Oh, what a delightful little twist, my dear! Crypto inflows just can’t stop their charming streak of positivity, bringing in a delightful $5.5 billion over the past three weeks.

And why wouldn’t they? The market is in a perpetual state of optimism, as the world’s little economic hiccups seem to only serve as a tailwind for the ever-so-dashing pioneer of crypto. 🤑

Crypto Inflows Reach $2 Billion—Take That, Tariffs!

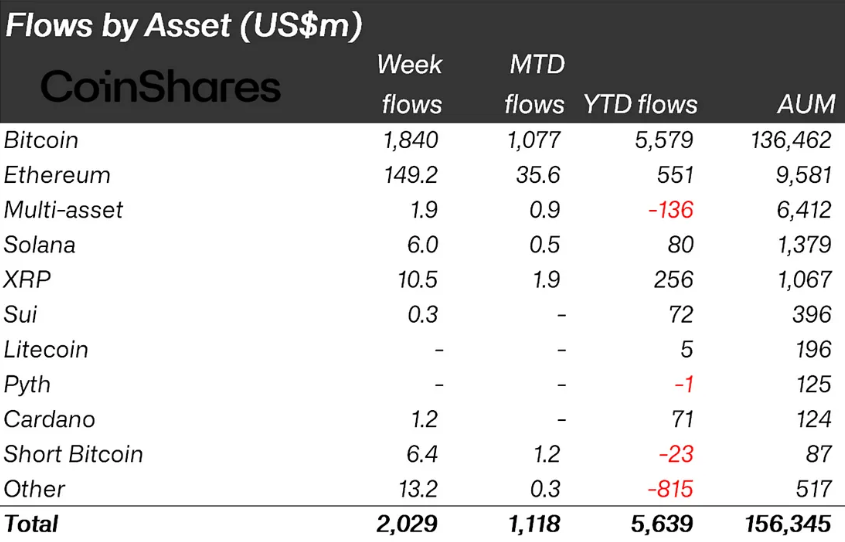

The latest report from our ever-so-dedicated CoinShares team reveals that crypto inflows hit a neat $2 billion last week—marking the third week in a row of such glorious financial fanfare.💸

Last week, the market seemed to surge like a champagne cork popping at an exclusive party, with crypto inflows clocking in at $3.4 billion, as investors scrambled to turn to their digital assets for a little bit of safe harbour. Just the week before, it was a more modest affair with only $146 million in inflows—but fret not, XRP decided to do its own thing. 📉

But this week? The show was all about Bitcoin, darling. It led the pack with an impressive $1.8 billion in inflows, while Ethereum followed closely with a more modest $149 million. As for Solana? Oh, sweet Solana… just a casual $6 million. Better luck next time, old sport. 🧐

CoinShares remains upbeat, claiming that despite Trump’s tariffs throwing tantrums left and right, the bullish sentiment is as contagious as a springtime cold, thanks to some rather sparkling economic data from the US. 👏

Market optimism, though clearly not without its quirks, was supported by strong employment data. The GDP numbers might have been a tad underwhelming—falling by 0.3% thanks to the pesky export declines caused by those tariffs—but let’s not forget that core GDP, reflecting the private sector, was up a healthy 3.0%. A bit of a dance between triumph and tribulation, don’t you think? 💃

CoinShares’ very own James Butterfill notes that businesses might be getting ahead of the tariff game. The futures markets have their eyes on potential rate cuts in 2025, but, alas, with strong payrolls and elevated inflation, the chances of the Federal Open Market Committee cutting rates this week appear… rather slim. 🥂

“We believe the current data is likely insufficient to prompt the Federal Open Market Committee (FOMC) to cut rates at next Wednesday’s meeting,” wrote Butterfill.

Consumer behavior? A bit cautious, darling. Services inflation is showing some weakness. Equities and Bitcoin, however, remain sensitive to any tariff updates. Employers, apparently, are trying to avoid any unnecessary drama and delay job cuts. Good for them. 👏

And despite the world’s economic theatre, Bitcoin continues its romp forward, especially in the US. The market is practically cheering from the sidelines. 🏅

“Our latest Digital Asset Manager Fund Survey reflects this evolving sentiment: investor preference for Bitcoin has strengthened post-U.S. election, with 63% of respondents now holding it—a 15 percentage point increase since January. Digital asset weightings have risen to 1.8%, the highest level in a year, driven by both price appreciation and improving sentiment. Institutional allocations have climbed to an average of 2.5%,” Butterfill explained.

However, let us not forget that both new and seasoned investors continue to hold the same grudge against the volatility that defines the market. A persistent disconnect between perceived risk and actual behavior, as Butterfill so astutely puts it. 🧐

For those curious, as of this very moment, BTC is trading at a rather attractive $93,997—though it has dropped a mere 2% in the last 24 hours. It appears the $94,000 mark is just a fleeting dream, at least for today. 🍾

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- One Piece Episode 1129 Release Date and Secrets Revealed

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Top 8 UFC 5 Perks Every Fighter Should Use

- AI16Z PREDICTION. AI16Z cryptocurrency

- REPO’s Cart Cannon: Prepare for Mayhem!

- Nine Sols: 6 Best Jin Farming Methods

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- Invincible’s Strongest Female Characters

2025-05-05 15:51