It is with no small measure of astonishment that we report the recent tumultuous events surrounding the tokens known as Story (IP) and The AI Prophecy (ACT), which experienced a most alarming decline of 20% before a rather unexpected recovery earlier today. The precise cause of this upheaval remains shrouded in mystery, yet it appears to be linked to the rather high trade volumes on the esteemed Binance Futures platform.

Despite the subsequent recovery, the sudden drops have left many a heart fluttering with concern, particularly in light of the recent calamity that befell MANTRA’s OM token, which plummeted a staggering 90% just yesterday, with its co-founder hastily pointing fingers at Binance. Oh, the drama! 🎭

ACT and IP, two tokens of seemingly unrelated pursuits, found themselves in a most curious predicament, experiencing simultaneous crashes and rebounds. The cause, as previously mentioned, remains elusive, yet the connection to Binance Futures is undeniable.

Pray, What Caused the Sudden Crash and Rebound of ACT and IP?

Binance Futures, a trading platform of considerable repute, has been known to send the prices of various assets soaring to great heights. However, today, the community is left in a state of bewilderment, as speculation surrounding Binance Futures appears to have caused ACT and IP to take a nosedive in value.

ACT, a token of artificial intelligence, and IP, which seeks to place intellectual property upon the blockchain, both suffered rapid declines of 27% and 21.5%, respectively. Yet, in a most remarkable turn of events, they both managed to rebound, with ACT even boasting a net growth of 2.5% over the past 24 hours. IP, having been a top performer for several months, caused quite the stir among its holders with its sudden drop, though the recovery suggests that this volatility may be but a fleeting fancy.

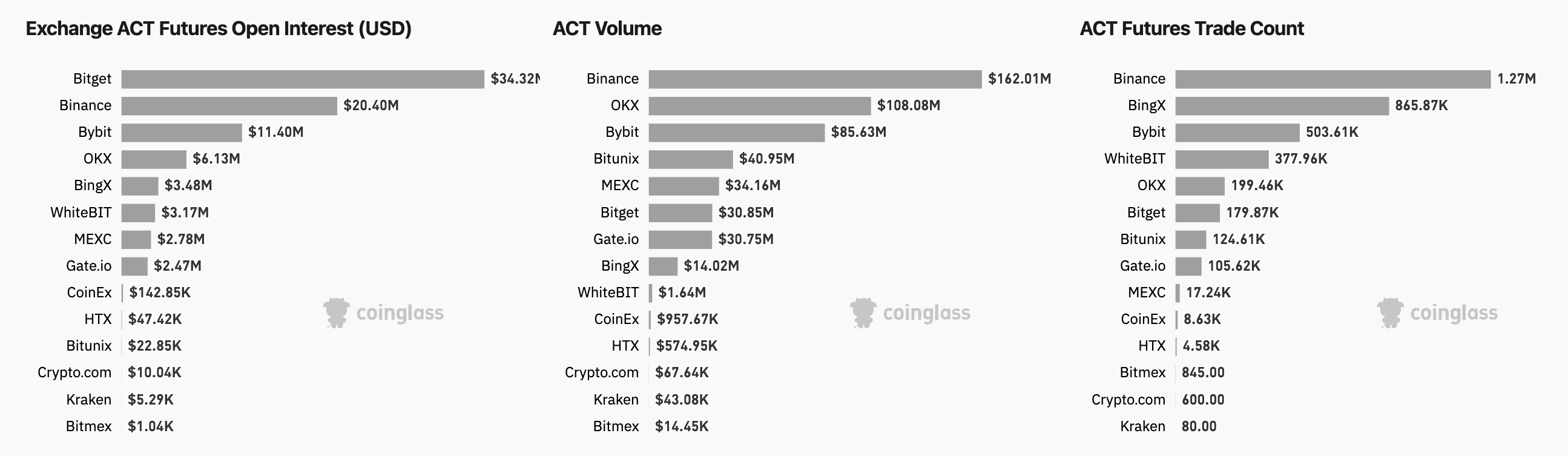

According to the esteemed Coinglass data, over 1.27 million ACT futures trades were executed on Binance—more than double that of the second-highest exchange, BingX. Binance also holds a rather impressive $20.4 million in ACT futures open interest.

This concentration renders Binance a most critical engine of price discovery. When large positions are hastily liquidated—often due to stop-losses, margin calls, or the whims of algorithmic trading—it can create a rather outsized impact on the prices of the underlying tokens.

Indeed, the futures markets now frequently eclipse the spot markets in both volume and velocity. While this may enhance liquidity, it also introduces a certain fragility to the proceedings.

A liquidation cascade—where long positions are forcibly closed due to declining prices—can indeed accelerate the downward momentum. Today’s synchronized drop in both IP and ACT suggests that excessive leverage and crowded positions may have triggered such a cascade on Binance.

These developments reaffirm that token prices, particularly for those emerging or mid-cap assets, are increasingly influenced by the whims of the derivatives markets. As more projects find themselves listed on futures platforms at an early stage, volatility driven by short-term positioning rather than the noble pursuit of long-term value creation is becoming the new norm. How delightfully chaotic! 😂

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-15 01:46