As a researcher with a background in cryptocurrencies and market analysis, I find the recent shift in Bitcoin exposure among hedge funds to be an intriguing development. The data presented by ETC Group indicates that these funds have significantly reduced their BTC holdings, marking a bearish sentiment towards the asset. This trend could potentially have broader implications for the cryptocurrency market and its institutional investors.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development: hedge funds have been adopting new strategies, resulting in a decrease in their Bitcoin holdings, which is the lowest it has been since October 2020.

The ETC Group’s recent findings reveal a notable reduction in Bitcoin holdings by these specific funds, indicating a potential strategic change with potentially far-reaching consequences for the bitcoin market.

Towel Thrown For Bitcoin

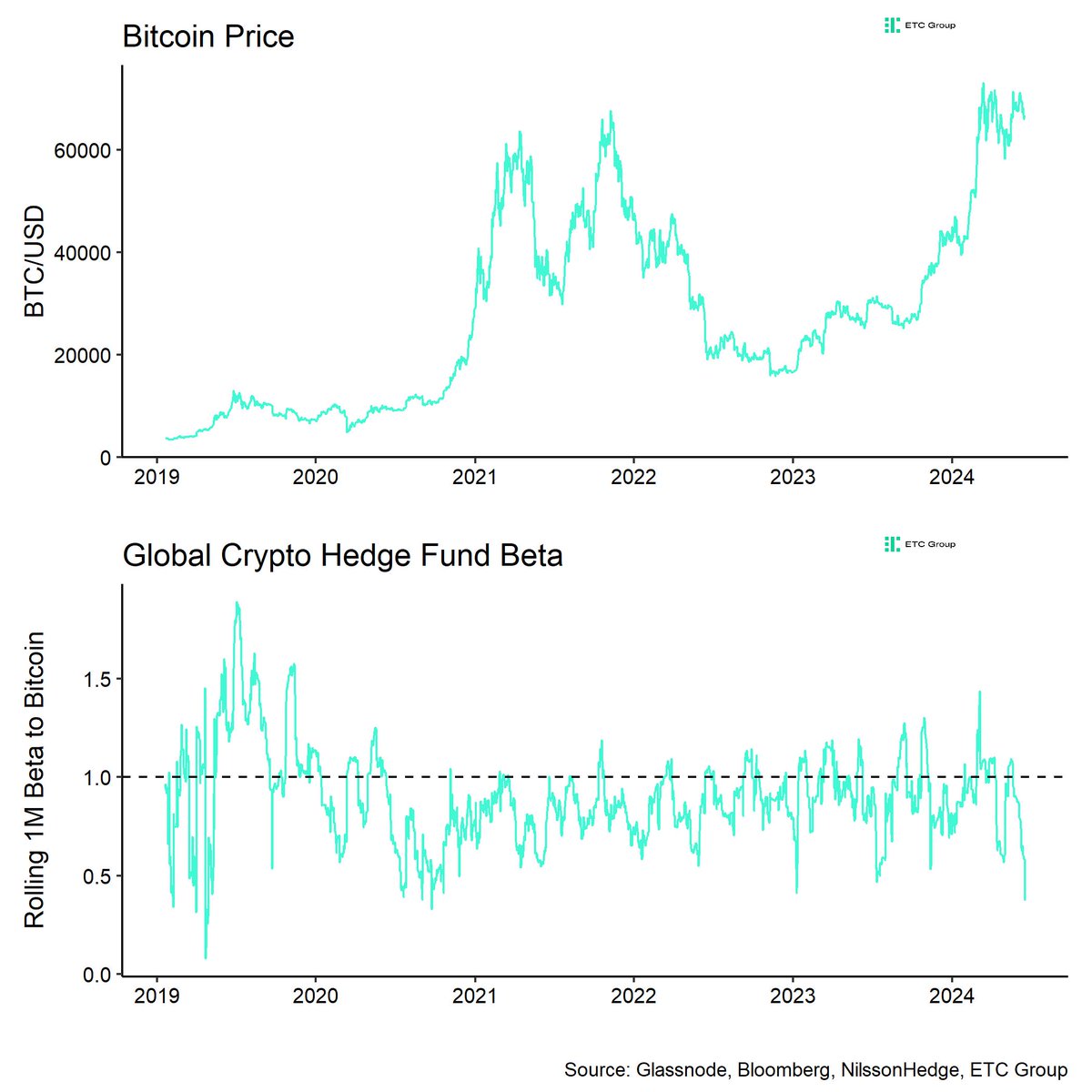

André Dragosch, the Head of Research at ETC Group, has noted a significant decrease in Bitcoin holdings among crypto hedge funds. Over the past twenty trading days, these funds have reduced their Bitcoin exposure to a mere 0.37%, which is the lowest it has been since October 2020.

Among experts in the investment field, there is a more reserved or pessimistic view towards Bitcoin’s price action as it faces difficulties in surging forward.

As a researcher studying the behavior of hedge funds, I’ve observed a tentative stance they’ve taken recently that aligns with ongoing redemptions from crypto exchange-traded products (ETPs). This pattern indicates a growing apprehension among institutional investors regarding the crypto market.

As a crypto investor, I’ve observed that hedge funds often follow market trends and exhibit pro-cyclical behavior. This means they might have sold off their Bitcoin holdings when the market was bearish, but if the market recovers and rallies, they could slowly start investing again. In other words, we might not see a quick or significant influx of institutional investment into Bitcoin if the market turns bullish.

BOOM: Crypto hedge funds have really thrown in the towel on #Bitcoin lately.

They have reduced their $BTC market exposure to only 0.37 over the past 20 trading days.

Lowest since October 2020.

— André Dragosch | Bitcoin & Macro (@Andre_Dragosch) June 19, 2024

Bitcoin’s Resilience Amidst Headwinds

From a different perspective, Bitcoin (BTC) has displayed strength today, coming close to touching $66,000 before pulling back slightly to $65,142 as I write this, while still managing a small daily increase of 0.4%.

The broad market slump and several crucial elements are causing these trends. According to CryptoQuant analysts, miner capitulation, a decrease in new stablecoin production, and substantial ETF redemptions are the main reasons for the recent market drops.

Reducing mineral revenue sources has led to a higher volume of Bitcoin sales to meet operational expenses, thereby intensifying the price decrease.

Simultaneously, the decrease in the production of prominent stablecoins such as USDT and USDC has reduced the inflow of fresh funds into the market, thereby impacting market liquidity and increasing volatility.

As a crypto investor, I’ve noticed that recent market movements have been influenced by various factors. One of these elements is the rumors surrounding the German government supposedly selling their Bitcoins. These speculative actions have added to the unease among investors and caused fluctuations in the market.

The German Government is now on Arkham.

Approximately 50,000 Bitcoins, equivalent to around $2.12 billion, were confiscated by the German Federal Criminal Police Office (BKA) from the individuals managing the infamous film piracy platform, OpenBay, which became operational in 2013.

The BKA received the Bitcoin in mid-January after a ‘voluntary…

— Arkham (@ArkhamIntel) January 31, 2024

As a researcher studying the cryptocurrency market, I’ve noticed the current pressure on prices. However, I’d like to highlight a promising finding from my analysis using CryptoQuant: the present price levels are relatively near significant support zones. Historically, these areas have demonstrated robust rebound capacity.

Featured image created with DALL-E, Chart from TradingView

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- TAO PREDICTION. TAO cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- HUDI PREDICTION. HUDI cryptocurrency

- OOKI PREDICTION. OOKI cryptocurrency

2024-06-20 07:12