As a seasoned researcher with over a decade of experience in the financial markets, I have seen my fair share of market cycles and trends. The latest development in CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator has caught my attention, particularly given its recent shift into negative territory.

According to the Bitcoin cycle indicator from analytics firm CryptoQuant, it appears that BTC may have shifted into a more bearish trend following the recent market downturn.

CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator Now In Negative Territory

In a new post on X, CryptoQuant Head of Research Julio Moreno has discussed the latest development in the “Bull-Bear Market Cycle Indicator” devised by the analytics firm.

The measurement we’re using here is derived from the Profit & Loss (P&L) Index by CryptoQuant, an amalgamation of several widely used on-chain indicators that evaluate both unrealized and realized profits and losses.

In simpler terms, the P&L Index helps us figure out whether Bitcoin is currently in a rising or falling market trend. When this index goes above its 1-year moving average, it suggests that Bitcoin might be starting a bullish period. Conversely, if it falls below the moving average, it could indicate a shift towards a bearish phase.

In simpler terms, we’re using a tool called the Bull-Bear Market Cycle Indicator to present the P&L Index in a more user-friendly way. This is done by measuring how far it deviates from its moving average over a period of 365 days.

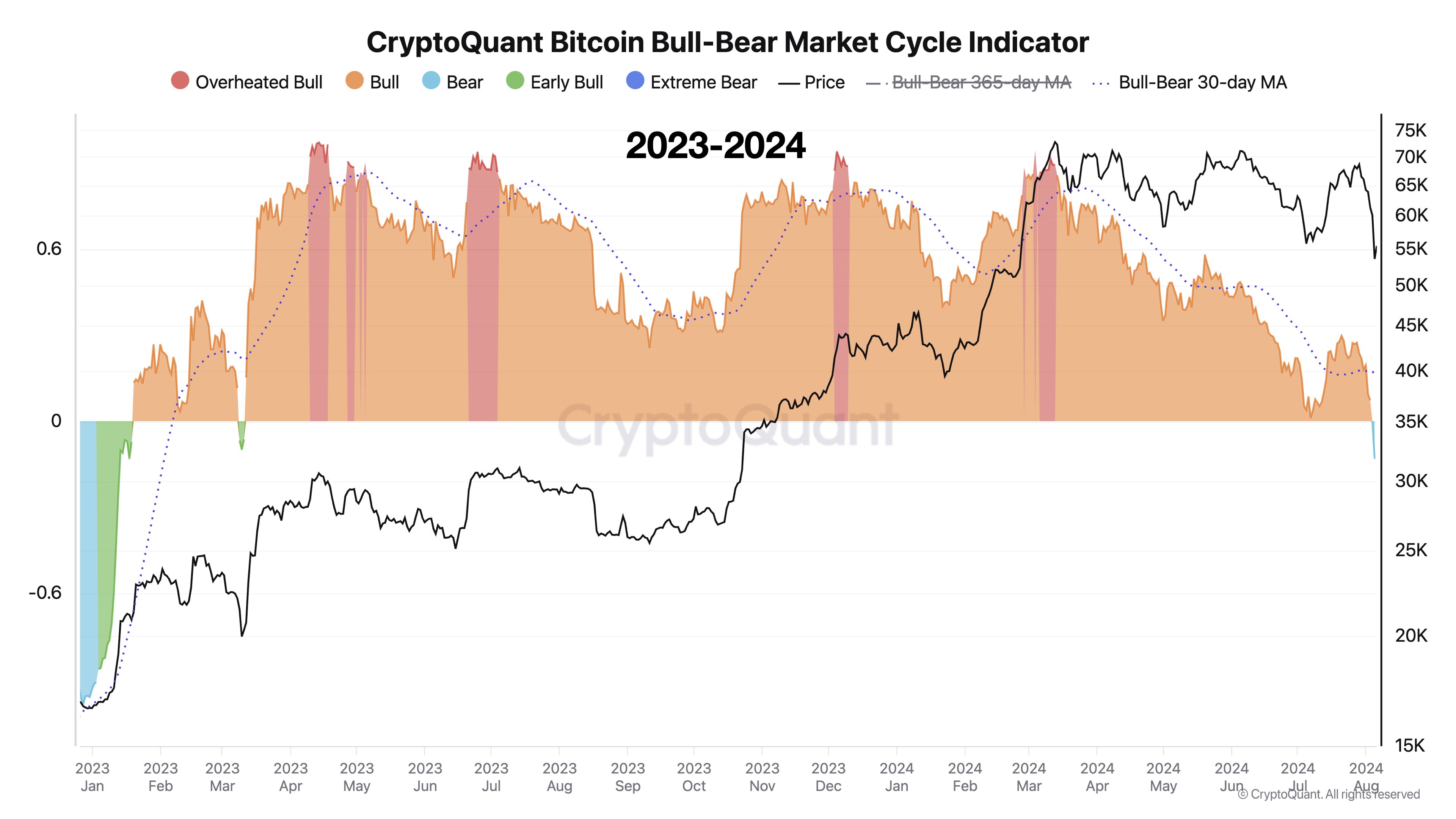

Now, here is a chart that shows the trend in this Bitcoin indicator over the last couple of years:

The Bitcoin Bull-Bear Market Cycle Indicator spiked earlier this year, coinciding with the asset’s price reaching an unprecedented peak (new all-time high), and entering a zone referred to as “overheated bull” territory.

At these levels, the P&L Index outpaces its moving average (365-day) by a considerable margin, signaling that the asset’s price might be inflated. Additionally, during this period of overvaluation, the asset reached a high point which currently serves as the pinnacle of the rally to date.

Following several months within typical bull market conditions, the indicator seems to have dropped below the zero line, suggesting that the Profit and Loss (P&L) Index has now dipped beneath its moving average of the past 365 days.

According to the Bull-Bear Market Cycle Indicator, Bitcoin appears to be entering a bearish phase. This is a notable shift, as this signal hasn’t been given since early January 2023, according to Moreno.

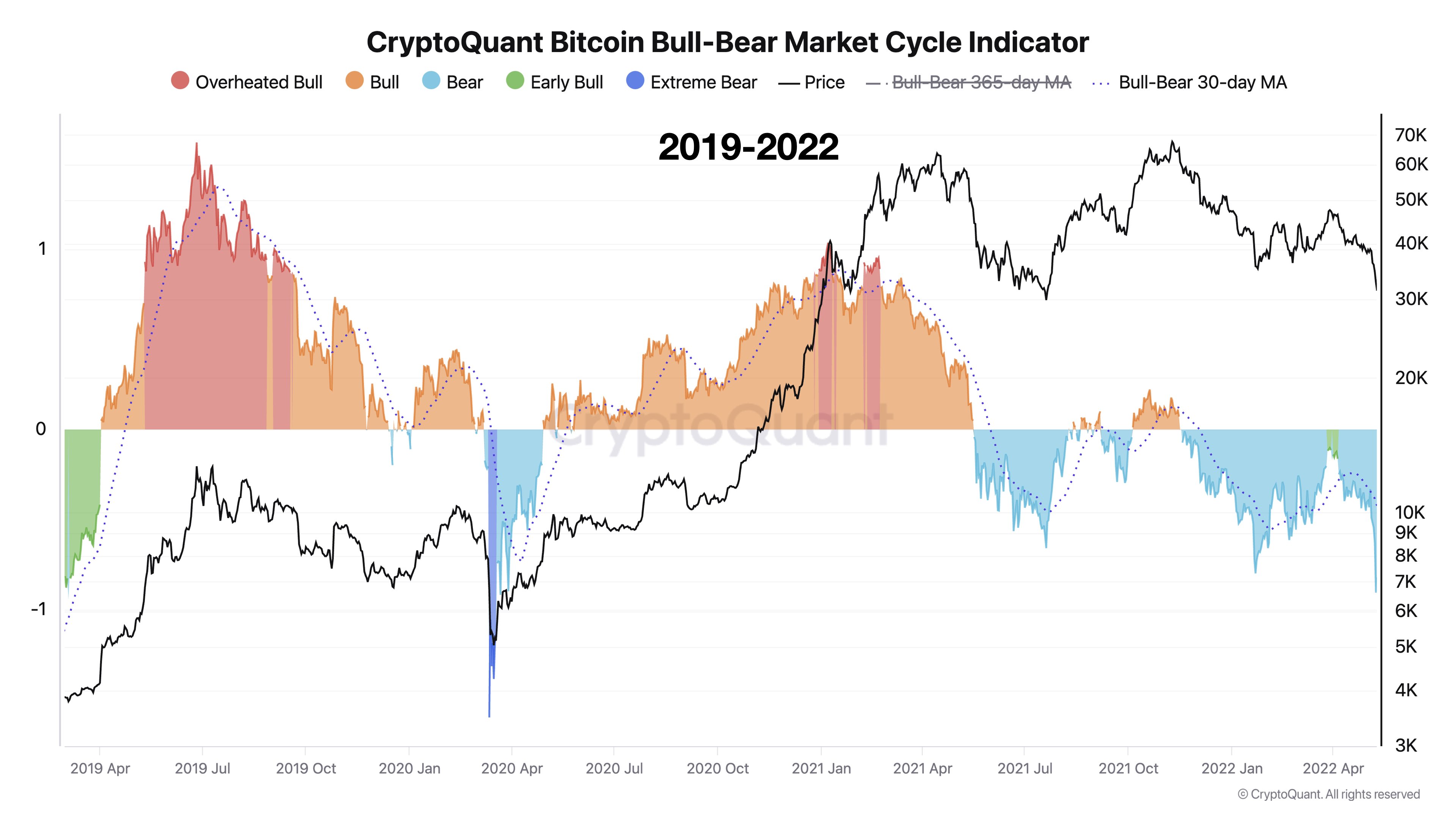

A point worth considering is that this signal might not automatically indicate that the cryptocurrency will enter a prolonged bear market. The CEO of CryptoQuant has highlighted instances in the past where this metric briefly suggested a bearish trend for Bitcoin, but it didn’t last.

According to the graph, it’s clear that the significant drop in COVID-19 cases in March 2020 and the Chinese mining ban in May 2021 were both associated with brief periods of market downturn, as indicated by the trend we’re observing.

Time will tell whether the Bitcoin Bull-Bear Market Cycle Indicator will stay within the negative zone for just a short while, similar to previous instances, or if it will persist longer.

BTC Price

Currently, Bitcoin is being exchanged slightly below the $57,000 mark, experiencing a decrease of approximately 14% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- SCOMP PREDICTION. SCOMP cryptocurrency

2024-08-08 07:12