Finance

What to know, darling:

- Digital Asset Treasuries, those so-called clever creatures, are dashing about like headless chickens, failing to outshine Bitcoin or those dreary ETFs, despite their pompous promises of financial wizardry. 😂

- Most have stumbled disgracefully, save for a handful of outliers like Japan’s Metaplanet or Twenty One Capital, who’ve managed a fleeting victory over Bitcoin. Whoop-de-doo! 😒

- The ghastly truth: Simply clutching onto Bitcoin-whether in the spot market or through an ETF-proves far more rewarding than these theatrical calamities. Bravo for simplicity! 🙄

“Just buy an ETF,” quipped that Strive chap at Hong Kong’s Bitcoin Asia, summing up the utter exasperation with Digital Asset Treasuries-these grandiose corporate marionettes vowing to trounce Bitcoin via ingenious financing and balance-sheet acrobatics, yet flopping about like amateur thespians in a farce. How droll! 😏

Bitcoin itself has risen a modest 23% this year, while most Digital Asset Treasuries-MicroStrategy, Semler Scientific, GameStop, Trump Media, and their ilk-have trailed miserably behind both BTC and those plodding ETFs. Only rarities like Twenty One Capital and volatile Metaplanet have edged ahead. How utterly predictable! 💩

This chasm reveals the DAT trade’s comic flaw: designed to outdo BTC through leverage, funding, or operational sorcery, yet most lag the dullest exposure imaginable. One longs for a stiff martini. 🍸

Their fancy waltz of leveraged beta and balance-sheet poise crumples when equity premiums, convertibles, or debt markets turn sour. Imagine MicroStrategy’s $8 billion debt with a rate hike-ghastly! Those bonds, with their 0.42% coupon and four-year maturities, seem charming now, but in a high-rate world, they’d be a frightful bore. Fear not, though! 😱

Despite daily headlines of crypto chaps hijacking shell companies to glut balance sheets with BTC, cautions mount like a Wagnerian opera. Galaxy Digital nags that the whole charade hinges on a persistent NAV premium, echoing the 1920s investment-trust folly. NYDIG sneers that the darling “mNAV” metric conceals liabilities and puffs up exposure with phantom debt conversions. Oh, the pretension! 🙄

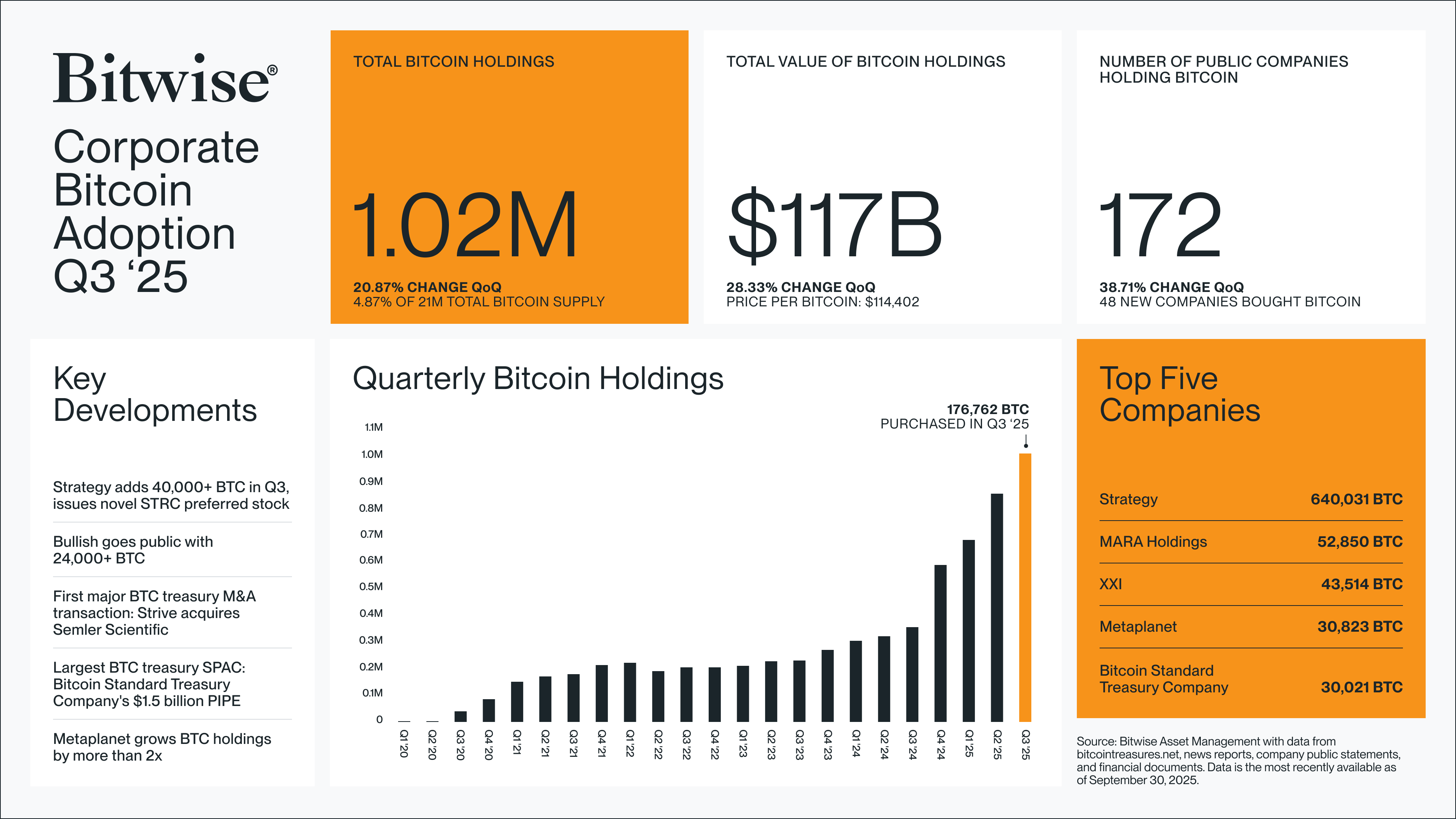

Not that corporate Bitcoin dalliances are a chimera-they’re proliferating madly. Bitwise reports 40% more public firms hoarding Bitcoin in three months. Splendid! 📈

Some, like Coinbase, Bullish, or miners such as MARA, sport BTC naturally in their portfolios, or use it as a hedge against fiat’s fickle moods. Others, alas, are BTC DATs-distinct from those gambling on proof-of-stake darlings like ETH or Solana, which offer real network yields. How sophisticated! 😏

By staking natives and running validators, these gems earn via network antics, not mere leverage. Owning an ETH or TRX DAT? Exposure to Ethereum or Tron-homes to the stablecoin spectacle. Treasuries as mini-ecosystems, compounding as networks burgeon. Charming, isn’t it? 🌟

Tron’s listing, SRM reincarnated as Tron Inc, exemplifies this, with nearly half USDT traffic on its rails. For a ‘Visa moment’ with USDT in Latin America’s frenzy, why, Tron Inc beckons! How thrilling, or is it just smoke? 🚀

Yet this on-chain magic remains rare; most DATs can’t transmute balance-sheet girth into yield or participation. Meant to be wiser than ETFs-capitalist, yielding, blockchain-bound-they often devolve into leveraged Bitcoin mimics. What a disappointment! 😂

Until more prove they can multiply capital swifter than a passive ETF, Matt Cole’s Hong Kong wisdom endures: “Just buy the ETF.” How depressingly apt! Cheers! 🍾

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- How to Unlock all Substories in Yakuza Kiwami 3

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-10-15 13:46