The crypto markets, like a tiresome party where the host cannot end the conversation, extended the descent today, slipping further into a high-volatility performance that has unsettled both spot and derivatives enthusiasts. Bitcoin price declined about 8.6%, flopping about near the $65,000 mark, while Ethereum and the rest of the fashionable altcoins followed suit with sharp intraday losses. The ferocity of the move betrays more than a routine bout of profit-taking. With liquidations accelerating and sentiment sinking into a mood of Extreme Fear, the current crypto crash presents investors with the perennial conundrum: should one buy the dip as though it were a new season, or wait, and let the thing behave like a public drawing-room curtain?

Liquidations Data Reveals Market Still Under Stress

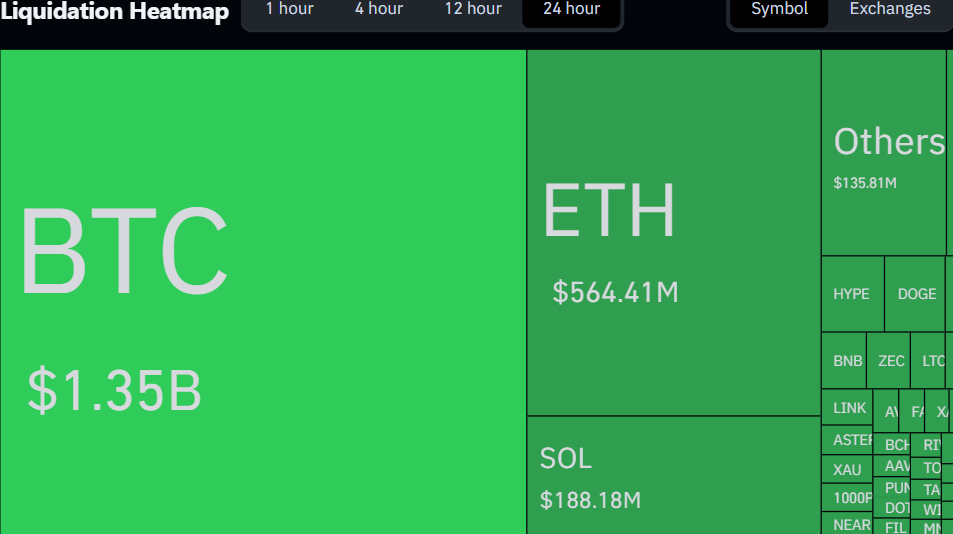

The principal trigger of today’s collapse lies in the arithmetic of derivatives. Some $2.59 billion of positions were wiped out in the last twenty-four hours, a spectacle among the year’s most aggressive flushes of leverage.

Bitcoin and Ethereum bore the brunt of the closures, while the minor coins collapsed in a domino of liquidations as price levels failed in quick succession. Simultaneously, open interest declined 10.1% to $95.77 billion, a bell rung to announce that leverage is being removed, not repositioned. Such conditions hint at instability rather than balance. Markets, it seems, struggle to form durable bottoms while liquidation velocity remains as brisk as a martini in a motorcar rally.

Sentiment Hits Extreme Fear, But Capitulation Is Incomplete

The Crypto market Fear & Greed Index plummeted to 10, burying sentiment in Extreme Fear, a region historically preceding a modest revival in the medium term. Yet the signs remain a muddle of shadows. Bitcoin exchange balances rose by 13,800 BTC, suggesting selling pressure has not yet spent itself. Coins continue to drift toward exchanges rather than being consigned to the long-term vaults of the patient few. In prior cycles, robust bottoms formed after extreme fear persisted alongside waning exchange inflows, a duet that has yet to bow in unison this time around.

Bitcoin Price at $65K: A Decision Zone, Not a Confirmed Bottom

Bitcoin’s decline toward the $65,000 beltline now brushes against a signal that long-term market participants rarely ignore. The monthly stochastic oscillator has slipped into extreme oversold territory, a condition that has appeared only three times in the last decade. Each prior episode aligned with major bear-market bottoms and the onset of prolonged accumulation. History, however, is not a timepiece to be trusted blindly. In earlier cycles, Bitcoin did not suddenly reverse higher. More often price wandered for weeks, sometimes months, in sideways fashion or carved out modest new lows as leverage was purged and sentiment reset.

That dynamic matters today. While the long-term stochastic hints that downside may be structurally limited, the short-term data still reflects strain. Open interest is falling, liquidations remain elevated, and exchange balances are rising, indicating that traders are still de-risking rather than rebuilding. Practically, this yields a split narrative. For the long-horizon cohort, conditions begin to resemble an early accumulation phase. For the short-term operator, volatility risk remains high until liquidation pressure eases and price stabilizes above key support. The signal suggests Bitcoin may be nearer to a bottom than a top, but confirmation will demand patience, not prophecy.

Final Thoughts: Right Time to Buy or Wait?

The broader crypto market is emitting classic stress signals rather than a crisp bottoming performance. Extreme fear readings, multi-billion-dollar liquidations, and declining open interest imply that forced deleveraging still plays through the system. While some assets display pockets of strength and selective accumulation, this reads more like rotation and repositioning than a broad-based recovery.

Historically, durable market bottoms form after volatility has contracted and sellers have exhausted themselves, not during the peak of a liquidation carnival. Right now, liquidity is thin and confidence fragile, leaving room for further downside or prolonged consolidation. This is not a straightforward “buy the dip” moment for the market as a whole. A cautious stride and patient stance are advisable, with selective accumulation only where robust fundamentals and on-chain support clearly justify it.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

2026-02-06 15:03