Well, bless my stars and garters, it seems the digital gold rush has hit a snag, or so the CoinShares folks would have us believe. Last week, the great crypto exodus slowed its gallop to a mere $187 million, a veritable trickle compared to the Niagara of cash that’s been fleeing this wild west of finance. Prices are still as wobbly as a three-legged mule, but hey, progress is progress, right?

- Crypto outflows took a nap, dropping to $187 million-a sign the stampede might be losing steam, even if prices are still doing the jitterbug.

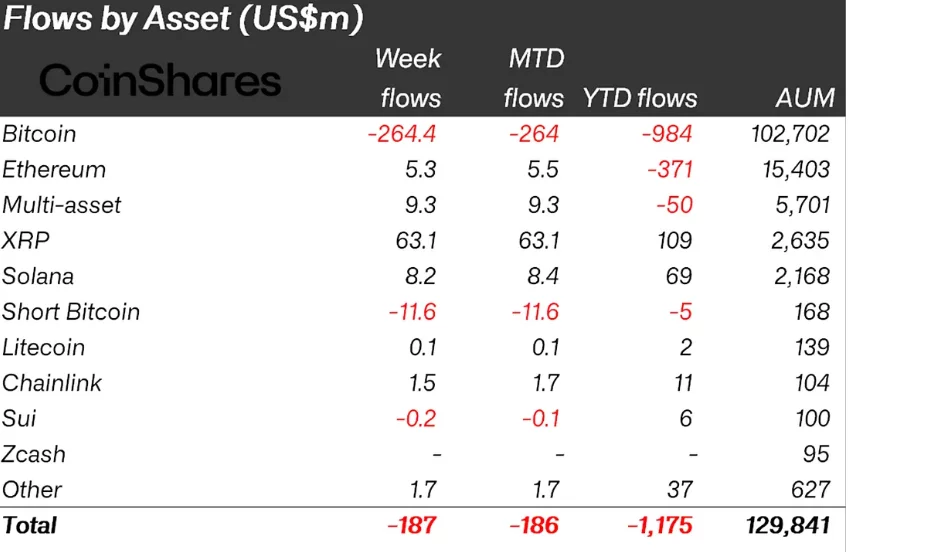

- Bitcoin, the once-mighty king of the hill, led the outflows with $264 million, while altcoins like XRP, Solana, and Ethereum strutted their stuff, attracting fresh cash like flies to a honey pot.

- Trading volumes are through the roof, and Europe’s throwing its hat in the ring, hinting that the market might be finding its sea legs-or at least a life preserver.

Now, as the wise folks at CoinShares point out, fund flows are like a weather vane-they spin with the wind of prices. But it’s the pace of the spin that tells the real tale, often whispering sweet nothings about where investor sentiment is headed. This recent slowdown? Well, it’s like the market’s taken a deep breath and said, “Maybe we’re not all doomed after all.”

The bottom, they say, might be nigh. But then again, in this game of crypto roulette, the bottom’s as elusive as a honest politician.

Bitcoin Takes a Backseat as Altcoins Hog the Limelight

Old man Bitcoin, the granddaddy of crypto, is feeling the blues. With $264.4 million heading for the hills last week, his year-to-date losses are now a cool $984 million. Even the bears are losing interest, with short Bitcoin products seeing outflows of $11.6 million. Seems like nobody wants to bet against the old timer anymore-or maybe they’re just tired of losing.

Meanwhile, the altcoins are having a hoedown. XRP led the charge with $63.1 million in inflows, making it the belle of the ball so far this year. Solana and Ethereum weren’t far behind, raking in $8.2 million and $5.3 million, respectively. Even multi-asset products got in on the action, adding $9.3 million to the pot.

Geographically, it’s a mixed bag. Europe’s showing some spunk, with Germany and Switzerland leading the charge. Canada and Brazil are also dipping their toes in the water. But let’s be honest, it’s like a game of musical chairs-everyone’s just hoping they’re not left standing when the music stops.

CoinShares reckons the market’s stabilizing, but let’s not kid ourselves-prices are still as predictable as a cat in a room full of rocking chairs. Slowing outflows, surging trading volumes, and altcoin enthusiasm? Sounds like the market’s caught between a rock and a hard place, but at least it’s not drowning.

Assets Shrink, But Traders Party Like It’s 2021

Assets under management (AuM) have shriveled to $129.8 billion, the lowest since March 2025. Coincidence? Maybe. But it’s also when crypto prices hit their last “local low.” History repeating itself? Or just another day in the crypto circus?

Despite the shrinkage, trading activity is off the charts. ETP volumes hit a record $63.1 billion last week, beating October’s high of $56.4 billion. Seems like investors are either desperate or delirious-or maybe both. Volatility, they say, is the spice of life. Or in this case, the spice of financial ruin.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Sony Shuts Down PlayStation Stars Loyalty Program

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2026-02-09 12:54