Ah, Jerome Powell, our dear maestro of monetary mystics, decided to keep interest rates steady—probably to give the market a good old fashioned whiff of complacency. Meanwhile, his subtle hints about tariffs and inflation had the crypto realm sweating more than a cat in a bath.

Meanwhile, traders riding the leverage rollercoaster experienced a delightful spectacle of liquidations—over $200 million of borrowed bravado bravely bowed out in just under an hour. Bitcoin dipped below $116K, Ethereum took a modest 3% tumble, then—like a stubborn phoenix—both staged a partial comeback, much to everyone’s relief (or chagrin).

Bitcoin’s quick rebound saw it tip back above $118K, though it left behind a cozy 0.8% daily loss. Ethereum steadied around $3,750—down by a mere 0.6%—probably wondering if it too should start planning a comeback tour.

Right now, Bitcoin has danced back to its starting line—up 0.7%, while Ethereum, in true resilient fashion, is surging ahead by 2%. Seems like the market’s mood is “almost normal,” if you squint hard enough.

- Powell’s ‘wait-and-see’ attitude: The Federal Reserve’s next party is not until September, leaving two months for the economic detectives to decipher the cryptic signals of growth and gloom. Powell appears eager to postpone decisive action, perhaps hoping the market will do it for him. Early bets suggest a 39% chance of a rate cut—just enough to keep everyone squinting.

- Market’s overall mood: Absent a hike, the worst case was simply “meh”—which, surprisingly, looks not so bad. Bitcoin remains within sniffing distance of its all-time high, the crypto market cap edges closer to $4 trillion, and stalwart tokens like ETH are flexing their muscles.

Altcoins: The Masochists of the Market 🎭

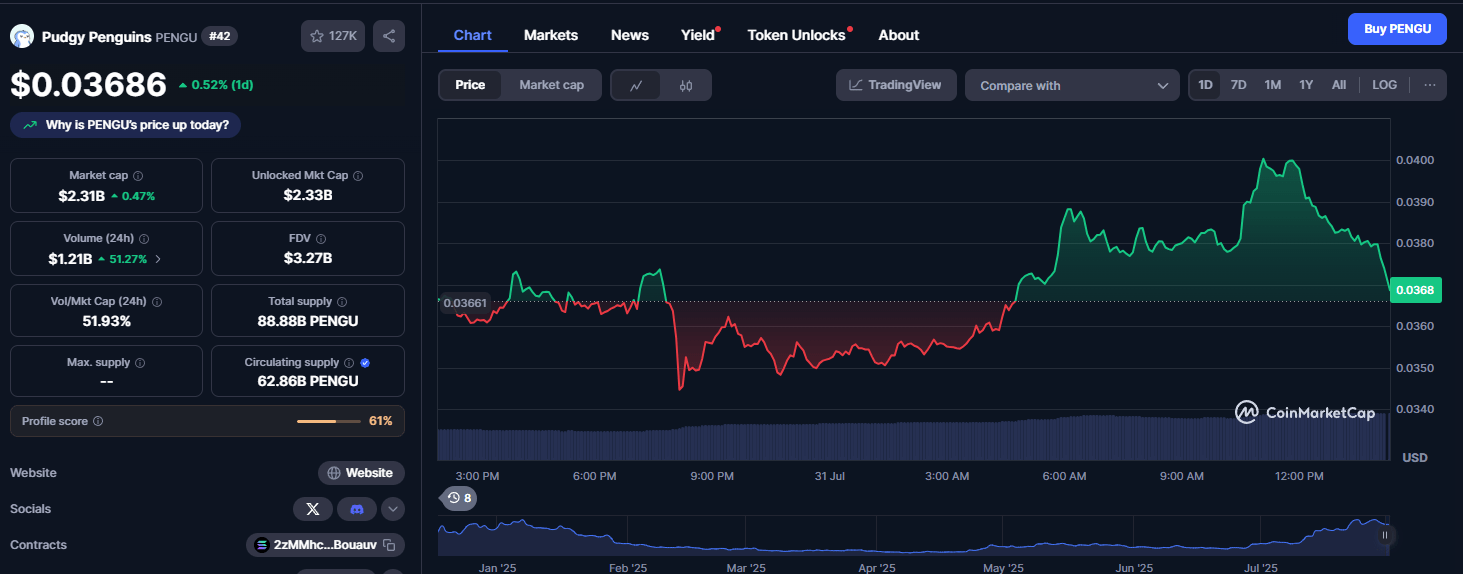

Altcoins bore the brunt of Fed-induced mood swings: $SOL, $AVAX, and $HYPE each tumbled 4-5%, only to bounce back with the agility of caffeinated kangaroos. Meme coins like $BONK and $PENGU also played the “drop 10%, then recover” game—because why not?

Contrast this, however, with Meta and Microsoft delivering earnings that stirred investor optimism—10% and 6% rises, respectively—proving that some stocks still understand the art of making money while others are busy learning to walk again.

Matt Mena from 21Shares suggests that the Fed’s reaction might be a bit sluggish, with consumer spending looking more like a slow dance, unemployment rising, and yields still festering. This cautious stance could risk a deeper economic nap—if the Fed’s hand isn’t too heavy when they finally choose to wake up.

Nevertheless, if September’s rate odds favor a cut, Bitcoin might just leap back past $120K—possibly even top $150K by year’s end, provided inflation continues its snooze fest and macroeconomic pressures spark the needed pivot. Which, you know, is basically the hype we all secretly hope for.

Bitcoin Hyper ($HYPER): The Turbocharged Bitcoin Layer 2 🏎️

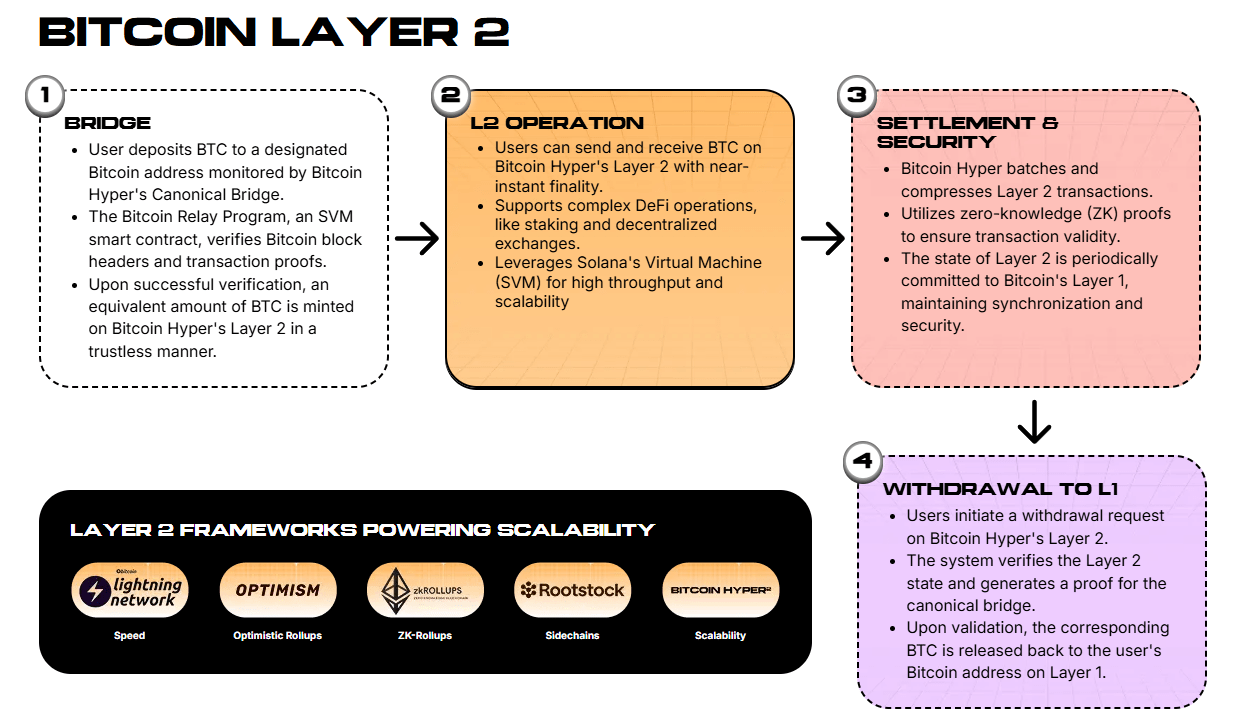

If Bitcoin had a superhero sidekick, it’d be Bitcoin Hyper ($HYPER)—an ambitious attempt to make the blockchain as fast as your internet connection on steroids. Harnessing the Solana Virtual Machine, it promises near-instant transactions, pocket-friendly fees, and seamless transfers between layers of the crypto cosmos.

This project is packing native staking, DeFi antics, zero-knowledge tricks, and more—basically turning Bitcoin into a Swiss Army knife for the decentralized age. Already, the presale has raised a whopping $6.1 million—imagine what your coffee fund could turn into if you got in early.

At just $0.012475, folks are wondering: is Bitcoin Hyper destined to hit $0.08625 in 2026? Only time will tell, but don’t be the last to find out.

Visit the Bitcoin Hyper presale page and put your crypto hat on.

Maxi Doge ($MAXI): Because Bigger Is Better 🐶💰

If meme coins are your thing—and who isn’t?—Maxi Doge ($MAXI) is the heavyweight champion of gains. With staking at 1683% APY and a hefty 25% of tokens reserved for leverage projects, it promises big things for the bold and the brave.

At a dime-a-dozen $0.00025, $MAXI already snagged $141K in just two days—because meme coins do love a quick push, and, frankly, so do investors craving a payday.

Check out the Maxi Doge presale before it’s meme-mentum too late.

Toncoin ($TON): The Telegram Token to End All Tokens 🐦

Forget incremental improvements—Toncoin is building a whole Web3 world inside Telegram, with wallets, dApps, and crypto payments seamlessly integrated. With over 900 million users, it’s like crypto in every pocket—and on every chat thread.

Up nearly 6%, $TON is riding the wave of a blockchain forecast to attract 2.6 million daily users by 2025. It’s the future of chat-based crypto, whether we’re ready or not.

Market Mood: Rollercoaster or Swing Set? 🎢

Powell’s cryptic messages are the tightrope walk of inflation control and economic slowdown. Short-term chaos, yes, but the bigger picture? Altcoins are resilient, and Bitcoin is eyeing a comeback larger than a Hollywood reunion.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- TRX PREDICTION. TRX cryptocurrency

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Xbox Game Pass September Wave 1 Revealed

- INR RUB PREDICTION

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

2025-07-31 18:47