As a seasoned researcher with a deep understanding of the cryptocurrency and decentralized finance (DeFi) landscape, I find MakerDAO’s recent $1 billion investment in tokenized US Treasury securities to be an intriguing development that could significantly impact the future direction of DeFi.

In a major announcement, MakerDAO, the foremost Decentralized Finance (DeFi) platform, disclosed an investment worth $1 billion in tokenized US Treasury securities. This bold step has sent ripples through the crypto industry and could potentially redefine the foundations of the DeFi landscape.

Major Players Boost Tokenization

As a researcher examining the developments in the decentralized finance (DeFi) space, I’ve come across the significant strides made by MakerDAO in expanding their portfolio beyond Ethereum. With an impressive $1 billion investment allocated to tokenized US Treasuries, this innovative move not only reduces the platform’s reliance on a single asset but also paves the way for the future of real-world asset (RWA) tokens on MakerDAO.

As an analyst, I believe that MakerDAO’s entrance into the $2 billion tokenized Reinsurance Asset (RWA) market will set a new standard for the industry. This move is likely to spur further growth and innovation within this sector.

MakerDAO’s $1B Tokenized Treasury Investment: Major Players Dive In!

MakerDAO’s $1B play into tokenized U.S. Treasuries is shaking up the market.

Heavyweights like BlackRock’s BUIDL, Superstate, and Ondo Finance are vying for a piece.

MKR token saw a 5% boost on this news.…

— Crypto Town Hall (@Crypto_TownHall) July 14, 2024

The involvement of industry giants such as BlackRock’s BUIDL, Superstate, and Ondo Finance significantly boosts the importance of this development. These financial heavyweights signify that tokenizing traditional financial assets like treasuries is not just a passing fad but a strategic requirement.

With the expanding presence of major players in the Decentralized Finance (DeFi) sector, the merging of traditional banking systems and blockchain technology becomes more and more apparent.

MKR Token Gains Momentum

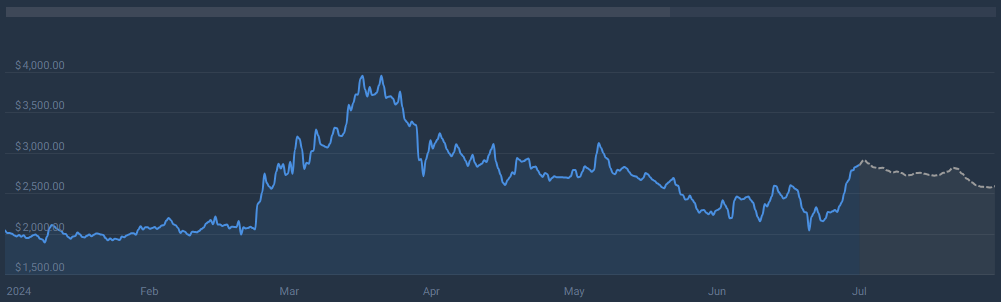

The value of MakerDAO’s native token, MKR, has risen by 30% since the announcement, indicative of positive feelings among traders and investors.

Currently, the latest forecast for Maker’s price indicates a decrease of 9.22%, resulting in an estimated value of $2,597 for the MKR token by August 14, 2024.

With a generally optimistic perspective and a Fear & Greed Index reading of 52 (indicating Neutral status), now could be a good time for investors to consider adding MKR to their investment portfolios.

Integrating Crypto And Traditional Finance

MakerDAO’s $1 billion investment in tokenized US Treasuries signifies more than just a financial decision; it’s a powerful statement about the prospect of decentralized finance (DeFi) and the intersection of traditional financial assets with blockchain technology.

Through this action, the platform demonstrates its unwavering commitment to expanding the boundaries of what’s possible in Decentralized Finance (DeFi). As a result, new hurdles and prospects arise for the entire DeFi community to explore.

In the coming months, we can expect increased collaboration and participation from major financial institution representatives and blockchain startups. This anticipated trend has the crypto community on the edge of their seats in anticipation of new developments.

MakerDAO’s groundbreaking actions are expected to significantly shape the future of the Decentralized Finance (DeFi) market and the broader financial landscape over the next few years.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- BSW PREDICTION. BSW cryptocurrency

2024-07-15 14:41