Crypto Flows Are Hot Again! $7.5B In, Bye Bye February Blues

Well, would you look at that? Digital assets decided to shake off their January hangover and boomed last week with $785 million pouring in. Ethereum, the drama queen of the crypto world, led the parade with a shiny $205 million, thanks to some snazzy upgrades and a new bossy co-exec. Who knew tech upgrades could be so sexy?

Ethereum Steals the Show, Again. Surprise! 🚀

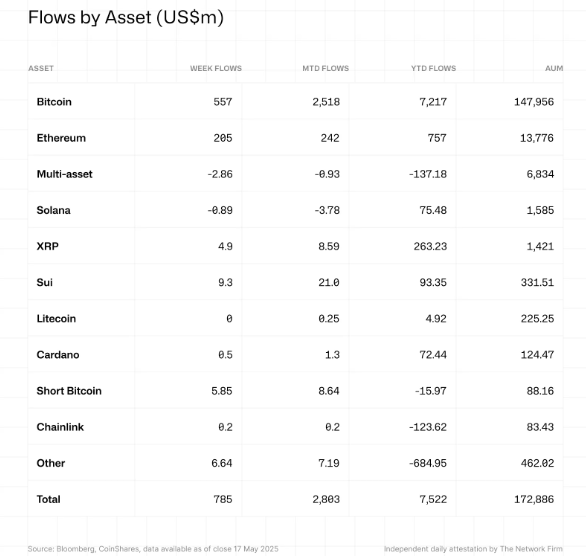

Crypto investment products finally got their act together, netting a cool $785 million last week. That’s five weeks of straight-up gains—no more crying over spilled crypto. Year-to-date? A hefty $7.5 billion, enough to buy… well, probably a yacht or two, if you’re into that sort of thing. Coinshares says it’s like the market finally woke up from a bad dream and remembered how to have feelings. Read all about it here.

Ethereum, that overachiever, got a cash injection of $205 million, flexing after its Pectra upgrade and the appointment of Tomasz Stańczak—yes, a name that sounds like a rapper—to a big fancy position. With $575 million in the bank this year, Ethereum’s basically telling everyone, “Hey, I’m still relevant, remember me?” Buy Ethereum, or don’t.

Bitcoin, the OG crypto diva, kept its crown with $557 million, though it’s feeling a little cautious—probably waiting for the Fed to drop more breadcrumbs. Short-bitcoin funds also saw some love, grabbing $5.8 million. Because, hey, who doesn’t love a bit of hedge wizardry?

Regionally, the U.S. was the big spender, raking in $681 million. Germany and Hong Kong followed, while Sweden, Canada, and Brazil decided to be total party crashers with minor outflows. Looks like investor mood is shifting—less panic, more long-term love, especially for Ethereum, even with all the macro chaos going on. Ah, the thrill of crypto, darling. 🤑

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- Nine Sols: 6 Best Jin Farming Methods

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Invincible’s Strongest Female Characters

2025-05-20 01:29