As an analyst with over two decades of experience in the financial markets, I have witnessed numerous trends come and go, but the surge in Bitcoin ETF inflows today is undeniably one for the books. With a staggering $556 million flowing into these funds, it’s clear that institutional investors are increasingly viewing cryptocurrencies as a viable asset class.

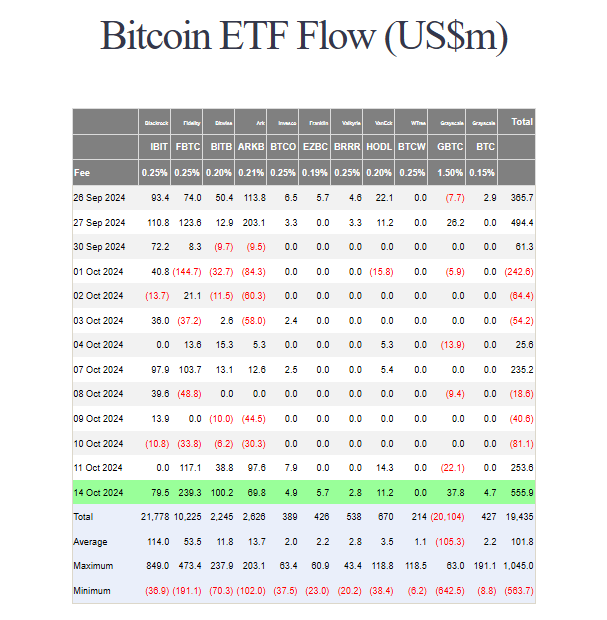

Today, Bitcoin US-based ETFs are experiencing a surge in investment, recording their largest influx in four months to the tune of $556 million across 12 funds. Remarkably, this surge in investments came as Bitcoin itself was recovering, reaching a two-week peak of $66,500.

The largest one-day inflow, amounting to $239 million, was recorded at FBTC (Farside), marking the highest since June. Additionally, BITB (Bitwise) and IBIT (BlackRock) also showed strong performance with BITB accumulating $100 million and IBIT pulling in $79.51 million from new investors.

Increased Activity Across Funds

In recent market uptrends, various investment funds experienced an increase in investments. The stocks for ARK Invest and 21Shares (ARKB) reached approximately $70 million, while Grayscale’s bitcoin trust (GBTC) registered its first inflow since September, totaling more than $37 million. Despite this, the trust has faced significant outflows amounting to over $20 billion since its launch.

In addition to these smaller investment options, the following also experienced increased capital influx: HODL, EZBC, BTCO, Grayscale Bitcoin Mini Trust, and Valkyrie, collectively bringing in more than $29 million.

I’ve seen a surge in trading activity with the 12 Bitcoin ETFs I’m invested in, pushing the total volume up to approximately $2.61 billion. Experts believe this trend will continue, leveraging the substantial net inflows of around $19.36 billion accumulated over the past ten months. This growth might be attributed to the fact that Bitcoin ETFs have outperformed gold-based products this year, with a net inflow of about $1.5 billion.

Ethereum ETFs Lag Behind Bitcoin

In simpler terms, Bitcoin ETF investments reached their peak significantly more than those for Ethereum ETFs, which showed a comparatively stronger response. The net inflows into Ethereum ETFs amounted to $17 million, with BlackRock’s ETHA leading the way at $14 million.

Other Fidelity (FETH), Invesco (QETH), and 21Shares (CETH) funds experienced inflows ranging from approximately $393,690 to over $1.3 million. The trading volume for Ethereum ETFs increased significantly, reaching $210 million compared to the previous day’s $143.54 million. Interestingly, since their launch in July, these Ethereum ETFs have recorded net outflows totaling $542 million.

As a market analyst, I observed a promising rebound in the overall cryptocurrency market today. Specifically, Bitcoin climbed up to a trading price of $65,268, indicating a recovery from previous losses. Intriguingly, Ethereum followed suit, experiencing nearly a 3% growth to reach an impressive closing level of $2,594 by the end of the day.

According to Nate Geraci, President of ETF Store, today was an exceptionally busy day for Bitcoin Spot ETFs, with the cryptocurrency investment product experiencing growing popularity compared to more conventional and secure investments like gold.

Read More

- EUR ARS PREDICTION

- EUR CAD PREDICTION

- CHR PREDICTION. CHR cryptocurrency

- EUR MYR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- USD BRL PREDICTION

- POL PREDICTION. POL cryptocurrency

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- SAFE PREDICTION. SAFE cryptocurrency

2024-10-15 20:11