Well, folks, it seems that according to CoinGecko’s quarterly report, the crypto market cap has taken a nosedive of 18.6% in Q1 2025. That’s right, a staggering $633.5 billion has evaporated into thin air, much like my will to exercise after a long day. 🏋️♂️

Now, before you start throwing your hands up in despair, the report did manage to identify a few positive trends. But, as is often the case, they came with a side of significant downsides. It’s like finding a penny in the street only to realize it’s stuck to a chewed-up piece of gum. 😬

Crypto Suffered Heavy Losses in Q1

The latest CoinGecko report paints a rather gloomy picture of the first quarter. January kicked off with a bullish cycle that had everyone feeling like they were on top of the world. But alas, macroeconomic factors have since crashed the party, leaving us all feeling a bit like a deflated balloon. 🎈

According to this report, crypto’s total market cap fell 18.6% in Q1 2025, which is a staggering $633.5 billion. Investor activity has plummeted alongside token prices, with daily trading volumes dropping 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges fell 16.3%, and CoinGecko suggests that the Bybit hack might have had a hand in this mess. Who knew hacking could be so detrimental? 🤷♂️

The report, while heavy on numbers, did point out a few specific events that impacted crypto. Markets hit a local high around Trump’s inauguration, fueled by euphoria over potential friendly policies. It’s like getting excited about a new diet plan only to find out it involves kale smoothies. 🥤

His TRUMP meme coin sparked a brief frenzy in Solana meme coin activity, but that excitement fizzled out faster than a soda left open overnight. And let’s not forget the LIBRA scandal, which had a further dampening impact. Talk about a party pooper! 🎉🚫

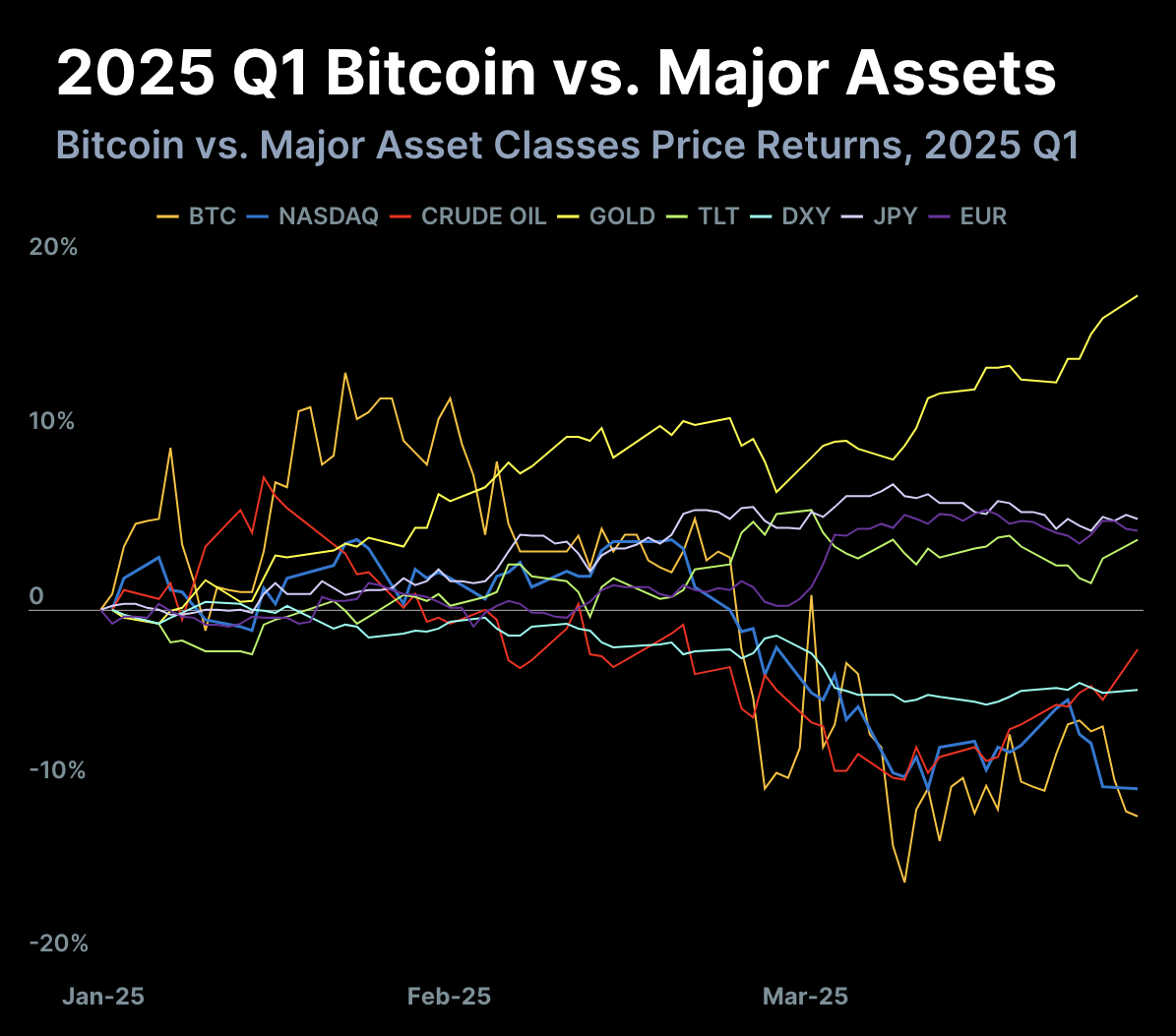

Bitcoin, bless its heart, increased its dominance in Q1 2025, accounting for 59.1% of crypto’s total market cap. It hasn’t held that share since 2021, which is a testament to its stability compared to the wild ride of altcoins. But don’t get too comfortable; BTC also fell 11.8% and was outperformed by gold and US Treasury bonds. Ouch! 😱

This data point is particularly concerning because Trump’s tariffs have wreaked havoc on Treasury yields. Yet, the report clearly shows that the rest of crypto suffered even more. Ethereum’s entire 2024 gains vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. It’s like watching your favorite TV show get canceled after one season. 📺

Countless other areas saw similar results, but they’re too numerous to easily summarize. Almost every quantifiable positive development came with at least one major caveat. Solana may have dominated the DEX trade, but its TVL declined by over one-fifth. It’s like winning a race only to find out you were running in the wrong direction. 🏃♂️💨

Bitcoin ETFs saw $1 billion in fresh inflows, but total AUM fell by nearly $9 billion due to price drops. The reports reflect that recession fears are gripping the crypto market tighter than a toddler holding onto their favorite toy. 🧸

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- How to Unlock the Mines in Cookie Run: Kingdom

- REPO: How To Fix Client Timeout

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-17 03:11