As a seasoned analyst with years of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The current state of the market, much like a New Year’s Eve party that starts off with high spirits but ends with everyone going home early, mirrors the recent crypto rally and subsequent downturn.

Heading into the last week, there was a lot of hopefulness in the crypto market as investors predicted a “Christmas Rally” for Bitcoin, with some targeting the $100,000 milestone. However, on Christmas day, Bitcoin made an attempt at that price level, but the bears quickly regained control shortly after.

For the majority of significant cryptocurrencies like Ethereum, Solana, and XRP, the narrative remained similar. As the crypto market entered a bearish trend in 2024, a wave of doubt swept over the digital asset sector as the year came to an end.

Why Is Trading Activity Dwindling In The Market?

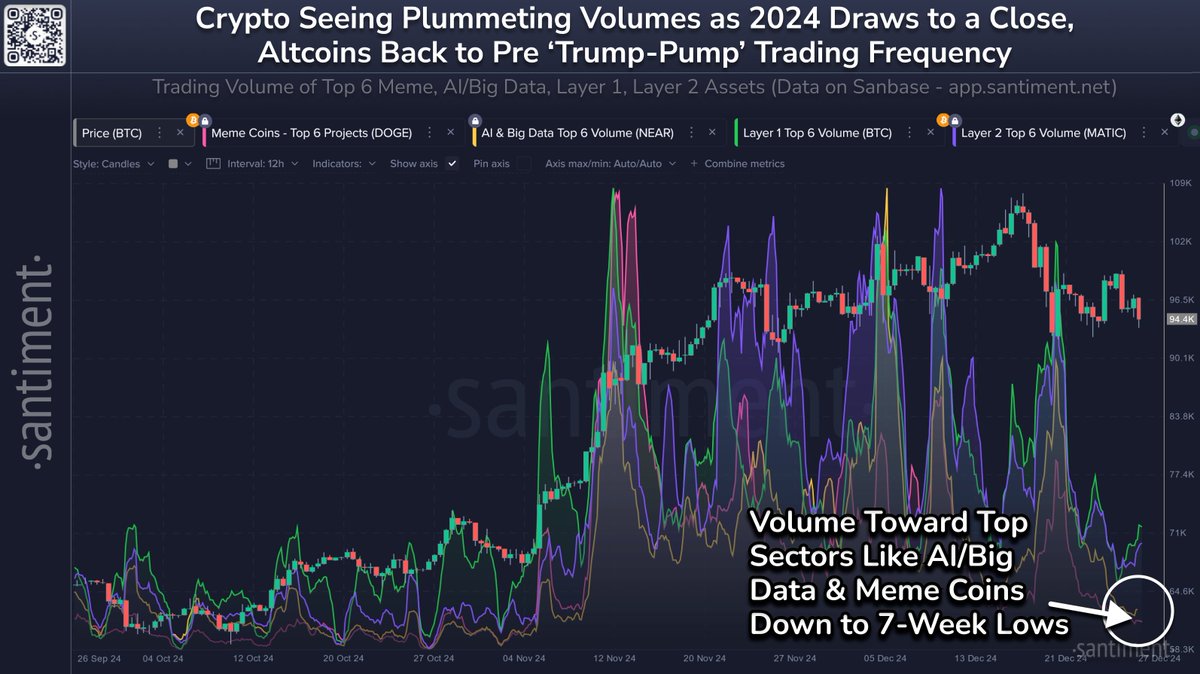

Recently, market intelligence firm Santiment posted an intriguing observation about the crypto market towards the end of 2024 on their X platform. Based on data from a blockchain company, it appears that trading activity is gradually decreasing across different areas of the cryptocurrency market.

According to Santiment’s data, trading activity has decreased by 64% over the last week, with the AI/Big Data and meme coin sectors hitting their lowest points this week. This shift is quite surprising given that Bitcoin recently reached a new all-time high of $108,135 in the preceding week.

Simultaneously, Santiment suggests that a decrease in trading volume, particularly for speculative altcoins, was something that everyone should have foreseen. In simple terms, as the holiday season approaches and traders focus on wrapping up their annual finances, the last week of December is typically one of the least active weeks in terms of trading activity, according to the analytics firm.

In simpler terms, an analyst named Grizzly from Quicktake explained that the Coinbase Premium Index, which measures the gap between the price of Coinbase Pro (in USD) and Binance (in USDT), has been decreasing for similar causes. Grizzly suggested that lower market activity during the holiday season, combined with restricted cash flow, could be responsible for this price decrease.

If whales maintain their strong tendency towards accumulation, Santiment suggests that the crypto market might experience an unforeseen, significant surge by the end of 2024, despite the current low interest and involvement from retail participants.

Total Crypto Market Capitalization

Currently, the overall value of all cryptocurrencies amounts to approximately $3.43 trillion, marking a 2.2% drop over the last day. However, considering that the crypto market cap has grown by more than 100% this year, it’s clear that 2021 has been a prosperous year for the digital asset industry, regardless of how it ends in December.

Read More

- REPO: All Guns & How To Get Them

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- BTC PREDICTION. BTC cryptocurrency

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

2024-12-28 16:41