What to know: 🤔

By Omkar Godbole (All times ET unless I’m in a different timezone, which I’m not, but still…)

Bitcoin’s still hanging around $103,000 like a bad houseguest who won’t leave. 🤦♂️ Meanwhile, ZEC, ICP, and QNT are up 18%-probably because they’re the only ones with a pulse. 💃

The crypto market’s like a game of musical chairs, but the music stopped, and everyone’s just standing there awkwardly. 🪑 Wintermute calls it “self-funded mode,” which is just a fancy way of saying, “We’re all broke now.” 🥴

New money’s drying up faster than my sense of humor. Stablecoins, ETFs, DATs-all three are on life support. 💉 U.S. spot ETFs lost $1.5 billion in two weeks. That’s like losing your wallet at a casino, but the casino’s your 401(k). 😭

M2 money supply’s rising, but it’s all going to AI and infrastructure. Crypto’s like the forgotten middle child. 😢 Ray Dalio says the Fed’s “easing into a bubble,” which sounds like something I’d do with a bag of chips. 🍟

Traders, keep an eye on Bitcoin’s 50-week moving average. If it bounces, we might see new highs. If not, well, time to dust off that resume. 📈

In other news, Coinbase is begging the U.S. Treasury not to overregulate GENUIS stablecoin. Meanwhile, Lighter’s bot glitch sent HYPE to $100. 🤖 Chainlink’s now their oracle partner-because nothing says “trust” like a bot glitch. 🤷♂️

Dollar index is near resistance at 100.25. If it breaks out, crypto’s in for more pain. Goldman Sachs says the Supreme Court might rule against Trump’s tariffs, but don’t hold your breath for China to benefit. 🌍

What to Watch 👀

For a more comprehensive list, see CoinDesk’s “Crypto Week Ahead.” Or don’t. I’m not your mom. 👩💻

- Crypto

- Nothing scheduled. Shocking, I know. 🦗

- Macro

- Nov. 6, 7 a.m.: Bank of England interest-rate decision. Est. 4%. 🏦

- Nov. 6, 2 p.m.: Mexico central bank interest-rate decision. Est. 7.25%. 🌮

- Nov. 6, 2:30 p.m.: Federal Reserve Governor Christopher J. Waller talks about payments. Watch live if you’re into that sort of thing. 🎤

- Earnings (Estimates based on FactSet data)

- Nov. 6: Block (XYZ), post-market, $0.64. 💳

- Nov. 6: Iren (IREN), post-market, $0.15. 🧊

Token Events 🎟️

For a more comprehensive list, see CoinDesk’s “Crypto Week Ahead.” Again, no pressure. 🤓

Conferences 🎤

For a more comprehensive list, see CoinDesk’s “Crypto Week Ahead.” I’m starting to feel like a broken record. 🎶

- Day 4 of 5: Hong Kong FinTech Week 🏙️

- Day 3 of 3: Schwab IMPACT 2025 (Denver, Colorado) 🏔️

- Day 2 of 2: Blockchain Futurist Conference (Miami) 🌴

- Day 1 of 2: Bluechip25 Conference (Vienna) 🎻

Market Movements 📊

- BTC is down 0.77% at $102,873.60. 24hrs: +0.73%. 🤷♂️

- ETH is down 1.58% at $2,607.45. 24hrs: +1.89%. 🤹♂️

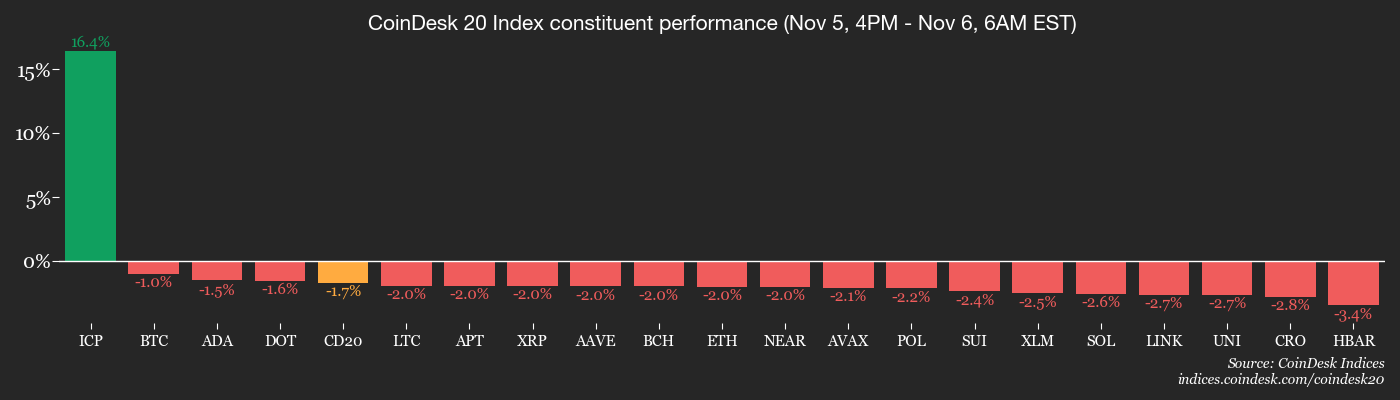

- CoinDesk 20 is down 1.33% at 3,261.54. 24hrs: +1.80%. 🧮

- Ether CESR Composite Staking Rate is up 5 bps at 3.06%. 📈

- BTC funding rate is at 0.0071% (7.7854% annualized) on Binance. 📉

- DXY is down 0.24% at 99.96. 💵

- Gold futures are up 0.59% at $4,016.60. 🏆

- Silver futures are up 0.91% at $48.46. 🥈

- Nikkei 225 closed up 1.34% at 50,883.68. 🗾

- Hang Seng closed up 2.12% at 26,485.90. 🏙️

- FTSE is down 0.28% at 9,749.73. 🇬🇧

- Euro Stoxx 50 is up 0.03% at 5,670.66. 🇪🇺

- DJIA closed on Wednesday up 0.48% at 47,311.00. 🇺🇸

- S&P 500 closed up 0.37% at 6,796.29. 📈

- Nasdaq Composite closed up 0.65% at 23,499.80. 💻

- S&P/TSX Composite closed up 1.09% at 30,103.48. 🇨🇦

- S&P 40 Latin America closed up 2.32% at 3,054.60. 🌎

- U.S. 10-Year Treasury rate is down 1.9 bps at 4.138%. 📉

- E-mini S&P 500 futures are unchanged at 6,830.00. 🕑

- E-mini Nasdaq-100 futures are unchanged at 25,759.50. ⏳

- E-mini Dow Jones Industrial Average Index are unchanged at 47,432.00. 🕰️

Bitcoin Stats 🔢

- BTC Dominance: 60.57% (unchanged). 🦅

- Ether-bitcoin ratio: 0.03291 (-0.17%). 🤝

- Hashrate (seven-day moving average): 1,111 EH/s. 💪

- Hashprice (spot): $41.97. 💰

- Total fees: 4.18 BTC / $429,396. 🧾

- CME Futures Open Interest: 135,525 BTC. 📝

- BTC priced in gold: 24.5 oz. 🏅

- BTC vs gold market cap: 6.91%. 🏆

Technical Analysis 📐

- BTC penetrated the 38.2% Fibonacci retracement. Ouch. 😖

- Next support at $94,237 (61.8% retracement). 🤞

- On the higher side, $116,400 is the leb-I mean, level. 🤦♂️

Crypto Equities 💼

- Coinbase Global (COIN): closed at $319.30 (+3.9%), -0.23% pre-market. 🤔

- Circle Internet (CRCL): closed at $113.03 (+1.6%), +0.38% pre-market. 🌐

- Galaxy Digital (GLXY): closed at $31.44 (+0.87%), +1.72% pre-market. 🌌

- Bullish (BLSH): closed at $48.32 (+5.62%), +0.37% pre-market. 🐂

- MARA Holdings (MARA): closed at $17.13 (+3.07%), -0.41% pre-market. 🏃

- Riot Platforms (RIOT): closed at $18.97 (-1.58%), -0.32% pre-market. 🤖

- Core Scientific (CORZ): closed at $21.8 (+0.28%), +0.32% pre-market. 🔬

- CleanSpark (CLSK): closed at $16.58 (+2.22%), unchanged pre-market. 🧼

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $62.18 (+6.4%). 🚀

- Exodus Movement (EXOD): closed at $23.24 (+0.48%). 🏃

Crypto Treasury Companies 💰

- Strategy (MSTR): closed at $255 (+3.24%), -1.13% pre-market. 🤯

- Semler Scientific (SMLR): closed at $28.74 (+20%), -0.84% pre-market. 🧪

- SharpLink Gaming (SBET): closed at $12.13 (+3.85%), -1.15% pre-market. 🎮

- Upexi (UPXI): closed at $3.67 (+5%), +1.77% pre-market. 🚀

- Lite Strategy (LITS): closed at $1.85 (+5.11%). 💡

ETF Flows 📊

Spot BTC ETFs

- Daily net flows: -$137 million. 😢

- Cumulative net flows: $60.26 billion. 🤑

- Total BTC holdings ~1.34 million. 🏦

Spot ETH ETFs

- Daily net flows: -$118.5 million. 😭

- Cumulative net flows: $13.91 billion. 💰

- Total ETH holdings ~6.61 million. 🏛️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2025-11-06 16:49