So, Bitcoin, right? It’s acting like a moody teenager these days-dipping, bouncing, and just playing mind games with chartists at every turn. It’s like, come on, make a decision! This morning, it’s hanging out just below $88,000, around 8:30 a.m. EST, caught in this awkward dance between bears who just won’t let go and bulls trying to muster up some courage. It’s like a bad date that just keeps dragging on. 🐻🐂

Bitcoin Chart Outlook

The Relative Strength Index ( RSI) on the 1-day chart is just sitting there at 41, basically saying, “I don’t know, man,” echoing the sentiments of traders everywhere. Meanwhile, the MACD is being a real downer with a reading of −1,799, hinting at some serious downward momentum. I mean, who invited that guy to the party? 🙄

And then you’ve got the momentum oscillator and the commodity channel index waving their little flags from the bullish camp, like, “Hey, we’re still here!” But the average directional index at 26 is just confirming what we all feel: this market has an identity crisis-it’s too weak to inspire but not broken enough to ignore. It’s the financial version of a midlife crisis. 🚗💨

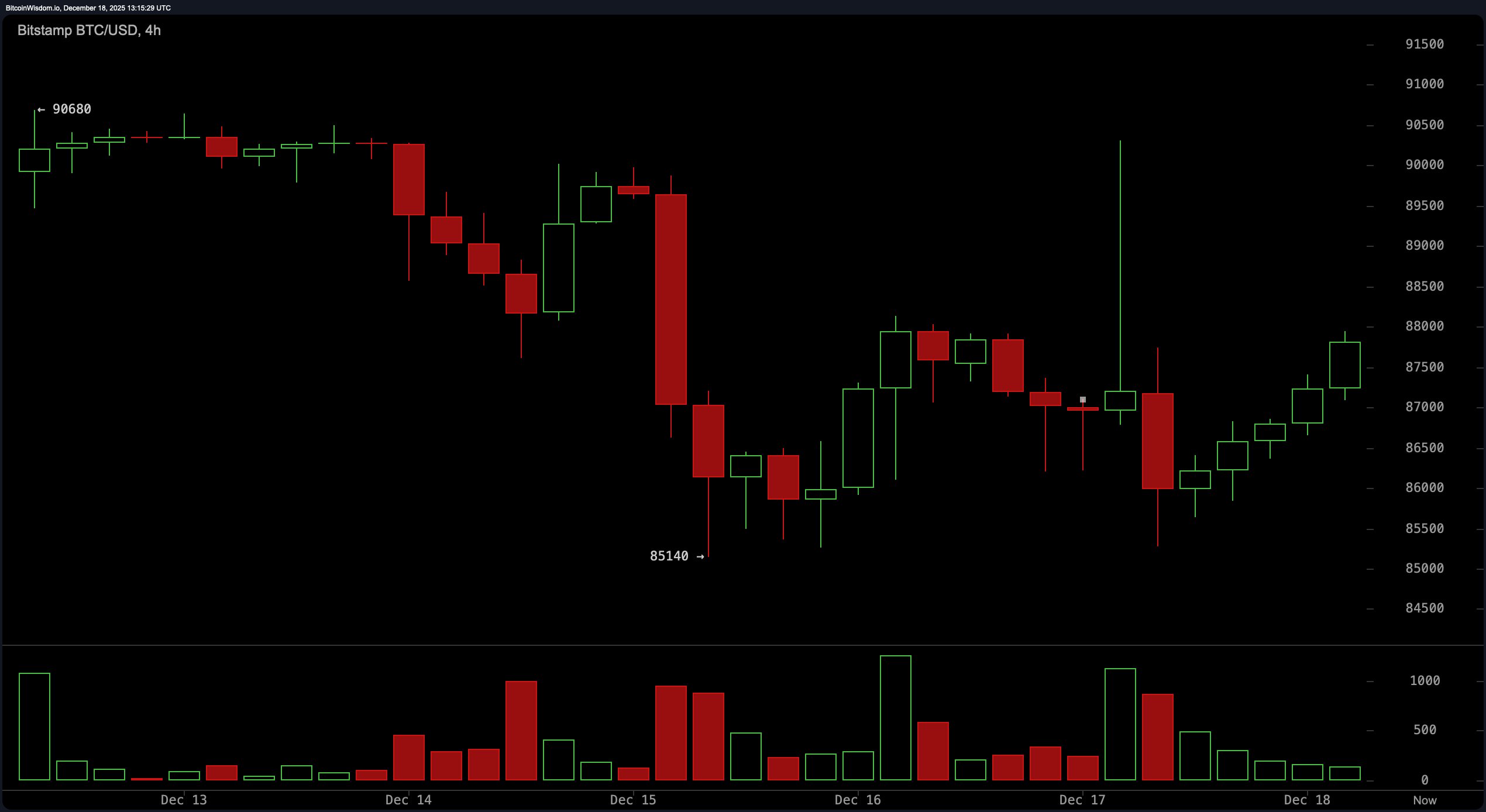

Now, the 4-hour chart? Oh boy, that’s where things get juicy. After a dramatic nosedive from around $90,600 to about $85,140, Bitcoin seems to be trying to stage a comeback-maybe a double bottom or a higher low. It’s climbing back towards $87,500-$88,000, with volume pulses suggesting the bulls are dipping their toes in the water. But it’s still a bit soggy-like trying to walk through a puddle with socks on. 😬

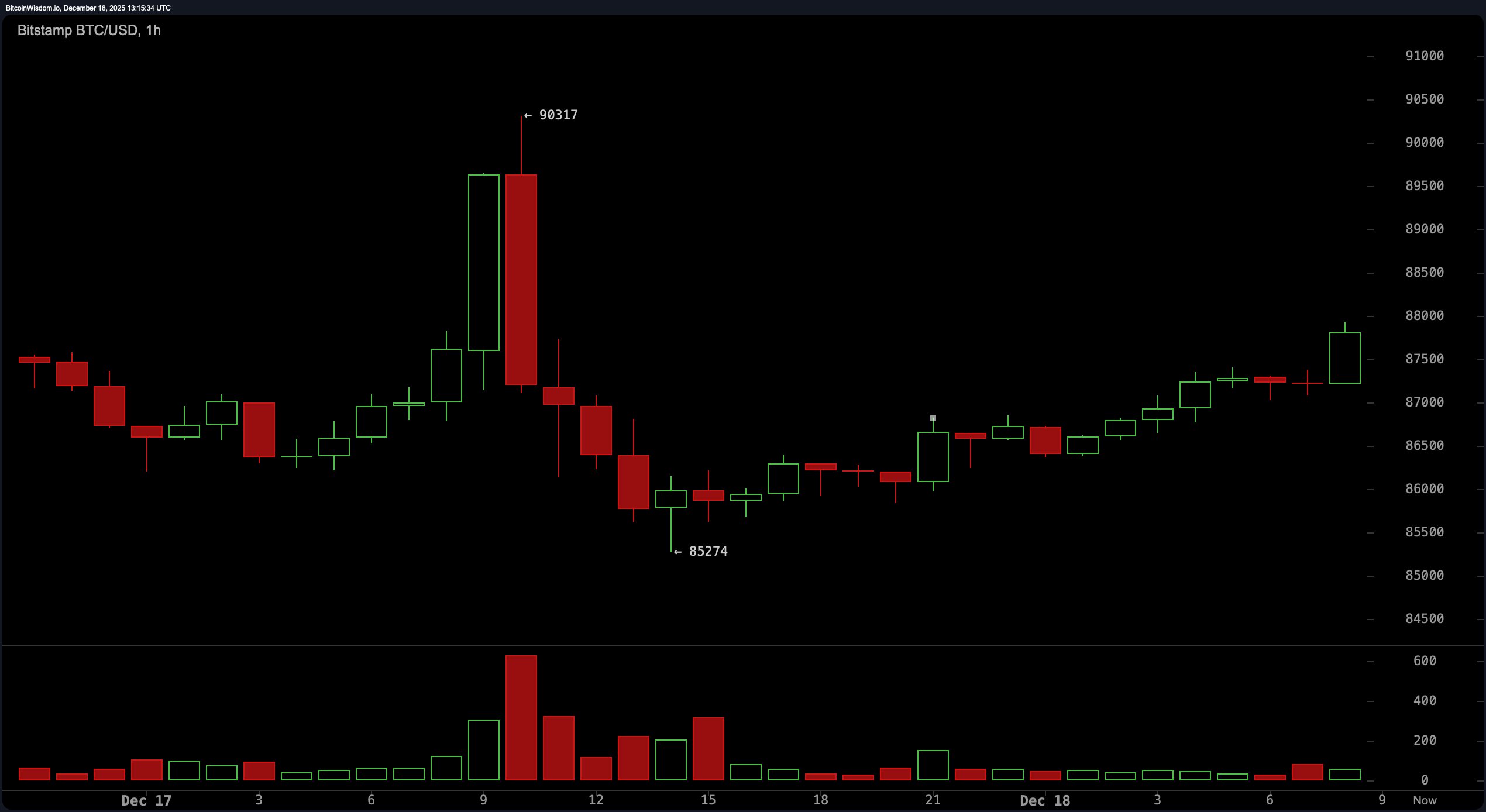

Let’s talk about the short-term action on the 1-hour chart-it’s like a roller coaster ride, but without the fun. After a plunge from $90,300 to just over $85,000, Bitcoin is trying to build a tiny uptrend, forming higher highs and higher lows. But the volume? It’s more like a polite golf clap than a roaring audience. Nobody’s really convinced yet. Plus, the EMAs are hovering overhead like an ominous cloud-$88,540 and $89,379-which means the next test is just above current levels. If it pulls back to $87,000, well, that could be a low-risk spot for the thrill-seekers. 🎢

If we zoom out to see the bigger picture, those moving averages are just chilling way up there-$100,157 and $102,559 for the 100 and 200-period EMAs, respectively. Even the 50-period SMA is sitting at $94,441, not offering any support. It’s like they’re saying, “Good luck getting back up here, buddy!” The long-term trend is still feeling the effects of its last bender, and Bitcoin needs a serious kick in the pants to get back in the game. 🍸

The short-term charts are buzzing with potential, showcasing a structure of higher lows and recovery bids from recent dips. If Bitcoin can push past the $88,500-$90,000 range with some actual volume, we might see a broader reversal. The one-hour and four-hour setups are looking promising-if only momentum doesn’t decide to take a nap. 💤

Bear Verdict:

Even with some hopeful signs, Bitcoin is still trapped below critical resistance levels, with the daily trend leaning towards the downside. The moving averages are stacked over like a bad buffet, and the MACD is serving up bearish readings alongside tepid volume, which screams structural weakness. Until $90,000 is convincingly reclaimed, any rally is likely to be a quick flash in the pan-just like my last relationship. 💔

FAQ 🐂 🐻

- What is bitcoin’s price today?

Bitcoin is trading at $87,122 as of December 18, 2025. Just another day in paradise! - Is bitcoin in a bullish or bearish trend?

Short-term charts show bullish signs, but the overall trend is still playing the sad violin. 🎻 - What is bitcoin’s intraday price range?

The 24-hour trading range is between $85,373 and $90,164. It’s like a bad sitcom-same plot, different day. - What do technical indicators say about bitcoin now?

Indicators are mixed, with weak momentum and heavy resistance near $90K. It’s a classic case of “I can’t even.”

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- God Of War: Sons Of Sparta – Interactive Map

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- Who Is the Information Broker in The Sims 4?

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-12-18 17:38