What to Know:

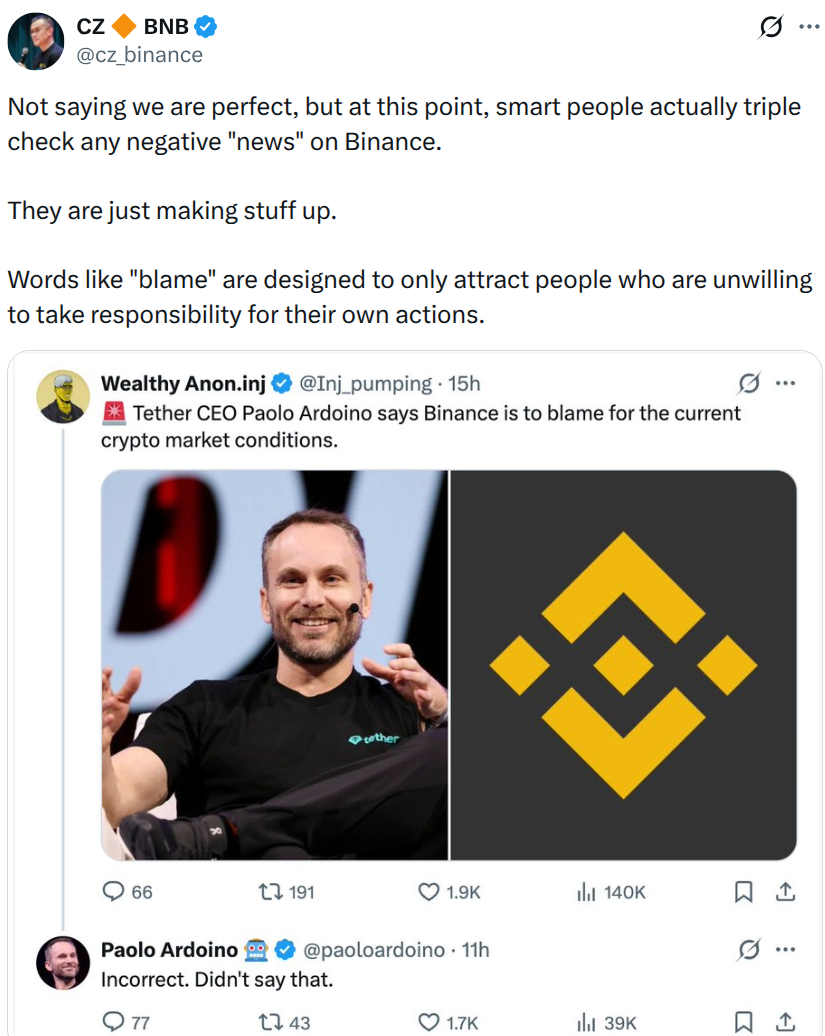

- Changpeng Zhao urges crypto users to embrace personal responsibility for their funds and trading decisions, pushing back against market FUD, with the dry humor of a man who has met worse storms than a price dip.

- Market fragmentation across Bitcoin, Ethereum, and Solana creates systemic risks that no amount of self-discipline alone can barter away-like trying to mend a dam with a wink and a prayer.

- LiquidChain aims to solve this by creating a unified Layer 3 that merges liquidity from these ecosystems for seamless cross-chain execution, as if someone finally tied the knots of a stubborn rope rather than cursing the wind.

In the constant weather of volatility and rumor, former Binance CEO Changpeng ‘CZ’ Zhao drops a hard truth into the marketplace: take responsibility, or enjoy the cold comfort of excuses.

His words cut through the clamor. The message remains simple and unadorned: stop blaming exchanges or influencers for your losses. The power-and the risk-are in your hands, not in a convenient scapegoat left somewhere between a chart and a rumor.

Humor lingers even here. Bitcoin lounges near the high ground of $69K, every dip becomes a small panic, every rally a suspicious glint in the eye. The point isn’t in discovering a scapegoat; it’s in equipping yourself with the right tools and the resilience to endure the long winter of markets.

But there is more to the tale. Personal responsibility swallows a wall when the plumbing of liquidity is fractured. How to manage risk when funds are trapped in silos on BTC, ETH, and SOL? Fragmentation becomes a cruel map: brutal slippage, forced reliance on wrapped assets, and the nightmare of clean execution.

For the proactive trader CZ envisions, the answer is not merely a better attitude but better infrastructure. This is where new infrastructure projects like LiquidChain ($LIQUID) enter the stage, offering tools that begin to make financial self-sovereignty a plausible reality.

Unifying Fragmented Markets for Proactive Traders

The core issue for any serious trader is liquidity fragmentation. A wonderful opportunity on a Solana DEX is meaningless if your capital sits idle on Bitcoin or in an Ethereum pool.

We know the drill: moving assets between chains is slow, expensive, and usually relies on centralized bridges-an obvious point of failure. It’s exactly the kind of systemic risk personal caution cannot fix with luck alone.

LiquidChain ($LIQUID) tackles this head-on. It’s a Layer 3 protocol designed to act as a universal cross-chain liquidity layer. Instead of spawning another isolated blockchain, it fuses the liquidity of Bitcoin, Ethereum, and Solana into one unified environment.

That’s a big deal. It enables single-step transactions across ecosystems. Imagine swapping native $BTC for a Solana token without a bridge or a wrapped asset. That isn’t just convenient; it’s a meaningful reduction in risk.

It also leads to a more efficient market with less slippage and deeper liquidity for everyone. And for developers? The platform’s “Deploy-Once Architecture” lets them build a dApp once and instantly tap into users and assets from all three crypto giants. It’s the toolkit a serious, multi-chain trader has been waiting for.

BUY YOUR $LIQUID HERE

Building a Position in the Future of Liquidity

If crypto history has taught anything, it’s that the biggest returns often come from backing foundational infrastructure before it’s everywhere. Think Chainlink for oracles or Ethereum for smart contracts. LiquidChain aims for that same category by addressing cross-chain liquidity, and its presale offers a ground-floor entry for those betting on an interconnected, multi-chain future.

The project is gaining traction, with its presale raising over $533K so far. Tokens are priced at $0.0136, making it an accessible play for those who like to look ahead. Of course, it’s not without risk; Layer 3 technology is young, and execution challenges are real. Yet the upside is exposure to a protocol solving a multi-billion-dollar market inefficiency.

The $LIQUID token isn’t just for speculation. It’s designed as the fuel for the ecosystem, used for transactions and liquidity staking rewards, giving users a real incentive to participate in the network’s health and security. With what it powers and could become, it earns its place among the notable altcoins.

For investors who see where the market is headed, this addresses a clear and growing need.

DISCOVER THE LIQUIDCHAIN PRESALE

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2026-02-10 20:28