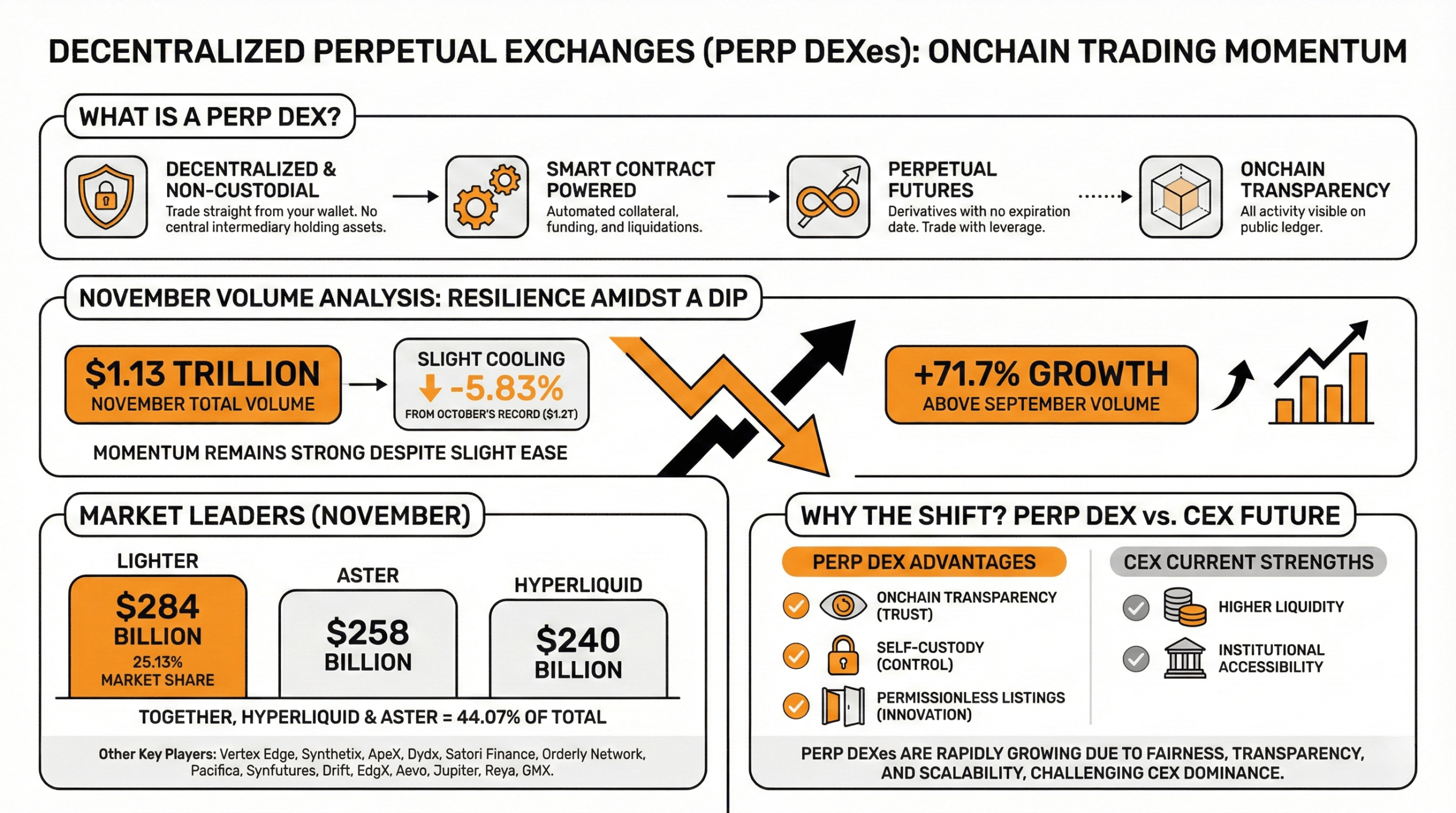

Now, sir, let me tell you a tale. Seems these here decentralized perpetual exchanges – what they call “perp DEXes” – they done racked up a sum in October that’d make a bank robber blush! A cool $1.2 trillion, mind you. But November, well, it cooled off a tad. A measly $70 billion less…a pittance, really. Still, it’s 71.7% more than September, so don’t you go thinkin’ these fellas are takin’ a nap. No sirree!

Perp DEX Momentum? Still Kickin’!

At its heart, a perp decentralized exchange (DEX) in this DeFi business is like a fancy marketplace where folks trade these things called “perpetual futures contracts”. No expiration dates on these, see? It’s all done with these clever contraptions called “smart contracts” straight from yer own wallet, sometimes with a bit of borrowed boldness – they call it “leverage”.

Everything’s out in the open, on the ‘chain’ as they say, and nobody’s holdin’ yer funds hostage. Collateral, payments, and even takin’ a tumble – it all happens where everyone can see, without some busybody banker lookin’ over yer shoulder. Last month, folks at defillama.com tell us these “perp protocols” moved a staggering $1.2 trillion, the biggest haul they’ve ever seen. Imagine the bookkeeping!

Come November, the pace slowed just a hair, slippin’ a modest 5.83% to $1.13 trillion. Defillama.com figures show over $240 billion splashed ‘round on Hyperliquid, while Aster chimed in with $258 billion. Those two alone handled nearly half the trade! Lighter, now they scooped up a hefty $284 billion – a quarter of the whole shebang. Imagine carryin’ that much weight!.

The rest of the action flowed to folks like Vertex Edge, Synthetix, ApeX, Dydx, Satori Finance, Orderly Network, Pacifica, Synfutures, Drift, EdgX, Aevo, Jupiter, Reya, and GMX. EdgX and ApeX? They were holdin’ their own, too – a right competitive bunch, they are. 🧐

Folks are bettin’ these perp DEXes will eventually send the old-fashioned centralized exchanges packin’. Why? Because everything’s out in the open, you own yer own money, and practically anyone can list a trade. Builds trust, ya see? Innovation and all that jazz.

Now, those centralized fellas still got the most money and the big boys playin’ there, but these perp DEXes are growin’ faster than a weed in a garden. They are fair, transparent, and gettin’ quicker all the time. So even with a slight slowdown in November, it’s clear these perp DEXes aren’t goin’ anywhere soon. Not by a long shot! 🤠

FAQ ❓

- What in tarnation is a perp DEX?

A perp DEX is a newfangled exchange where you trade these perpetual futures contracts without needin’ a bank. - How much hocus-pocus happened in November?

A grand total of $1.13 trillion’s worth of trade, a wee bit less than October’s record. - Who were the high rollers in November?

Hyperliquid, Aster, and Lighter were the names to remember, movin’ most of the money. - Why are folks flockin’ to these DEXes?

Transparency, keepin’ yer own gold, and open access – that’s what draws folks in.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- I Used Google Lens to Solve One of Dying Light: The Beast’s Puzzles, and It Worked

2025-12-01 03:58