The crypto world is like a wild west showdown right now-unpredictable, chaotic, and with a few too many cowboys losing their hats. No one knows what’s coming next, but a lot of folks are starting to get nervous about a looming bear market. Rob Isbitts, a crypto analyst from Barchart, has thrown in his two cents, and he’s got three big signals that suggest things are about to get colder in the world of crypto.

The Crypto Price Dance: More Correlations Than a Family Reunion

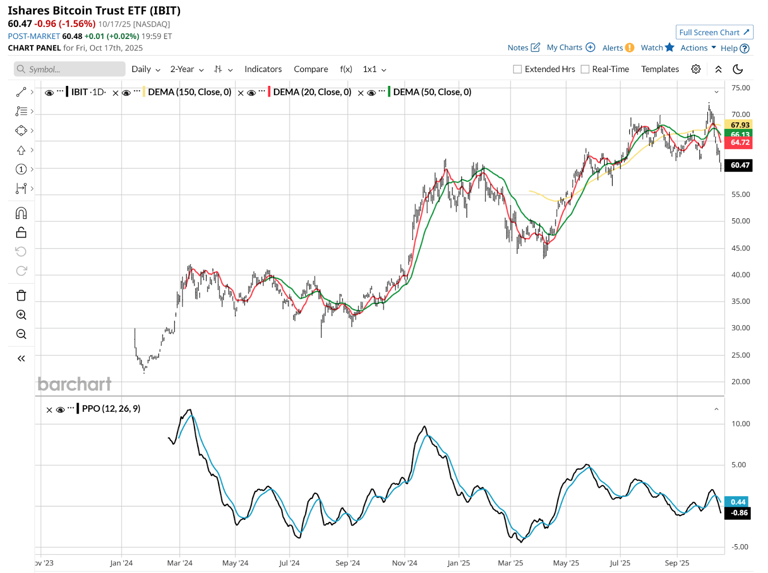

First off, let’s talk about those oh-so-interesting correlations. Remember last year? No? Well, that’s fine-April was the time when the launch of Bitcoin spot ETFs was the talk of the town. BlackRock’s IBIT fund, which is swimming in over $85 billion, saw a 50% spike-only to nosedive by 25% afterward. That’s some real rollercoaster action, folks.

Fast forward to this year, and the same patterns are playing out. The market is shaking and shimmying as more investors pull out of these funds, which only makes the whole thing feel like one of those reality shows where nobody really wins.

Now, Isbitts is pointing at the Percentage Price Oscillator (PPO)-yes, that fancy term everyone loves to throw around. It’s signaling that Bitcoin’s price might be headed for a nosedive in the coming weeks. So, buckle up.

Ethereum, the second cousin of Bitcoin, isn’t looking too hot either. Sure, it’s still standing tall as a major player, but it’s getting sucked into the same gravitational pull as Bitcoin. As the saying goes, “When Bitcoin sneezes, Ethereum catches a cold.”

And let’s not forget Solana (SOL)-you know, the crypto that’s like that one guy who tries a little too hard to be different. If Bitcoin takes a dive, Solana’s likely to jump off the deep end, with its volatility making things even worse. For example, when Bitcoin dropped 15%, Solana’s futures-based ETF fell double that. Ouch, right?

Gold, the Old Reliable, Makes a Comeback

If you’ve been watching the market lately, you’ll notice the same pattern of “lower lows” creeping in. If these don’t reverse soon, it’s going to be like trying to climb a mountain in a snowstorm-difficult and probably futile.

Here’s where it gets interesting-gold, that old shiny friend, is making a comeback. It used to be seen as the “anti-dollar asset,” but now, it’s looking more like a safe haven in a world that can’t seem to make up its mind. Central banks are stashing up on gold, and that’s starting to mess with the crypto ecosystem.

Gold’s price moves are starting to mirror those of crypto, and it’s creating a weird new dynamic. Crypto ETFs and stocks, once the darlings of the investment world, are starting to show signs of cracking under the pressure. So, maybe it’s time to dust off your gold bars from under the mattress?

Isbitts also pointed out that while Bitcoin is volatile (duh!), it has shown some serious staying power. Every time it takes a tumble, it manages to climb back up to new highs. However, don’t get too excited-if Bitcoin does rise again, it’s likely to start from a much lower price point than we’d like to see.

But hey, don’t start selling your Bitcoins just yet-Bitcoin managed to creep back up to $112,900 in the last hour of Tuesday morning’s trading. Who knows? Maybe it’s just trying to make a dramatic comeback before it takes another dive. Stay tuned!

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-10-22 01:29