Ah, yet another week of chaos in the crypto world—what a surprise! The “steady” stream of money out the door has hit record levels once again. According to CoinShares, a staggering $584 million slipped through the cracks of crypto-focused investment products, making the two-week total a lovely $1.2 billion. Who said crypto was risky?

And what could possibly be driving this mass exodus? Oh, just the little matter of uncertainty surrounding the US Federal Reserve’s interest rate cuts—or rather, the lack thereof. James Butterfill, Head of Research at CoinShares, suspects this is the root of all evil, feeding investor jitters and sending them fleeing in panic. Ah, the sweet taste of economic instability.

But wait, it gets better. Exchange-traded product (ETP) volumes have plummeted to new lows, with global trading dropping to a miserable $6.9 billion. That’s the weakest weekly volume we’ve seen since Bitcoin ETFs went live in the US earlier this year. Who needs liquidity anyway?

Bitcoin and Ethereum: The Sacrificial Lambs of the Crypto Exodus

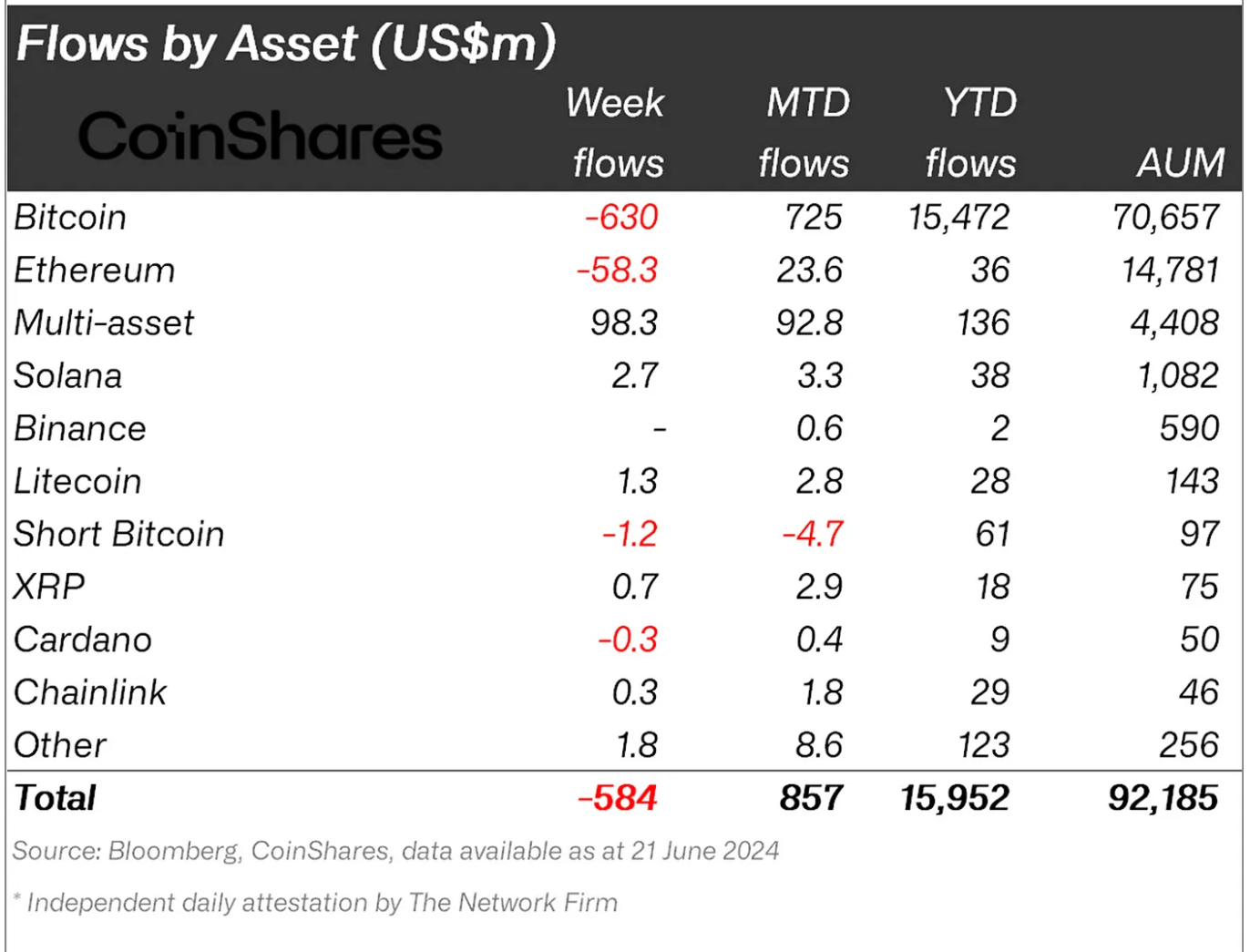

Bitcoin, as always, takes the brunt of the damage, with $630 million evaporating from BTC investment products. Yes, you read that right—$630 million. And, oh, the drama doesn’t stop there—short Bitcoin products also took a hit of $1.2 million. It’s almost like investors are holding their breath, waiting for the next big disaster to hit… but with no guts to bet on it.

Ethereum, not wanting to miss out on the fun, saw $58 million quietly slip away as well. Yes, the crypto elite are feeling the chill as cautious investor behavior takes center stage. Could it be… fear? Nah, just good ol’ uncertainty.

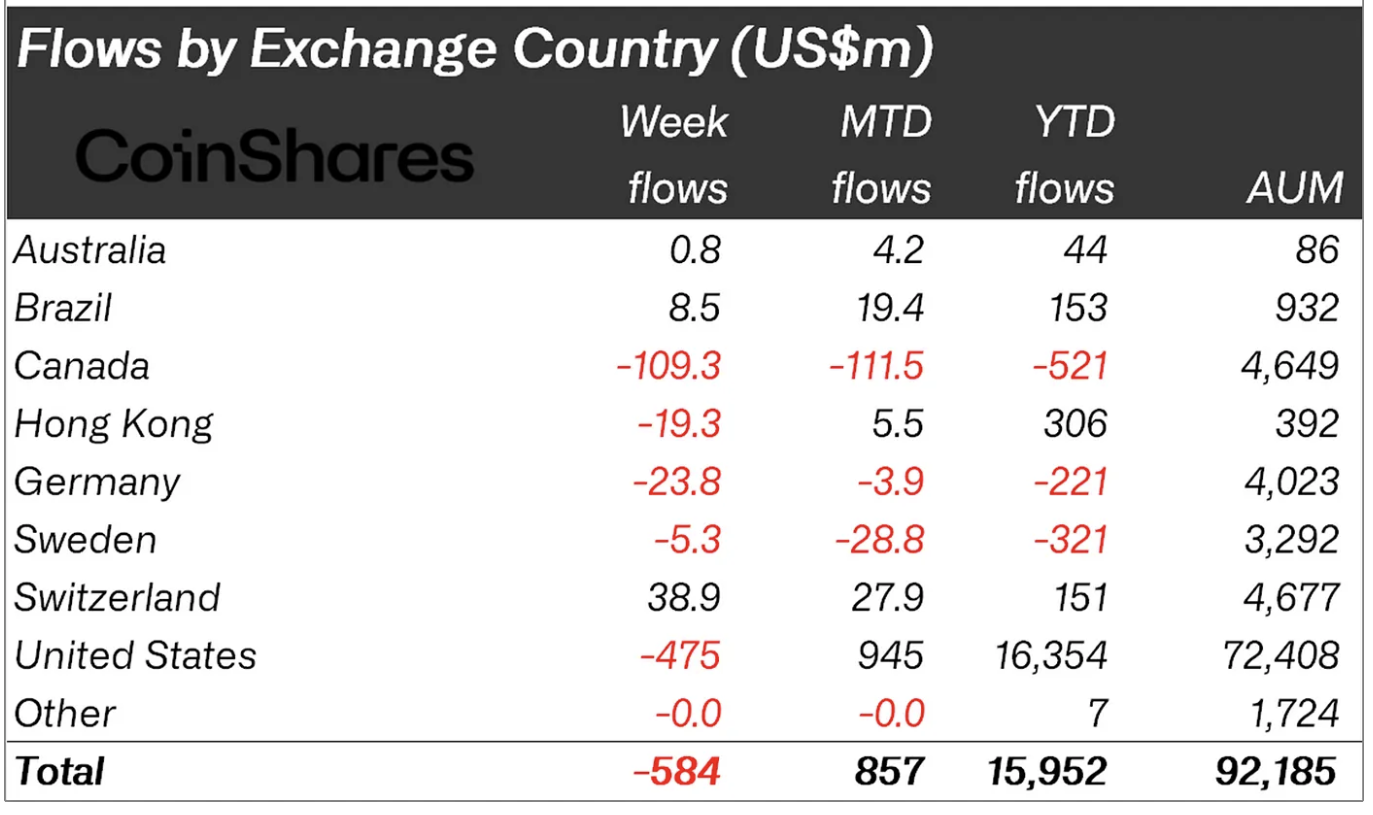

As for where the money’s going, well, the United States takes the crown with $475 million in outflows, followed closely by Canada at $109 million. Germany and Hong Kong? Well, they didn’t escape unscathed, but with a relatively small amount of $24 million and $19 million. Poor souls. If only they’d gotten the memo.

Now, for the plot twist! Switzerland and Brazil—yes, you heard me right—are defying the odds. Switzerland brought in a solid $39 million, while Brazil fared even better, bagging a neat $48.5 million. Could it be that they’re onto something we’re all missing? A bit of local flavor in this global soup?

Altcoins: The Brave Heroes of This Dystopian Crypto Drama

Meanwhile, in the land of altcoins, there’s a flicker of hope. Solana, Litecoin, and Polygon, those humble underdogs, saw a tiny but not insignificant inflow of $2.7 million, $1.3 million, and $1 million, respectively. Let’s face it—these are the true survivors, the ones who know how to hustle. 🏃♂️💨

And don’t forget multi-asset products, those crafty little devils. With $98 million pouring in, they’re spreading their bets across various cryptocurrencies—because why risk it all on one when you can play it safe (ish)?

So here we are, folks. A market in disarray, where the wealthy make their exit, and the bold—like those altcoin warriors—make their move. With all eyes on the Federal Reserve and the growing tension in global markets, it’s clear: the crypto rollercoaster isn’t stopping anytime soon. But who’s really surprised? In the end, it’s all just a matter of who can weather the storm—or at least grab a few coins along the way. 🌪️💰

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Borderlands 4 Still Has One Ace Up Its Sleeve Left to Play Before It Launches

2025-06-17 07:31