As a seasoned researcher with over a decade of experience in analyzing cryptocurrency markets, I must admit that the current state of Dogecoin, Bitcoin, and Tron has raised some eyebrows. The recent downtrend in these assets is not something new to me, but the swiftness and intensity of this drop have caught my attention.

Dogecoin has slipped into a downward trend after dropping below its key 50 Exponential Moving Average (EMA). This line is significant for Dogecoin because it typically indicates bullish activity when kept above, but falling beneath suggests a move towards bearish territory and raises doubts about the asset’s near-term prospects. Recent price fluctuations have exposed Dogecoin’s potential weakness.

Although Dogecoin’s struggle to stay above the 50 Exponential Moving Average (EMA) is troubling, given the overall weakness of most altcoins, it suggests that sellers are dominating buyers, potentially leading to a further drop if the current trend persists.

As an analyst, I observe that a significant drop in DOGE‘s price has occurred below its 50 Exponential Moving Average (EMA), which could be a warning sign. While this event doesn’t necessarily mean a “death cross” has been formed yet (where the long-term average falls below the short-term average), it often foreshadows unfavorable trends. Keeping a close eye on the market dynamics is crucial at this point.

Bitcoin‘s weakness

Bitcoin’s market supremacy appears to be gradually weakening, showing signs of a downward trend. A significant drop in price has brought it close to the 100 Exponential Moving Average (EMA), suggesting that the bullish energy behind Bitcoin might be diminishing. The recent market data underscores an important point: there’s a high level of liquidity around the $63,000 mark.

As the EMAs approach $63,000, this price point becomes increasingly significant as a potential support level. If Bitcoin continues its downward trend, it might soon test this level. The declining trading volume is cause for concern, as a decrease in volume often signals that the current trend is losing popularity. This decreased interest in Bitcoin could suggest that the recent uptrend may not be sustainable.

If selling intensity increases, there could be additional drops in Bitcoin’s value, so it’s wise for traders and investors to practice caution. The technical markers effectively illustrate the current state of Bitcoin, with a potential loss of support for its price suggested by the convergence of the 50-day, 100-day, and 200-day Exponential Moving Averages.

Should Bitcoin fall beneath the 100 Exponential Moving Average (EMA), a previously significant support point, this could potentially transform into a pivotal level of resistance. The $63,000 threshold has proven to be noteworthy for Bitcoin, serving as both a barrier and a foundation at various instances in its history.

Tron’s unexpected decline

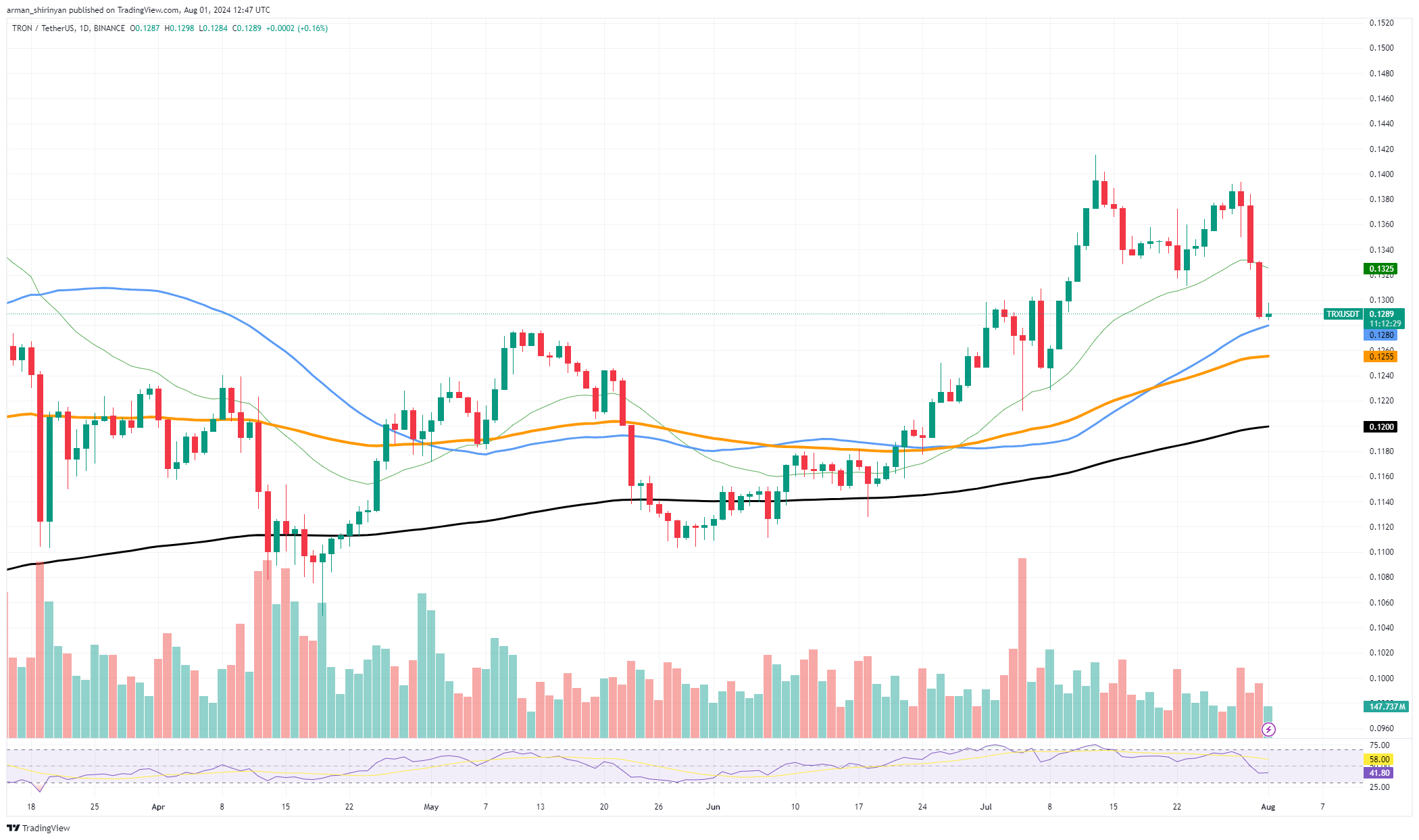

Lately, Tron (TRX) experienced a significant drop of 6.4%. This dip has pushed the coin to the 50 Exponential Moving Average (EMA), a crucial support line. Given the steep fall, this level is often seen as a potential spot for a price turnaround, offering some optimism to investors.

There are nevertheless additional variables to take into account. The fact that the RSI has fallen below 50 is a bearish indication that there is significant selling pressure. This phenomenon implies that unless there is a substantial change in market sentiment, the current downtrend may continue.

TRX might continue to decrease, despite currently being supported by the 50 EMA. If the price falls below this support, approximately $0.1200 would be the next crucial support level. A drop beneath it could suggest prolonged bearish trends. Notably, this level has proven strong in the past as a foundation.

Investors should pay close attention to these critical support levels in the market, including the current position of TRX at the 50 Exponential Moving Average (EMA) and the potential drop to $0.1200 below it. A bounce from the 50 EMA might signal a reversal and potential recovery, while the $0.1200 support level may be tested if the market fails to stay above this point.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- USD CLP PREDICTION

- WQT PREDICTION. WQT cryptocurrency

2024-08-02 03:45