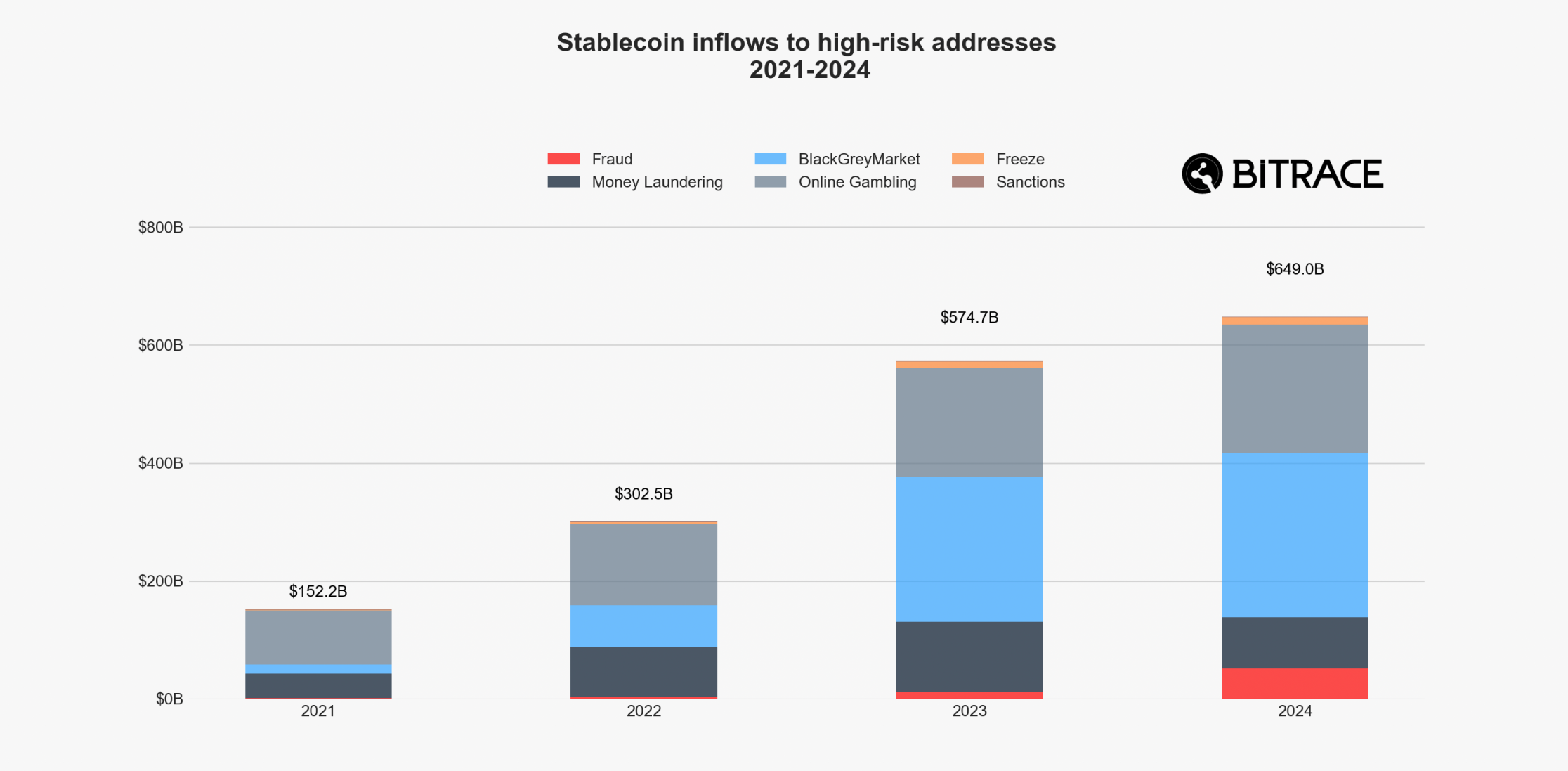

Bitrace’s 2024 Crypto Crime Report reveals something alarming: criminals have managed to shuffle $649 billion in stablecoins to risky addresses. How, you ask? Well, the fraud and money laundering sector of stablecoins has grown—but hey, the legitimate part of it grew even faster. Shocking, isn’t it?

The report didn’t just stop there. Oh no, it also tossed in some fun tidbits like gambling and darknet markets. And guess what? Law enforcement is getting a bit more aggressive against stablecoin money laundering. Tether and Circle froze over $1 billion in assets last year. Impressive, right? But let’s not get too carried away just yet. 😉

Stablecoins and Crypto Crime – The Underworld That Keeps Growing?

Now, stablecoins have become the lifeblood of the global crypto ecosystem. But, guess what? They also make a great tool for criminals. Just last month, crypto detective ZachXBT accused North Korean hackers of having an “epidemic” presence in the stablecoin market. Oh, what a surprise!

Bitrace’s 2024 Crime Report paints a picture of illegal activities everywhere in the industry, but with a special focus on stablecoins. Who knew?

According to Bitrace’s findings, criminals moved a mind-boggling $649 billion in stablecoins to shady addresses last year. But hold up! That’s just 5.14% of the total global stablecoin volume—down from 5.94% in 2023. So, yeah, the stablecoin world is growing, but criminals? Not so much, apparently. A small victory for law and order. 🙄

Of course, Tether dominates the scene. It’s the king of stablecoins, after all. Tron and Ethereum blockchains were the prime spots for USDT transactions, accounting for 90% of the crime-related stablecoin volume. Ethereum’s share grew, but Tron still ruled with a 75% dominance. Who’s surprised? Not me.

Stablecoins in Crypto Crime.

1/ Since 2022, stablecoins replaced Bitcoin as the go-to currency for illicit deals.

— Onchain Foundation (@OnchainHQ) December 27, 2024

While Bitrace’s report mainly harps on stablecoins, it did throw in some juicy extras, like the fact that illicit darknet trades grew by $30 billion as vendors jumped to DeFi. Oh, and crypto gambling? That surged 17.5% to $217.84 billion. What a time to be alive, huh?

On the flip side, the industry’s stepping up to fight back. Scams and frauds exploded from $12 billion in 2023 to a mind-blowing $52 billion in 2024. What a jump!

Escrow services like Huione are trying to mediate these chaotic transactions, and Tether’s been attempting to freeze its wallets. Sure, they’ve only neutralized a sliver of Huione’s trade, but hey, it’s a start. We’ll take it.

Tether and Circle have been busy freezing crypto wallets linked to criminal activity since stablecoins are at the heart of this mess. The total frozen assets grew by nearly $1 billion in 2024—double what it was in the previous three years combined. Impressive? Yes. Enough? Not even close. But we’re getting there.

In conclusion, stablecoins are clearly thriving in the world of crypto crime, but enforcement is stepping up. It’s not all doom and gloom. If the industry continues its crackdown on fraud and money laundering, it might actually make a dent. After all, the legitimate uses of stablecoins far outweigh the criminal activities, and criminals’ share is shrinking. So, there’s hope. Maybe. 😏

Read More

- Mr. Ring-a-Ding: Doctor Who’s Most Memorable Villain in Years

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

- Luffy DESTROYS Kizaru? One Piece Episode 1127 Release Date Revealed!

- Nine Sols: 6 Best Jin Farming Methods

- Invincible’s Strongest Female Characters

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Secrets: Khans of the Steppe DLC Release Time for Crusader Kings 3 Revealed!

- Black Clover Reveals Chapter 379 Cover Sparks Noelle Fan Rage

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

2025-04-29 19:12