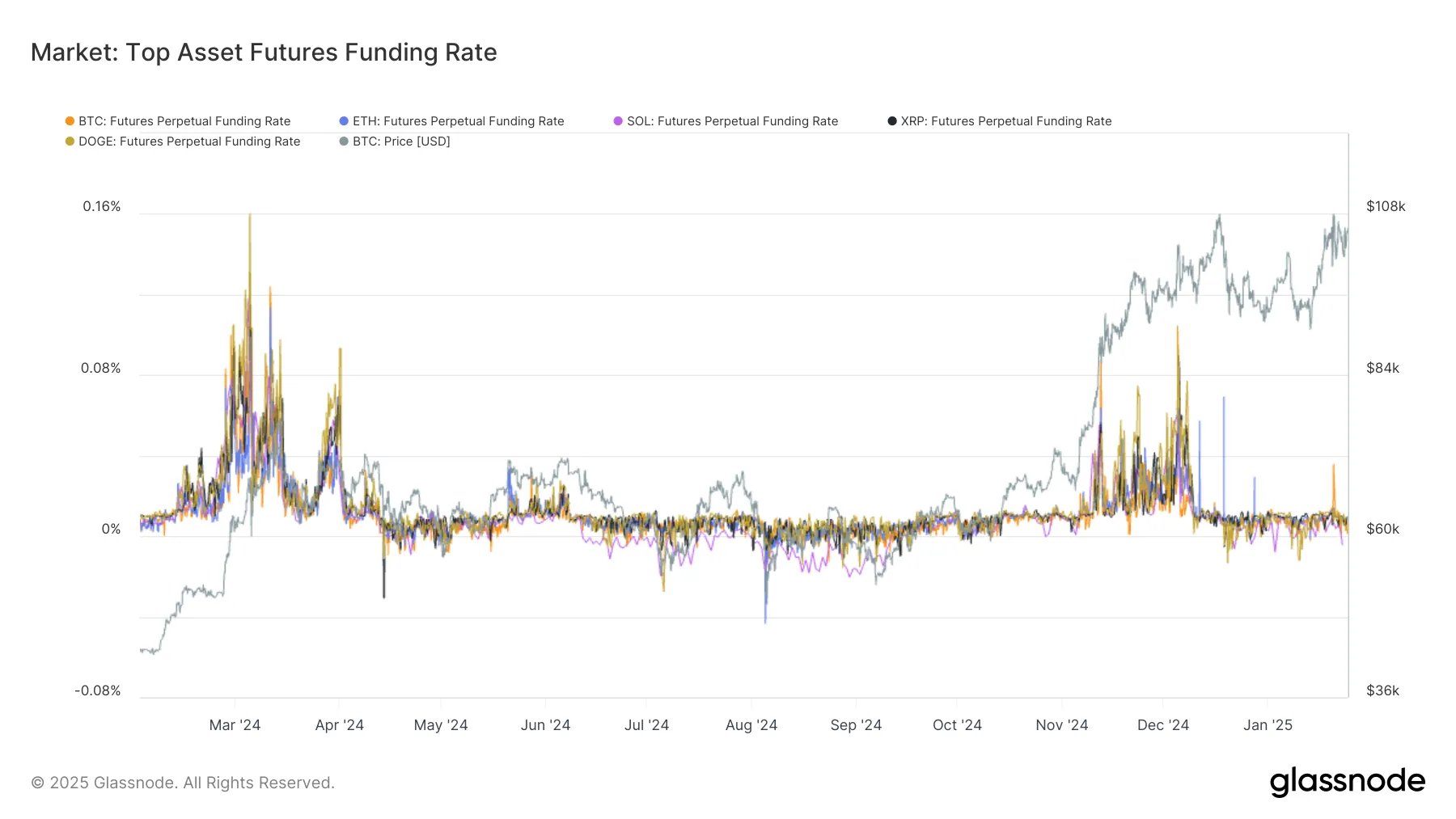

Interestingly, while a long squeeze has occurred in the sector, the exchanges have not been too long-heavy in terms of positions recently, as the analytics firm Glassnode has pointed out in a post that probably made them a few enemies.

“The hourly funding rates for the top 5 assets in the market ($BTC, $ETH, $SOL, $XRP, $DOGE) show the appetite for long positions has not returned to the levels seen in the November to early December rally,” notes Glassnode, probably while sipping a cup of tea and shaking their heads.

BTC Price

At the time of writing, Bitcoin is trading at around $100,400, down over 4% in the last seven days. So, if you were thinking of investing, perhaps consider a nice, safe piggy bank instead.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- 8 Best Souls-Like Games With Co-op

- Top 7 Tifa Mods for Final Fantasy 7 Rebirth

- The White Rabbit Revealed in Devil May Cry: Who Is He?

2025-01-28 09:43