Trend Research, a rather cheeky investment firm, decided to play a game of financial hide-and-seek with Ethereum. 🕵️♂️ They deposited their Ethereum like it was a magic bean and borrowed stablecoins as if they were chocolate coins from Willy Wonka’s factory. 🍫 The goal? To buy more Ethereum, redeposit it, and create a loop so clever it could probably win a Nobel Prize… if only they remembered to brush their teeth. 😒

This shenanigan was spotted by Lookonchain, a detective agency for blockchain mysteries, on December 29. The trail goes back to October 2025-yes, the future-or as we like to call it, Tuesday. 📆

According to a recent tweet (or message in a bottle, if you’re old-school), Trend Research borrowed $958 million in stablecoins. That’s enough to buy every pineapple pizza in existence and still have change for a taxi ride. 🍕🚕

Trend Research (@Trend_Research_) keeps borrowing $USDT to buy $ETH. 🤑

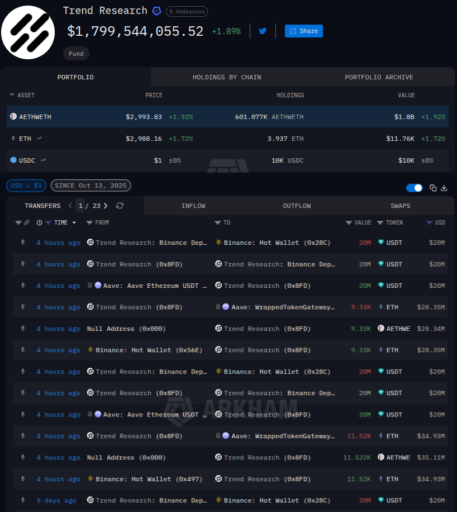

They now hold 601,074 $ETH ($1.83B) and borrowed $958M in stablecoins. That’s like buying a yacht for your goldfish and calling it a day. 🐠🛥️

The average purchase price? A number so ordinary it could probably sleep through a math class. 😴- Lookonchain (@lookonchain) December 29, 2025

The firm is leveraging Ethereum’s DeFi protocols like a kid with a slingshot and a vendetta. They deposit ETH on Aave like it’s a piggy bank for grown-ups, borrow stablecoins, buy Ether on Binance, and then redeposit it to grow their collateral. It’s a loop so smooth it could probably be used as a lubricant. 🚀

According to Arkham, Trend Research’s ETH is stored in AETHWETH tokens-a fancy name for “interest-bearing magic beans.” 🌱

Their December 29 antics began with an 11,520 ETH withdrawal from Binance, five days after depositing 20 million USDT. It’s a dance so synchronized, it makes a ballroom full of penguins look like professionals. 🐧💃

Behold the magnificent balance sheet of Trend Research, captured on December 29, 2025. | Source: Arkham Intelligence

Ethereum has been stuck below $3,000 like a stubborn cork in a bottle of champagne. 🥂 Analysts whisper about a $8,500 moonshot, but let’s be real-it’s probably just a dream. 🌙

In the meantime, Aave, Ethereum’s top lending/borrowing protocol, is having a discussion with its community. Aave Labs proposed “token alignment,” but the first vote failed with more drama than a soap opera. 🎭

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- How to Unlock & Upgrade Hobbies in Heartopia

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Sony Shuts Down PlayStation Stars Loyalty Program

- EUR USD PREDICTION

2025-12-29 19:27