In a most astonishing revelation, the illustrious stablecoin purveyor, Tether, has been crowned the grand poobah of centralized finance lending (CeFi) in the digital asset bazaar. Who would have thought? 🤔

Our dear Zack Pokorny, a research analyst at the crypto behemoth Galaxy Digital, has noted with a flourish that Galaxy and the Bitcoin lending firm Ledn have gallantly taken the second and third spots in this riveting lending hierarchy. Bravo! 🎉

When one combines the loan books of Tether, Galaxy, and Ledn, one arrives at a staggering total of $9.9 billion by the end of the fourth quarter of 2024. This triumvirate commands nearly 89% of the CeFi lending market and a whopping 27% of the entire crypto lending universe. Meanwhile, Coinbase, the top US crypto exchange, languishes in the fourth position. How the mighty have fallen! 😏

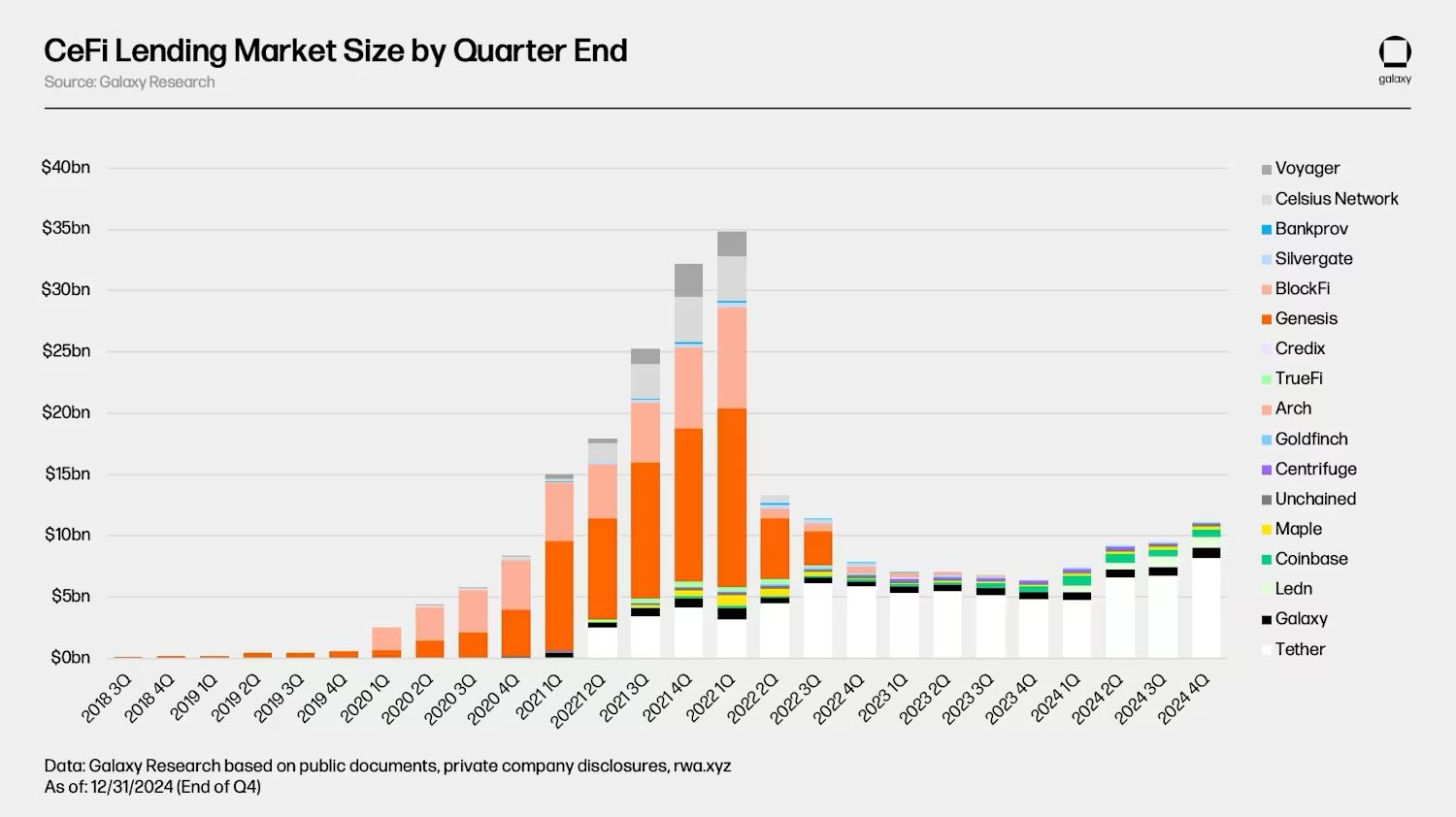

Alex Thorn, the head honcho of research at Galaxy, has declared that the total CeFi loan book size at the end of last year was a mere $11.2 billion, a rather disheartening 68% drop from the 2022 all-time high of $34.8 billion. Ouch! 📉

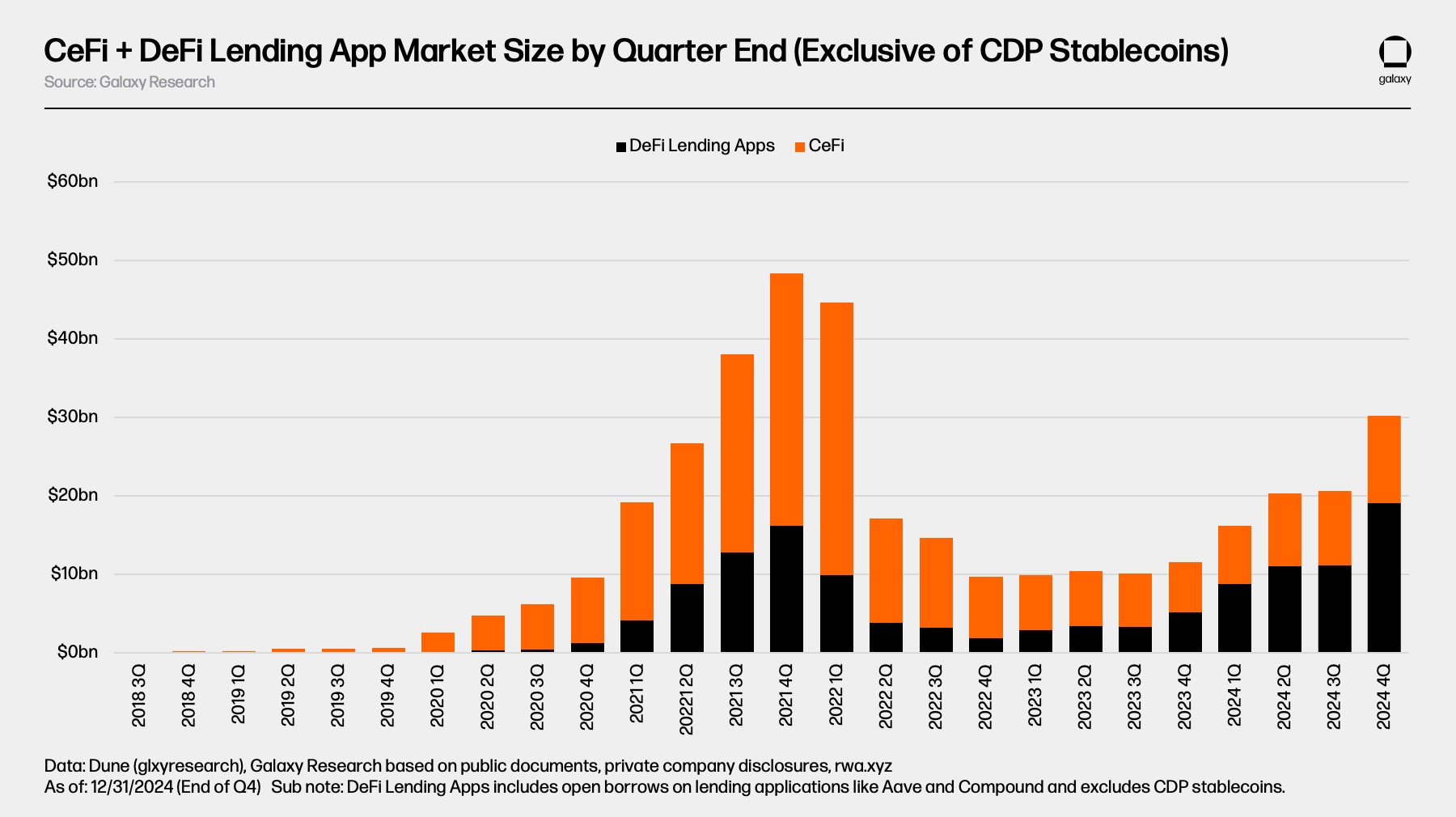

In a twist of fate, decentralized finance (DeFi) has emerged as the larger lending sector, boasting $19.1 billion in open borrows across 20 lending applications and 12 chains by the end of 2024, according to our intrepid Pokorny.

He further notes that DeFi lending across these chains and applications has surged by an astonishing 959% since the nadir two years ago. Who knew chaos could be so profitable? 💸

“DeFi borrowing has experienced a more robust recovery than that of CeFi lending. This can be attributed to the permissionless nature of blockchain-based applications and the survival of lending applications through the bear market chaos that felled major CeFi lenders. Unlike the largest CeFi lenders that went bankrupt and no longer operate, the largest lending applications and markets were not all forced to close and continued to function. This fact is a testament to the design and risk management practices of the large on-chain lending apps and the benefits of algorithmic, overcollateralized, and supply/demand-based borrowing.”

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-16 23:01